Assertive Fed signals three hikes for 2022

The Federal Reserve left interest rates unchanged, but are ending the QE asset purchases in February rather than May and are signalling the prospect of three interest rate hikes next year rather than just one. Upgraded GDP and inflation forecasts show the Fed feels the economy can weather the Omicron storm

"Transitory" gone, an early end to QE and 3 rate hikes in 2022

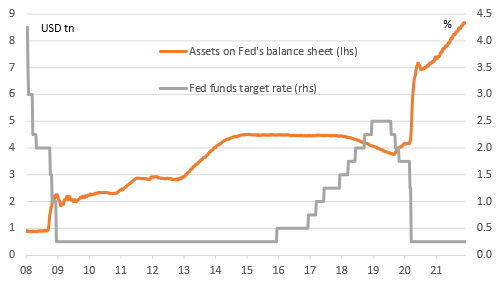

The Federal Reserve has left interest rates on hold, but there are plenty of changes elsewhere. The rate of QE tapering has been doubled to $30bn per month, as expected. This means that December still sees $90bn of asset purchases, but this now drops to $60bn in January, $30bn in February and we are down to zero in March. Nonetheless, this will still leave the Federal Reserve with more than $8.8tn of assets. Secondly, in the accompanying statement the “transitory” description of factors pushing up inflation has been dropped, as pre-announced by Fed Chair Jerome Powell a couple of weeks ago. Then there is the key change – the clear signal of earlier and swifter policy tightening in 2022 with three 25bp interest rate hikes now in the Fed's forecasts.

Fed funds target rate and the assets on the Fed's balance sheet

Three rate hikes now for 2022, three in 2023 and two in 2024

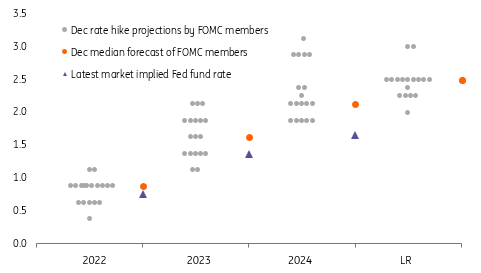

The "transitory" and QE annoucnements were widely expected, but the surprise is that the Federal Reserve is now projecting three 25bp rate hikes for 2022 up from the one that was in their dot plot in September. Most in the market (including ourselves) expected them to be more tentative given uncertainty surrounding the economic impact from Omicron and only move to two rate hikes.

The Fed continue to project three additional hikes in 2023, but now forecast only two rate hikes in 2024 versus the three they had in September. The net result is that between now and the end of 2024 they have got one extra hike versus September’s predictions (to a median of 2.1% from 1.8%), but they start coming through sooner. The long run forecast for Fed funds remains 2.5%.

Federal Reserve dot plot of individual forecasts for the fed funds target rate (%)

Fed remains hopeful that Omicron doesn't derail the story

The tone of the press release is a little more hawkish too with jobs growth now described as “solid” and inflation “elevated”. This was then backed up by an upbeat press conference from Chair Powell that while acknowledge Omicron illustrates that the Fed sees growth remaining “very strong” and that the Fed continues to expect “rapid growth”. Powell also acknowledged that wages are rising at their fastest pace “in many years”.

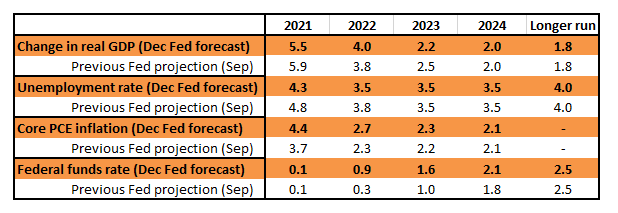

As for their other forecasts they have raised their 2022 GDP forecast to 4% from 3.8% in a somewhat surprising move given Omicron and concerns that it could result in more cautious consumer behaviour. However, they lowered GDP growth for 2023 to 2.2% from 2.5%. Unemployment rate forecasts have been lowered to 3.5% for each of the next three years while the core PCE deflator (the Fed's favoured inflation measure) is now 4.4% for 2021, 2.7% for 2022, 2.3% for 2023 and 2.1% for 2024. Previously they were 3.7%, 2.3%, 2.2% and 2.1% respectively.

Federal Reserve economic forecasts

Caution remains warranted

In our 2022 Economic Outlook, we wrote that were it not for the emergence of the Omicron variant, we would have shifted from our current two-rate hike view to a three-rate hike view for 2022. After all, we are forecasting real growth of 4.4%, inflation of 4.5% and the return of all of the lost jobs during the pandemic by the end of next year. So far, the evidence suggests that Omicron won’t derail the global recovery story, but there is still uncertainty and we could see consumer caution over the next couple of months. Nonetheless, that three hike call looks increasingly likely and the Fed seems confident that it will.

The Fed signals an intent to start tighten liquidity conditions by 2Q 2022

Beyond the taper is a phase where the Federal Reserve should begin to rein in bank reserves. It now looks like that phase starts by the second quarter of next year at the latest. The USD1.6tn going back to the Federal Reserve on its reverse repo facility at 5bp on a daily basis is indicative of the liquidity excess. It suggests that the Fed’s balance sheet can be reduced as a policy action as we progress through 2022, and especially when the taper is complete.

The biggest impact here is on front-end rates. In the background, repo should be allowed to edge higher as the US Treasury has more capacity to add collateral to the system through bills issuance as the debt ceiling is raised. But to the foreground, the act of the Fed taking reserves out will also have a direct effect on money market rates, placing them under rising pressure. This is showing up in a steepening of the money curve, as rate hike expectations also intensify. And is being seen right out to the 2yr, which is back up in the 70bp area. The 2yr should continue to edge higher, likely getting towards 1% by 1Q 2022. The three hikes in the dots for 2022 solidify this view.

The biggest impact is on front-end rates; the back end is where the perceived anomaly is

The back end is where the perceived anomaly is, as it continues to refuse to buckle under the elevated inflation backdrop; not even when the Fed has now explicitly accepted they have a job to do to calm inflation pressures. Slightly higher real rates and slightly lower inflation breakevens have been the consequential outcome in the 10yr area, with the nominal yield only up a tad on aggregate. The long end continues to be held down by net demand for Treasuries, the key theme seen in 2021, but there is also an implied worry that aggressive Fed hikes can hurt the economy. We acknowledge both of these as factors, but place a bigger emphasis on the former.

Should the demand for Treasuries persist into 2022 in the face of a run of rate hikes to come, then the risk remains that the curve faces an inversion threat far sooner than the Fed would like. Not our central view, as we expect to see long rates drift higher due to this combination of inflation, rate hike and liquidity reduction pressures. Key questions surround how aggressive the Fed will be when it comes to taking liquidity from the system.

Remember the Fed has the capacity to go nuclear and sell bonds back to the market, and force the 10yr yield higher. Alternatively, allowing bonds to roll off the curve will add available to collateral to the system. Either one of these can push longer end rates higher. Not there yet; but these are viable options, from 2022 and beyond.

FX: Hawkish Fed prepares dollar for next leg higher

While the Fed’s faster pace of tapering was largely as expected, a median of three rate hikes in 2022 was not. The Fed now expects 150bp of tightening in 2022-23 – a huge difference from the start of the year when policy was seen as unchanged into 2024 on the back of Average Inflation Targeting.

A conventional – and quite aggressive – Fed tightening cycle looks set to be unfolding over the 2022-23 period and one which should certainly send the dollar higher against the low-yielding EUR and JPY, currencies representing economies with negative output gaps and patient central banks.

Perhaps the surprise is today that the dollar has not broken to a new high for the year (yet). A hawkish spin from the Fed was expected, but just like in June and September, we suspect today’s hawkish FOMC statement and projections will set the bullish dollar trend for coming months.

We favour EUR/USD exiting the 1.1180-1.1380 trading range to the downside, with 1.10 possible before year-end. USD/JPY can trade through 115. EM currencies remain vulnerable, but some backed by aggressive tightening, e.g. RUB and CZK should outperform as local central banks press hard on the monetary brakes.

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more