Austria: It’s all systems go!

Austrian growth is robust, helped by good old-fashioned fiscal stimulus

Broad-based growth

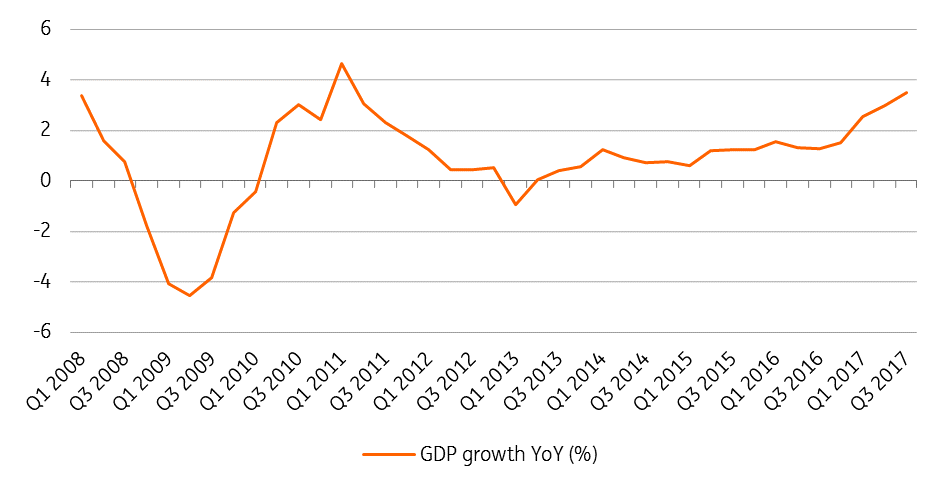

All signs are pointing to an ongoing and robust Austrian growth story; the Austrian economy is likely to have hit the 3%-mark in 2017, a level last seen ten years ago. Political quarrels are largely off the table and the new government has already started working. Growth is broad-based, driven by strong domestic and foreign influences, and it's also helped by a buoyant upturn in consumption, industry and investment. And that strong momentum is set to continue throughout 2018.

Robust growth performance is set to continue

The new political landscape

Looking at the economic impact of the new Austrian government, a good old traditional fiscal stimulus is in the making. Since December the new coalition between the centre-right Austrian People’s Party (ÖVP) and the far-right Freedom Party (FPÖ) is in place. Some measures for the next five years have already been announced, such as a tax bonus of 1,500 Euros per child per year and tax relief for smaller and middle-income groups, by lowering the unemployment insurance contribution.

Around 900-thousand low-income earners should benefit, gaining on average €311 a year. However, other measures such as rising working hours up to 60 hours a week, are more of a double-edged sword. That could contribute to a stronger growth performance but will also focus the discussion on social aspects of the labour market. The alignment of family allowance abroad as well as a reform of unemployment benefits still poses some questions. Nevertheless, we expect the Austrian economy to continue its current strong performance going into 2018, helped by the governmental fiscal stimulus.

Further upside for GDP growth

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

18 January 2018

ING’s Eurozone Quarterly: All systems go This bundle contains 13 Articles