Australia: The case against a rate cut

While much of the market has talked itself into expecting a further reduction of the already almost zero cash rate target (0.25%), we think further QE is more likely. The discussion on zero and negative rates in Australia continues. Recent bank bill rates below the 0.1% exchange settlement (ES) rate suggest that a zero or negative bill rate is possible

QE is already here, but it may be changing

As we head towards the 3 November Reserve Bank of Australia (RBA) rate meeting, we find ourselves almost alone in not expecting any further reduction in the cash rate. Almost the entirety of the Australian banking community is now looking forward to a reduction in the cash rate to 0.1% from its current rate of 0.25%.

Why don't we follow?

Well, we aren't saying we don't think the RBA will do nothing at the next meeting, by any means. We just think they would prefer to use a different tool. Our preferred approach would be for the RBA to adjust its current yield curve control (YCC), which to be clear, is already a form of constrained Quantitative Easing (QE).

We expect the RBA to keep the Cash Rate Target unchanged, to adjust from a yield target of QE to a volume (AUD100bn) target and start buying longer-dated bonds.

The RBA has been pretty successful in achieving the 0.25% yield on the 3-year government bond, or in fact noticeably below it, with very little actual asset purchasing, which points to the credibility of the programme. However, the RBA has still done some asset purchases in secondary markets to achieve this outcome, so we shouldn't be talking about the RBA moving to do QE, but instead, adjusting from a yield target of QE, to a volume target, where they may decide to purchase AUD100bn of bonds in a 3-10 year range, also moving along the yield curve, and flattening it.

RBA balance sheet and Exchange Settlement balances (AUDm)

Never a negative cash rate target - but maybe negative rates...

One thing that hasn't changed, when you read either comments from RBA Governor, Philip Lowe, or his colleagues, Deputy Governor Guy Debelle, or Assistant Governor Christopher Kent, is that the RBA's dislike of negative rates conceptually has not changed. Its a bit of a dated reference, but Governor Lowe's comment back in February that "...negative interest rates in Australia are extraordinarily unlikely. This is not a direction we need to go in", still represents the RBA's view on the matter, and was reiterated along with a dismissal of direct monetary financing at his address to the Anika foundation in July.

So what's the distinction between the cash rate now at 0.25%, and the consensus of economists favoured view that this moves to 0.1% at the November meeting.

If the cash rate were to be reduced to 0.1%, then the current exchange settlement rate of 0.1% would most likely fall to zero.

One argument is that if the cash rate were to be reduced to 0.1%, then the current exchange settlement rate of 0.1%, the Australian equivalent to US interest rates on excess reserves (loosely speaking as there is no reserve requirement in Australia) would most likely be squeezed to zero, narrowing the band between it and the cash rate. We don't envisage a parallel reduction, as this would turn it negative.

The reason the RBA doesn't like negative rates is they believe, as we do, that there is a nominal interest rate, below which, the benefits to borrowers of ever-lower rates begins to be dominated by the losses to savers. This demarcation does not have to happen at the zero bound but could happen at low positive rates of interest. It may already have been reached. In short, pushing the rate lower still, even if it remained notionally positive, might not only do no good overall to the economy but might on aggregate make it weaker. In any event, it would be hard to argue that a further 15bp cut in the cash rate target and 10bp on the exchange settlement (ES) rate would have a meaningfully positive impact on the economy or the labour market.

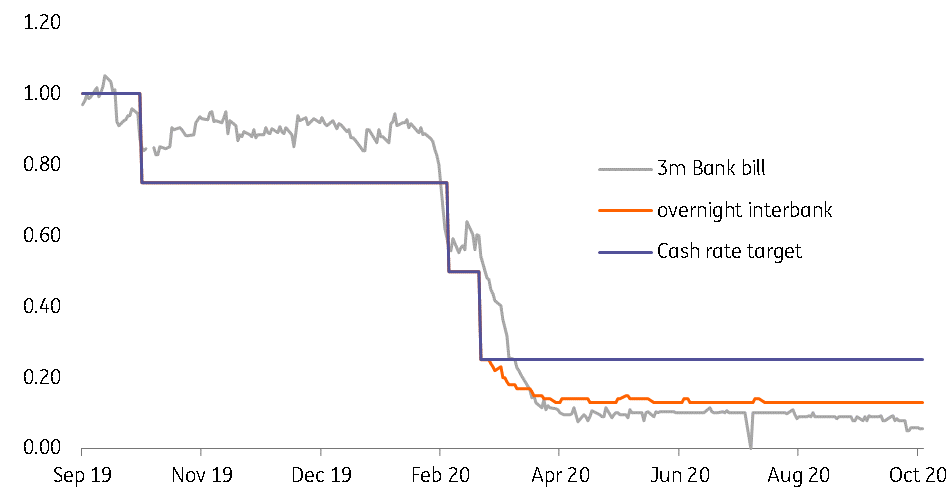

As Deputy Governor Debelle, pointed out back in his June speech, the actual cash rate is already substantially below the cash rate target, at about 13bp, settling (as they had expected), at just a few basis points above the ES rate, which also helps to anchor other interest rates such as short term repo rates, FX swaps and bank bills.

Indeed, that has been the case until recently. But in the last week or so, bank bill rates from 1-6 month tenors have dropped to a yield of between 5.5bp and 6bp – consistent with expectations of the ES rate falling to around zero, and likely representing an effective rate for the cash rate below a target reduced to 0.1%.

What if rates are cut?

Back in his September speech, Deputy Governor Debelle helpfully ran through the various policy options available to the RBA. A further reduction in cash rates and the ES rate were mentioned as options, but were third on his list, just ahead of negative interest rates, and given little discussion. Top of the list was buying bonds further along the yield curve – essentially our house view of some expanded QE, probably with a focus as far out as 10Y maturities. This seems to be the preferred route.

Below that was exchange rate intervention. Right now, the AUDUSD rate is below 0.71, and as has been noted by various RBA speakers recently, does not appear to be particularly overvalued relative to Australia's terms of trade. In fact, you could argue the opposite more easily. This seems an unlikely path to us.

Negative rates, of course, remain off the agenda, and will probably continue to be so absent an absolute disaster.

Which takes us back to cash and ES rates.

Australian money market rates

A temporary negative rate on bank bills and other money market rates is still possible

We could of course be totally wrong about the cash rate. We are vastly in the minority here, though we would note that the consensus in Australia is quite herd-driven, and can be a bit self-reinforcing. Consensus expectations can be wrong. The RBA is not unduly driven to deliver just because the herd is pointing in a particular direction.

But if the consensus is right, and the cash rate is cut and the exchange settlement rate goes with it down to zero, it is possible to imagine a temporary negative yield in a short tenor bank bill, resulting perhaps from a large bond redemption which was inadequately bought up or absorbed by the RBA leading to a short surge in ES settlement account liquidity and driving down market rates.

More likely, as ES balances above a certain amount tend to have a minimal effect on rates, even if shortages can be dramatic in the other direction, this will come from "misplaced" market expectations.

As we have seen already, the rate on the exchange settlement account is not an absolute floor for money-market rates – more of a magnet preventing them from falling too far below it. But if the ES rate were to be reduced to zero, downbeat market expectations, even if you accept that the RBA will never actually adopt a negative cash rate target, could do the rest.

Quickly scanning data series on Australian money market rates already shows the occasional slightly negative interbank deposit rate. with bank bills currently offering only 5bp or 6bp. If ES and cash rate targets were reduced further, it is just conceivable that a negative yield of -2bp or -3bp might arise for short term bank-bills for a period while those expectations held. Though we remain adamant that the cash rate will not drop this low, so this would be a temporary diversion from reality, but one that could occur from time to time.

AUD reaction to get mixed up with US election results

The futures market is fully pricing in a 15bp cut at the 3 November meeting, which leaves significant room for a positive reaction by AUD if our no-cut base case scenario materializes. While it is harder to gauge how much a shift in QE from YCC to a volume target – and what amount will be announced – we are inclined to think our view for AUD100bn of extra QE is pretty much in line with market expectations and would have a balanced impact on the AUD.

We see the balance of risks as skewed to the upside for AUD ahead of the meeting

The upside potential for AUD stemming from a surprise hold by the RBA would particularly depend on the language used by the Bank in keeping the door open for a cut in the future. Markets may simply push their expectations for a cut to the next meeting (on 1 December) if the message contains a strong dovish tone about further rate reductions, limiting the upside for AUD.

While we see the balance of risks clearly skewed to the upside for AUD ahead of the meeting, the vicinity to the first projections for the US election (late European night on 3 November) will likely keep the RBA impact rather short-lived. As we highlighted in our “US Presidential election G10 FX scorecard”, AUD can be the key beneficiary of a landslide win by Joe Biden – i.e. the most market-friendly scenario – and would probably be a key underperformer in the market-adverse cases of a contested result or Trump victory.

Looking beyond the short-term, the ability of the RBA to effectively shape a lower and flatter yield curve (which is not a firm guarantee) should have a dampening effect on the AUD’s rate attractiveness and reduce the size of future rallies in the currency. Still, this effect could be partly mitigated by the fact that other central banks are taking similar actions (for instance, the Bank of Canada recently announced the plan to purchase longer-dated bonds and the Reserve Bank of New Zealand is set to increase QE too and possibly start Negative Interest Rate Policy).

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

29 October 2020

Good MornING Asia - 2 November 2020 This bundle contains 5 Articles