AUD: Still on a slippery slope

The Aussie dollar has been a key outperformer in the last few weeks thanks to stabilising risk sentiment and a pause in interest rate cuts. While we don't expect the central bank to change its stance anytime soon, a further escalation in trade tensions could keep the downside risk elevated. We expect AUD/USD to move back to 0.67 by year-end

AUD has been the best proxy for China-related sentiment

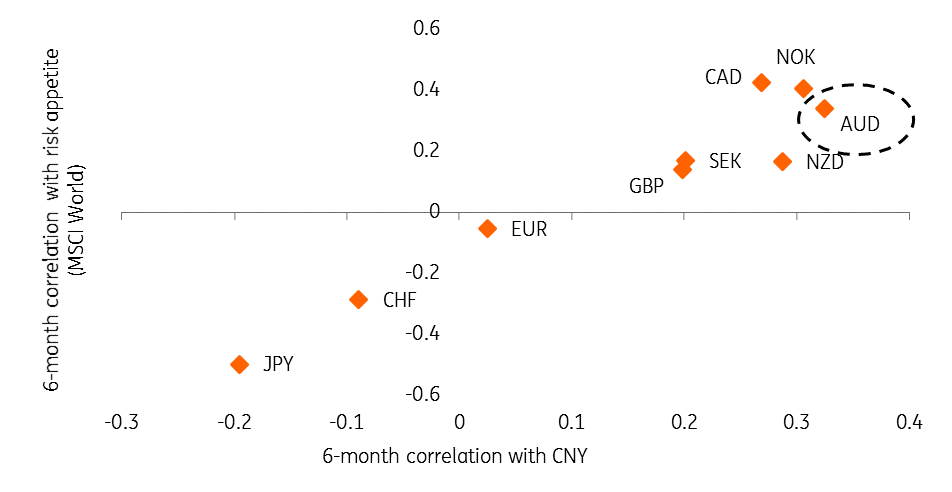

Looking at the past six months of FX movements (Fig. 1), the Australian dollar has acted as the most accurate proxy for China-related sentiment (especially on trade tensions), as demonstrated by the highest correlation with the Chinese yuan. The reasons for this relationship are not transitory and suggest the two currencies will keep moving in tandem.

First, Australia is more dependent on exports to China than any other economy in the G10 space. The looming slowdown in Chinese demand has quickly become a serious threat to the Australian economy. Second, the trade tensions (which have been the primary driver of Chinese market sentiment) are having a significant impact on global risk aversion, and a risk-sensitive currency such as the AUD is inevitably impacted. Third, the same trade turmoil has pressured commodity prices, some of which comprise a sizable portion of Australian exports.

Fig.1 - AUD is the most exposed to global and China-related sentiment

The RBA may be done for the rest of the year

The Reserve Bank of Australia lowered the cash rate twice this year, in June and July, before pausing in the August and September meetings. At the same time, the Bank has reiterated its openness to “ease monetary policy further if needed” to support growth and achieve its inflation target.

Additional easing may appear to be warranted given that inflation is currently at 1.6% year-on-year and far from the 2-3% target band. However, there has been some improvement from 1Q when CPI was at 1.3%, and inflation expectations have rebounded of late. Also, rate cuts seem to have halted the rise in the unemployment rate, which remains at 5.2%, and the August jobs report showed solid growth in full-time hiring. On top of that, recent GDP data (0.5% quarter-on-quarter in 2Q) endorsed the view that the economy is in relatively good shape.

All these reasons have led our economics team to write off any additional rate cut in 2019 and we are now expecting only one cut in 2020 (Fig. 2).

Fig. 2 - We are less dovish than market expectations on the RBA

Trade wars should get worse

The latest news on the trade front has been well received by risk assets, especially as China and the US are now ready to hold another round of negotiations in October. More recently, the announcement that China has exempted some tariffs on US exports has further supported hopes for a respite in the conflict. However, as noted by our China economist, the exemption should be seen as an attempt to support China's economy rather than as a concession to the US.

This fits into our house view which holds that trade tensions will actually escalate further in the coming months and that a US-China trade deal by the end of the year no longer seems like a realistic possibility. In fact, despite the recent positive news flow, the two sides still appear to be far apart on some key points - above all, on intellectual property, where the Chinese are unlikely to make large concessions. What's more, President Trump seems to be in no rush to reduce pressure on China just yet (equity markets and the economy are holding up relatively well) and he may not make a decisive move towards a trade deal before an economic slowdown becomes apparent.

Short-term downside remains warranted

We expect the medium-term outlook for the Aussie dollar to be dominated by two conflicting forces: escalating trade tensions and a less dovish than expected RBA. Of these, we believe the first driver will prevail. Hence, we believe the balance of risks for AUD/USD remains tilted to the downside and an extended pause by the RBA (hence, a more supportive rate outlook) should play out only as a mitigating factor.

Accordingly, we see AUD/USD dropping to 0.67 in the coming months, before starting to recover at the beginning of 2020. A year from now, we expect the relatively solid economic fundamentals in Australia and abating risk sentiment to push the pair towards 0.72.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more