Automotive Sector Update: Recovery underway, stirred but undeterred

Global car sales showed a recovery in the first half of this year against a weak backdrop last year. We are reiterating our expectations of 7 to 9% growth in light vehicle sales in 2021. We believe that the continued headwinds from the chip supply shortages may slow and should not deter the recovery while electrified vehicle sales continue to expand

Sales growing, underpinned by consumer demand

With the first half of 2021 already behind us, we are providing an update for our passenger car sector outlook for the full year. In our Automotive Sector Outlook, published in January, we outlined expectations for global passenger car sales growth of 7% to 9% in 2021. At the mid-point of the year, we are inclined to maintain this range, in spite of the continued supply chain headwinds experienced by car manufacturers. While some statistics for the first six months are still being finalised, we believe that things are progressing broadly as we expected with the recovery in sales, underpinned by solid consumer demand in major geographies.

Specifically, according to the European Automobile Manufacturers’ Association (ACEA), in January-June 2021, EU demand for new passenger cars increased by 25.2% year-on-year (YoY) to reach 5.4mn units in total. Given that last year’s comparative base was significantly impacted by the emergence of the Covid-19 virus, EU car registrations this year showed a sharp year-on-year drop in January-February, followed by an even more optically pronounced recovery during March-May. This was followed by a solid rate of growth of 10.4% YoY in June, against a much higher prior-year comparative base. However, the ACEA notes that the first half registration numbers were still well below the 2019 pre-Covid levels, by as much as 1.5mn units (or 21.7%) for the comparable period.

S&P reiterated a positive outlook for global light vehicle sales in 2021, upgrading its forecasts for the year to 8-10%.

In terms of the global picture, we note that earlier in May, S&P also reiterated a positive outlook for global light vehicle sales in 2021, upgrading its forecasts for the year to 8-10%, from 7-9% previously, while also cutting the 2022 sales growth forecast to 3-5% from 7-9% previously. In absolute terms, S&P now expects global auto sales to amount to 83-85 million units this year, relative to 77mn in 2020. Across major geographies, in FY 2021, using a mid-point of the estimated range, the rating agency expects sales of 26.2mn vehicles in China (+6.9% YoY), 18.0mn units in Europe (+9.8% YoY), 16.6mn in the United States (+14.5% YoY) and 23.4mn in the Rest of the World (+6.8% YoY).

Global Light Vehicle Sales Forecast

While we are encouraged by robust consumer demand fuelled by improved economic prospects, new vehicle inventories have not been replenished so far this year due to production volumes being held back somewhat by the well-publicised shortage of semiconductors for the use of passenger car manufacturers. These low inventories also resulted in the rapid rise in second-hand car prices.

Semiconductor shortages persist…

While we continue to believe that our base case scenario for the recovery of global passenger car sales this year should remain intact, we note that sourcing issues with the supply of semiconductors are proving to be a more lasting phenomenon than we, and industry participants, perhaps expected at the start of the year. As we have crossed the half-year mark, we feel that the visibility on the matter is still rather limited with new commentaries appearing almost daily and frequent updates provided on the sales and production impact. What can be noted is that the semiconductor shortages have already left a mark on the first half 2021 car manufacturer production and sales volumes and, also, the logistical issues are not likely to disappear completely in the short term as supply is still having trouble keeping up with demand.

…but won't derail the sector's recovery

At this point, we believe that the broad industry guidance is that shortages will continue to occur to some extent for the rest of this year and potentially into and even through 2022. In conjunction with its recent earnings, TSMC, the largest global chip manufacturer, commented that it expected supply tightness to last into 2022, but the company aims to increase its output of auto microchip units (MCU’s) by close to 60% YoY this year, relieving some of the supply pressures starting this quarter. We also note that the impact of the chip shortages is uneven across car manufacturers and each of them is striving to manage the situation in their own way and, importantly, prioritising the production of higher-margin models to minimise the impact on profitability, which given the aforementioned robust consumer demand should be less impacted than production volumes.

We may be on the cusp of semiconductor supply turning and things improving gradually.

Therefore, to recap, we may be on the cusp of semiconductor supply turning and things improving gradually. While the worst may be behind us, it is unlikely that things will return completely to normal during the remainder of this year. On balance, we still expect a noticeable impact on production and sales volumes for the full year. In the end, it may be that forecasts made at the beginning of the year (such as a net production loss of up to 3mn units, which S&P predicted in February, may be on the low side but not as significantly off the mark as might have appeared based on the worst moments of the second quarter). We also note that the chip shortages were exacerbated in the first half of this year by some one-off factors, such as the fire at Renesas’ Naka facility in March (the facility returned to normal production by the end of June) and by the inclement weather in the southwest of the US earlier in February.

Continued momentum for electric cars in 2021 and 2022

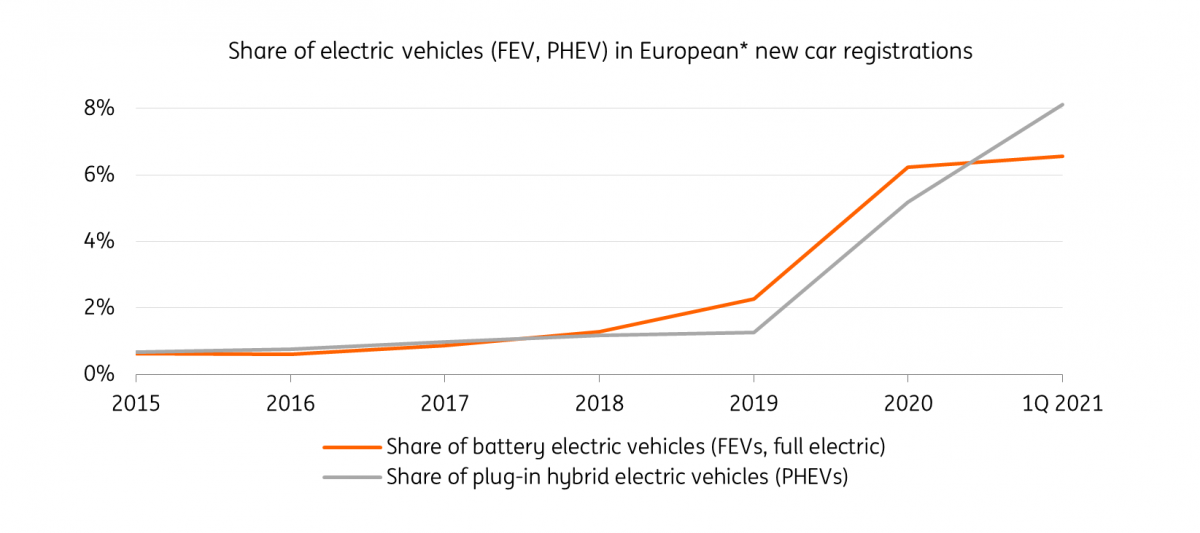

At the start of 2021, a mere 1% of the global rolling car fleet had a power plug (10 million units). This, however, is changing rapidly on the front side in new sales. The pandemic turned out to be an accelerator for the development and sales of electric vehicles (EVs). To support the car industry through the pandemic and simultaneously push a green recovery, EVs benefit from government support programmes and subsidies in various countries. BNEF expects the global share of EVs (full electric vehicles - FEV and plug-in hybrid electric vehicles - PHEV) in new sales to increase by 50%, from 4% to 6% in 2021, and rising further to 8% in 2022. Europe leads the world here, with EVs making up an expected 14% in new sales in 2021, followed by China (9%). Norway is at the forefront of the global shift, with EVs reaching a share of 82% in 1Q21.

Europe leads the EV-transition followed by China and the US

Mainstream car buyers look at PHEVs as an intermediate step

As the uptake of EVs reaches the car driving middle class, plug-in hybrids are providing an intermediate step for a large share of mainstream car buyers. These consumers prefer plug-in hybrids in order to stay flexible and also because there are more models to choose from. This is notably the case in Europe but globally PHEVs are also gaining traction. However, we believe this remains a temporary phenomenon. The share of PHEVs is expected to go down in a few years as FEVs continue to develop, prices reach parity and charging infrastructure is rolled out further.

European plug-hybrid car sales gain most traction in 2021

Manufacturers ramp up commitment to electrification

The shift to electric vehicles has a fundamental impact on car manufacturers. With a battery pack instead of an internal combustion engine (ICE), EVs are less complicated to construct. But designing new models, further development of (battery) technology, and digitalisation require massive investment in R&D and new production facilities, and organisations need to adapt drastically. Since regulators have embraced the future phase-out of the ICE car as part of their plans for the energy transition, and the transition is now beyond doubt, car manufacturers have adopted it as a central part of their strategy.

The EU ‘Fit for 55’-plan to significantly raise the CO2-reduction targets for new cars to 60% in 2030 offers new guidance. And in the US, the Biden administration is also facilitating the uptake of EVs as part of his infrastructure bill. Car makers are now striving to show that they are acting ahead of the transition by raising EV targets for new sales. In the first half of 2021, several car groups made announcements, including General Motors (100% in 2035), VW (70% in 2030 in Europe), Volvo/Geely (100% in 2030) and Stellantis (70% in 2030 in Europe, including Opel: 100% in 2028 in Europe). Alongside these targets, several car makers have also mentioned multi-billion investment programmes to develop their electric portfolios. While plug-in hybrids are usually just existing models that have been electrified, full electric vehicles require a complete make-over and a new product range, like VW is creating with its ID line up. Manufacturers are seeking to find opportunities to scale up EV-production volumes to create an attractive profitable base out of this as soon as possible.

EVs require more chips but manufacturers still seem to prioritise them

Increasing production levels also require more supplies. Ongoing semiconductor shortages are a real risk for raising production levels of EVs. EVs need more and advanced chips (as well as batteries) and European manufacturers, in particular, are still largely dependent on deliveries from other parts of the world (predominantly Asia). Although manufacturers seem to prioritise production of EVs over other car types to meet emission targets and keep up with competitors, longer lead times may still limit the rise in registration numbers of new EVs this year.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

16 July 2021

Message in a bottle This bundle contains 6 Articles