AUD: Cast-iron sentiment

Australia’s main export, iron ore's prices are surging thanks to resilient demand from China and supply constraints offsetting lingering woes in coal and building AUD recent resilience, which hasn't been dented by rising tensions between Australia and China. In the short-term, market’s complacency on a possible new trade war warrants caution on AUD

The risk-on mood that pervaded markets at the start of this week provided some steam to the extended recovery in global commodity prices and lifted commodity currencies.

However, the AUD has been benefitting from its commodities backdrop for some time, largely thanks to the extraordinary performance of iron ore, Australia’s number one export.

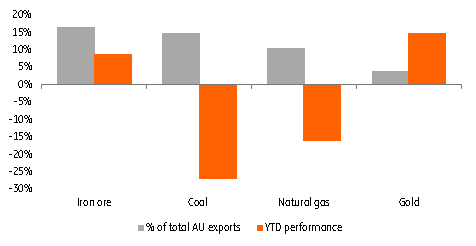

Fig. 1 - Performance of key Australian commodities

Iron ore: The big outlier in the commodity slump

Iron ore prices have gained 15% year-to-date (Singapore 62% fines) on the constructive fundamentals picture, steadily loosening monetary policy and a pick-up in credit velocity in China (Figure 2). On the supply side, shipments to China from major miners have slowed recently. Meanwhile, Brazil has emerged as a hotspot of the Covid-19 pandemic, adding to concerns about supply stability.

The demand for iron ore has remained robust from China. According to the latest data (15 May), the average operating rate has risen to 70.44% (0.69% mom; 0.37% yoy) based on a survey by Mysteel to 163 mills.

So far, iron ore has stood out as a big outlier in the commodity sphere

Consequently, there has been continuous destocking of iron ore inventories (down 13% YTD) at Chinese ports. The current inventory level stays at 102kt - the lowest since 4Q16.

China’s steel demand strength has remained elevated ever since economic activities resumed after lockdowns. To make up the lost time from the lockdowns, the country’s housing and infrastructure construction sectors have been running at higher capacities. More robust domestic demand has offset a weaker export market. So far, iron ore has stood out as a big outlier in the commodity sphere (Figure 3)

Fig. 2 & 3 - China's big role in iron ore outperformance

However, it has become questionable as to whether the high demand strength is sustainable over 2H20. There have been growing expectations on stimulus measures from China targeting the downstream sectors as demand is highly government investment-driven.

Coal: Struggling to recover

Coal prices have been unable to escape the pressure that we have seen across the commodities complex.

Newcastle coal has fallen by around 30% since the highs earlier this year, leaving it to trade at around US$50/t. Given the widespread country lockdowns we have seen, it is no surprise that demand has been weaker recently. As we see countries easing lockdowns and industry returning, this should provide some support to thermal coal prices. Although weak prices in Europe, mean that we could see increased Western hemisphere availability for Asia, which would limit the upside in Newcastle prices.

In the medium to long term, thermal coal demand is likely to come under further pressure, with some big consumers making their intentions clear to transition from coal to natural gas. Given that Asian LNG prices have been trading at record lows in recent months, this could help to speed up the transition towards natural gas.

Iron ore helped to build AUD resilience….

Looking back at the FX performance since early Covid-19 news hit the markets in late January, it is clear that the Aussie dollar showed an unnatural resilience for a commodity currency when compared with its closest peers NZD and CAD (Figure 4).

The resilience of iron ore prices to the global commodity meltdown provided a solid fundamental for AUD and likely made it stand out as the most attractive commodity currency when risk-aversion started to abate

The are various reasons behind the relative outperformance of AUD and include relatively contained Covid-19 contagion, not too stringent lockdown measures, low exposure to the oil slump, the central bank initiating tapering earlier than other central banks and – the outstanding performance of its key export, iron ore.

As shown above (Figure 1), the actual commodity backdrop for Australia is quite mixed, with coal (which accounts to almost the same exports as iron ore) and natural gas struggling to recover and gold’s outperformance accounting by only a marginal factor. However, it is not uncommon for currencies to be disproportionally reactive to the main commodity while overlooking dynamics in the other ones.

The resilience of iron ore prices to the global commodity meltdown provided a solid fundamental for AUD and likely made it stand out as the most attractive commodity currency when risk-aversion started to abate.

Fig 4 & 5 - AUD outperformance challenged by exposure to China

… which is evident as tensions with China rise

Now, AUD relatively strong fundamentals are probably playing a role in mitigating the negative impact of rising tensions between Australia and China.

The Australian government started calling for an independent probe around the origins of Covid-19 outbreak in China at the end of April, immediately claiming no intentions to backtrack in case of economic retaliation.

The potential implications of a fully-fledged trade war with China are quite appalling for Australia, which is the most China-dependent developed economy when it comes to exports

China imposed tariffs of up to 80% on Australian barley exports (worth around AUD 600mln), accusing Australian farmers to have artificially dumped prices. The dispute over barley is no news, as the Chinese Ministry of Commerce had already been engaged in an anti-dumping investigation in the past. The timing, however, surely raises concerns of mounting tensions between the two countries.

Fueling these concerns is the latest news that China is working on a list of Australian products that may be targeted with tariffs, stricter quality checks, and customs delays. The potential implications of a fully-fledged trade war with China are quite appalling for Australia, which is the most China-dependent developed economy when it comes to exports (Figure 5).

While this trade dispute appears to be at a very early stage and surely has the possibility of being quickly defused through diplomacy, the contained impact on AUD is quite remarkable.

In our view, it shows both that a) markets are quite complacent to the risk of tensions between developed countries and China, as shown by the limited market reaction to President Trump’s threats of sanctions and a new trade war; b) that the AUD has built a quite solid resistance to downside pressures thanks to a combination of factors, including its strength in iron ore.

In other words, AUD is quite evidently underpricing the risks related to rising Australia-China tensions. While there may be a long way before these tensions potentially mutate into a trade war, AUD complacency suggests some caution. In such an environment, and with oil on the path to recovery, CAD appears to offer a better risk-reward profile in the G10 commodity space.

In the longer-term, and barring any more escalation of the Aussie-China dispute, AUD continues to present enough solid fundamentals to move back to 0.70 by early 2021.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article