Automotive sector outlook: Recovering after traumatic 2020

Global car sales should increase by around 7 to 9% this year, as the economy rebounds and electrification steps up a gear. But the pace of recovery will vary by region and some downside risks still remain

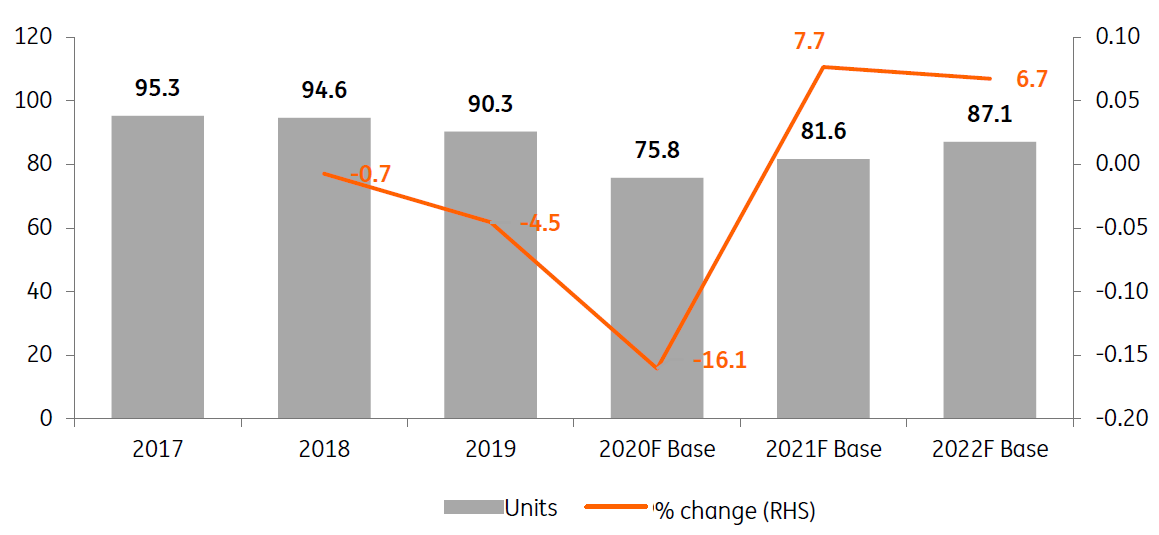

Demand for Passenger Cars Plunged in 2020 but is set to rebound this year

Passenger car sales fell dramatically in 2020, as the Covid-19 pandemic engulfed the world. Moody’s forecasts that global light vehicle sales plunged by 16% or approximately 14.5mn units in FY 2020. While the decline ended up being less pronounced than was feared after an even sharper first half drop of approximately 27%, the full-year fall was much sharper than the 9% decline seen in 2008, in the wake of the Global Financial Crisis. After such a dramatic reduction in sales volumes last year, based on our base case global economic recovery scenario across key regions, we believe that global light vehicle demand will rebound in 2021, potentially by 7% to 9%, depending on various industry forecasts. Specifically,

- Moody’s expects that under its base case economic scenario (G-20 GDP growth of 4.9%), global light vehicle unit sales will grow by 7.7% year-on-year in 2021 to 81.6mn

- IHS Markit forecasts a 9% YoY gain in global auto sales in 2021 and

- S&P projects 7-9% growth in global light vehicle sales this year (in its September 2020 note).

While sales are expected to rebound from the lows in 2021 and continue to grow in 2022, Moody’s doesn’t expect sales to return to the pre-crisis peak of approximately 95mn units seen in 2017-2018 until much later, potentially around 2025. Also, we caution that while the prospect of mass vaccination gives hope and underpins our and market expectations, the spike in the pandemic at the start of the year in a number important geographies, most notably in Europe, could also create some downside to the aforementioned forecasts.

Global light vehicle unit sales expected to show recovery in 2021 (in m units)

Pace and trajectory of recovery are expected to differ across key regions

We note that the rate of the Covid-19 impact on auto sales has been uneven across regions and this should be the case for the anticipated rate of recovery. Western Europe and North America suffered more in 2020, with declines forecast by Moody’s at 25.2% YoY and 15.2% YoY, respectively, while China’s auto sales have held up better, with a decline of 1.9% YoY last year, according to the preliminary data provided by the China Association of Automobile Manufacturers.

To put Western European numbers in perspective, preliminary data released by the local industry bodies and authorities indicates that new car registrations declined by approximately 32% in Spain, 29% in the United Kingdom, 28% in Italy, 24% in France and 20% in Germany. Conversely, the rate of recovery in 2021 should be more pronounced in Europe and North America (+12.2% for Western Europe and +5.8% for the US) relative to +4.0% for China, according to Moody’s base case forecast. Among other major international car markets, India is estimated to have experienced the sharpest drop of approximately 30% in 2020 but should rebound strongly by 20% in 2021, respectively, according to the rating agency’s forecast.

Auto parts sales growth to exceed the recovery in auto sales

Auto parts manufacturers are affected by the same dynamics as global and regional auto sales and have felt the impact from the Covid-19-related drop in production and demand. Moody’s predicts a 16-17% drop in aggregate organic revenues of European auto parts suppliers last year, followed by a rebound of 11-12% and 9-10% in 2021 and 2022, respectively. The rating agency expects that organic revenue growth of European auto parts suppliers will exceed global auto unit sales growth by some 200 to 300 basis points.

Electrification to be an important industry driver in 2021 and beyond

The pandemic appeared to accelerate the proliferation of new electric cars (EVs), rather than slow it down. Several European countries have adopted targets for a 100% EV-share in new sales for 2025, 2030 or 2035. Norway leads the pack in Europe with a share of 54% in new registrations last year followed by the Netherlands with 20.5% and Germany, France and the UK (all three slightly above 6.5%). China also has its own ambitious goals and targets 25% of new sales in 2025 compared with some 5% last year. Three important drivers pushing electric cars forward include, subsidies/tax exemptions, the decreasing total cost of ownership with the introduction of new cheaper models with attractive ranges, and regulations forcing manufacturers to reduce (average) emissions of new cars. Manufacturers have been shifting their innovation budgets accordingly in an attempt to keep pace with the introduction of a whole new range of vehicles in the years to come. BNEF predicts global EV sales numbers will surge 50% in 2021 from a total share of around 3% in 2020.

Big Tech moving further into auto space

One other interesting theme which we are seeing is a move of Big Tech and other technology companies into the traditional automotive space. In our view, this move is driven by the more stringent emissions requirements, which require new technological solutions for auto manufacturing, the quest for self-driving vehicles, new mobility patterns (such as outsourced or shared mobility, albeit dampened to an extent by the ongoing pandemic) and more generally, new technological challenges and demands for car manufacturers. The incredible rise in the valuation of Tesla during 2020 is testament to the market's faith in such sector trends. Recent press reports that Apple aims to launch electric car production for the mass market by 2024 is another manifestation of the same theme. Similarly, Google has been developing self-driving cars for over a decade now. Other technology-driven companies and start-ups also populate the space, vying to capture an early mover or unique technology advantage. We believe that the effect of this move on the traditional car manufacturers and their supply chains will continue to be felt over the coming years, potentially leading to an ever increasing fusion between the two industries.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

18 January 2021

A new age of ‘history and hope’ This bundle contains 8 Articles