Bank lending and deposit growth to decelerate

On the macro side, things are tentatively moving back to more normal conditions. In step with that, we expect bank lending and deposit growth to further decelerate in 2022, likely even dropping slightly below pre-pandemic trend growth as excess deposits are spent instead of new loans taken out

Macro overview: settling down after strong rebound

After a period of strong growth after lockdowns, economic growth in the eurozone is set to fade from here on. That is only natural, as the rebound in activity was mainly related to restrictions on everyday activities being lifted. At this point, GDP has recovered to 98.7% below pre-crisis levels. For 2022, we expect GDP growth to come in at 3.9%, which is still well above the pre-crisis trend but the quarterly pace is set to slow substantially. Nevertheless, this will be enough to close the gap with pre-pandemic levels.

In the coming quarters, we expect low levels of unemployment and some dissaving from consumers to still have some positive impact on growth, while business investment is also set to contribute positively to GDP growth as high levels of capacity utilisation and low interest rates provide a favourable environment for investment. At the same time, supply chain problems and shortages of inputs are causing production hiccups and are resulting in upward pressure on already high levels of inflation. Together with a possible resurgence of the virus and accompanying restrictive measures, these present some of the more prominent downside risks to the outlook for next year.

We expect the Pandemic Emergency Purchase Programme (PEPP) to end by March next year

By country, we expect Germany to see growth accelerate to 4.6% next year thanks to a recovering auto sector which is currently still plagued by production stoppages due to semiconductor shortages. But we also expect the periphery to continue a powerful catch-up performance with growth of 5.3% in Spain and 4% in Italy and Greece.

For the European Central Bank, this continued recovery with inflation trending above 3% - and expected to come in around 2% for 2022 – is likely to result in a somewhat more hawkish policy stance for next year than initially thought. We expect the Pandemic Emergency Purchase Programme (PEPP) to end by March 2022, after which we expect purchases to decline to about €50bn per month in the second quarter. This is set to decline further to about €20-30bn in the third. This would happen under the traditional Asset Purchase Programme but could also see a new transitional programme installed to deal with some particular problems related to returning to APP completely. This is a material decline in asset purchases, reflecting the improving economic circumstances and increased inflation expectations.

Household borrowing: nearing the peak

Eurozone bank mortgage lending has been accelerating since 2014. The start of the pandemic marked a temporary dip but growth forcefully resumed in 2021. Eurozone-wide net mortgage growth reached 6.1%YoY, the highest growth rate since March 2008.

In Germany, bank net mortgage lending reached 7%YoY, the highest since the ECB began recording growth in 2004. France and Belgium are above 7% too, though that is less exceptional in those countries than it is in Germany. Italy saw an acceleration in 2021 as well, while Spanish bank net mortgage lending turned positive in 2021 for the first time since 2010. Dutch mortgage borrowing has been growing since 2015, but is mostly supplied by non-bank lenders in net terms. Yet since 2021, Dutch net bank mortgage lending turned positive as well.

Eurozone bank lending to households

By type, Year-on-Year growth (%)

Household borrowing rates have likely bottomed out this year

Mortgage lending has clearly benefited from low rates and buoyant housing markets. Whether the upward trend can be sustained going into 2022 however, remains to be seen. Housing supply constraints may start to bite a bit more in various markets. Moreover, with inflation making the headlines, market interest rates have been creeping up of late. There is no clear effect yet on household borrowing rates, as you can see in the chart below.

Nominal household rates fell on average 10 basis points in 2020 but flattened out in 2021. Though some further convergence between different countries remains possible, eurozone-wide it seems likely that nominal rates have bottomed out this year. Taking all this together, we consider it likely that the eurozone is near the peak of household borrowing.

Composite borrowing rate for households, Eurozone (%)

Business borrowing: easing down

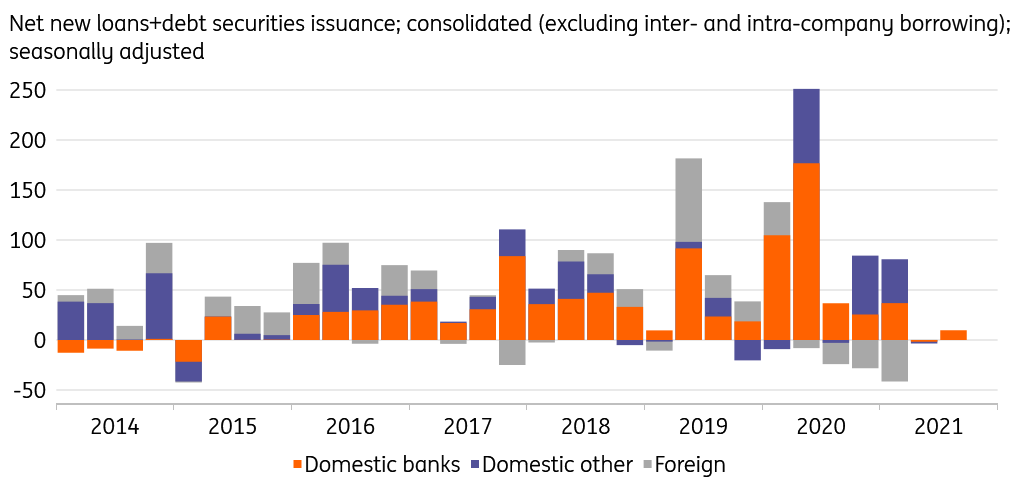

Taking bonds and loans together, eurozone banks normally provide roughly half of the debt finance needs of non-financial businesses. As the pandemic engulfed Europe, business borrowing spiked in the first half of 2020. This initial spike was provided disproportionally by banks, partly because of government guarantee schemes put in place, but also because in several Eurozone countries market finance temporarily became more expensive than bank funding for firms having access to both. After the pandemic business borrowing spike in the first half of 2020, borrowing by non-financial businesses decelerated in the second half of 2020 and the first half of 2021. Yet the start and subsequent speed of the deceleration differed substantially between countries, relating to, among other things, the way in which lockdowns hit domestic economies and the dominant form of government support (e.g. loan guarantees vs direct grants).

Eurozone net lending today is performing a bit weaker than it was pre-pandemic

For now, net bank lending trends appear to have returned to pre-pandemic trends in most countries. Net bank lending to businesses is holding up reasonably well in Germany and France, but has sunk below zero in Italy and, latterly, in Spain too. Overall, eurozone net lending is performing a bit weaker than it was pre-pandemic. The TLTRO benchmark deadline set at year-end may prompt a temporary acceleration in some countries, but we do not expect this, nor the provisional absence of further TLTRO incentives for bank lending down the line, to affect bank lending performance materially.

Eurozone, non-financial business borrowing by lending source

€bn/quarter

The deteriorated financial position of some businesses is likely to have an effect on financing demand. Overall, consolidated non-financial business debt stood at 87% of eurozone GDP in 2021Q2, up from 80% in 2019Q4. Some businesses may focus on redressing their balance sheets, dampening overall net credit demand. At the same time, many businesses hoarded cash in 2020, due to, for instance, government support, postponed investments and precautionary borrowing.

Eurozone businesses have some €300bn extra on hand

For the aggregated eurozone non-financial business sector, cash and deposits were up 16% in 2020, though cash holdings were growing by 5-10% per annum in the run-up to the pandemic too, Eurozone businesses now have some €300bn extra on hand compared to the pre-pandemic trend growth. This exceeds the yearly net financing needs of businesses in the previous decade. If businesses decide to put this cash buffer to use, it could substantially reduce their demand for external finance.

In our base scenario, the eurozone economy reaches its pre-pandemic size in the first quarter of 2022 and slowly settles down at a cruising speed of about 1.7% real GDP growth. Increased investment is positive for borrowing demand going forward, but the worsened financial position in some sectors and high cash availability in others both weigh down on demand. On balance, we expect net bank lending to business to trend below where it was before the pandemic over the next year.

Bank deposits: elevated inflows are ending

In 2020, eurozone bank deposit inflows roughly doubled to €1090bn, with households depositing €593bn and businesses €497bn. Over 2021, deposit inflows are returning to what could be considered normal. With government support receding and lockdowns lifted, and with pent-up consumption demand but also higher energy prices triggering a degree of dissaving, household deposit inflows are likely to diminish further. Businesses may use some of the cash they hoarded to pay down tax arrears or to finance new investments. Hence, we expect a further easing of business deposit inflows as well.

Eurozone banks, net monthly deposit inflow

3month moving average, €bn

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

2 November 2021

Bank sector outlook 2022: Bracing for transformation This bundle contains 6 Articles