Asia week ahead: Will Singapore’s central bank tighten policy again?

Chinese markets will be back in action after a week-long holiday and September economic data also starts to come through. But the highlight of the week will be Singapore's GDP numbers, where a significant slowdown will undoubtedly take the air out of central bank policy hawks

China back in action

After a soft September, the US dollar seems to be regaining its strength against most G10 and emerging Asian currencies. While there is nothing on the calendar to unsettle this, but all eyes will be on the People’s Bank of China's yuan fixing after the holiday. The USD/CNY fixing ground was higher in the week before the holidays, and the market spot almost followed suit. The US dollar’s comeback and heavy stock market sell-off in Hong Kong this week, possibly spilling over to Mainland China suggests CNY will resume trading on a weaker note.

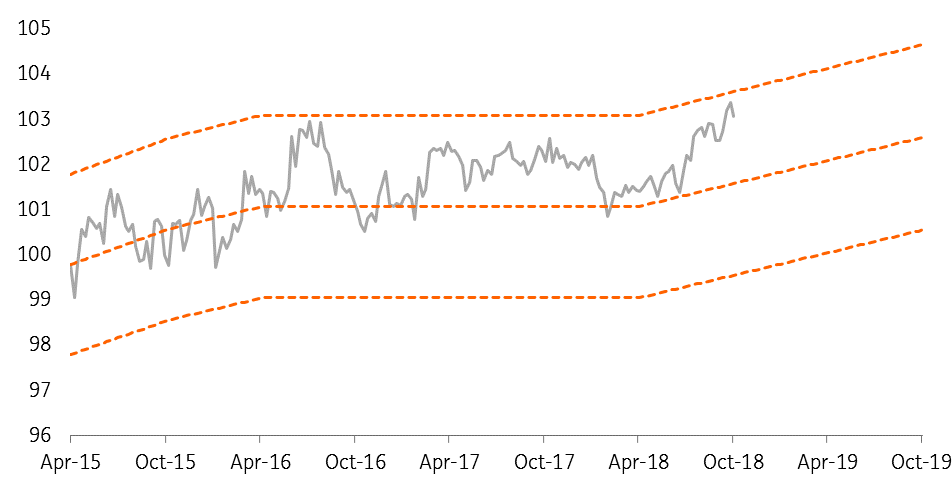

China’s September data also influences the markets, starting with the foreign reserves data to be released over the weekend followed by trade and monetary data over the course of the week. Unlike the CNY devaluation in 2015, when reserves experienced significant outflows, they have been pretty stable around $3.1 trillion despite the steep yuan depreciation this year. We believe this state of affair prevailed in September, as the trade war impact has yet to show up in the real activity and exports continue to grow by the high single-digit pace.

China's foreign exchange reserves have been stable

Likely inaction by Singapore central bank

Singapore’s advance GDP estimate for 3Q18 is due most likely towards the end of next week, and the central bank will also unveil the outcome of its semi-annual policy review around the same time as the GDP release. A sharp slowdown in manufacturing in the July and August release looks likely to extend to September based on a two-year low (Nikkei) manufacturing PMI. This is likely to dent the GDP growth, which is why we have cut our estimate of 3Q growth to 2.6% year on year from 3.3%, a slowdown from 3.9%.

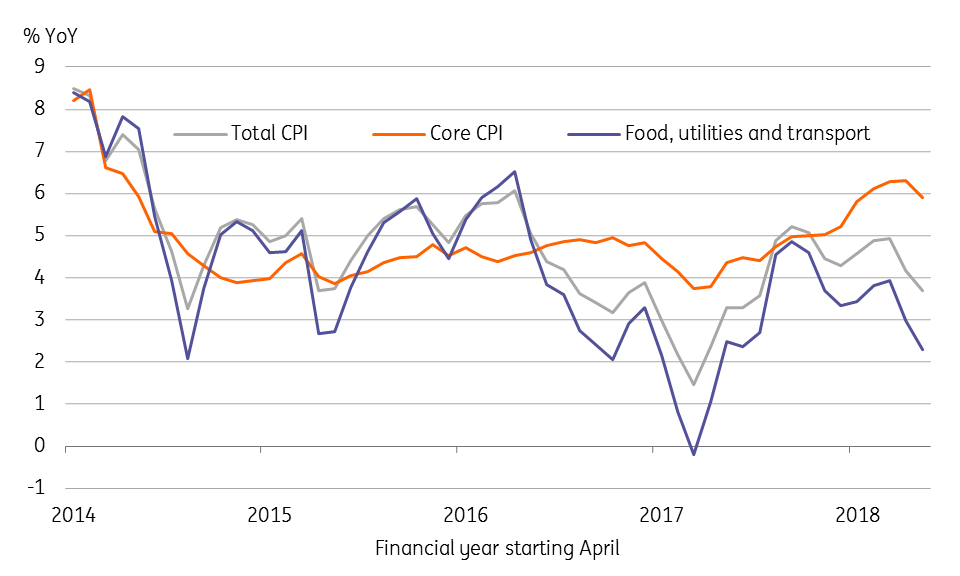

The central bank shifted the policy from neutral to tightening at the last meeting in April – a move from zero percent Singapore dollar trade-weighted exchange rate (S$-NEER) policy band appreciation to a 'modest and gradual' appreciation path. The Singapore dollar's outperformance in the global currency sell-off since the last central bank policy review has pushed the S$-NEER towards the strong end of the policy band, fuelling expectations of more policy tightening in October. However, we don’t see any compelling reasons for that, as consumer price inflation in Singapore continues to be among the lowest in Asia and GDP growth is also poised to slow. A significant GDP slowdown will certainly take the air out of policy hawks.

ING estimate of the MAS's S$-NEER policy band

Inflation risks resurfacing in India, slowly but surely

As the Reserve Bank of India looks set to tighten monetary policy again at the meeting on Friday, 5 October, the central bank will have no reasons to relax ahead of the September consumer price inflation release. The August inflation fall below 4% (the mid-point of the RBI’s 2-6% medium-term target) appears to be a one-off. Our estimate for September is that it will rise back above 4%. Even as food price inflation continues to be low, the pass-through from increasing global oil prices will intensify due to a weak rupee and core inflation, which strips out food and fuel prices, remains high.

Without vigorous policy tightening or additional support measures, we find it hard to forecast the rupee regaining any ground in the near-term. We have just raised our end-2018 USD/INR forecast to 75 from 73.5.

Recent dip in India's CPI inflation will be transitory

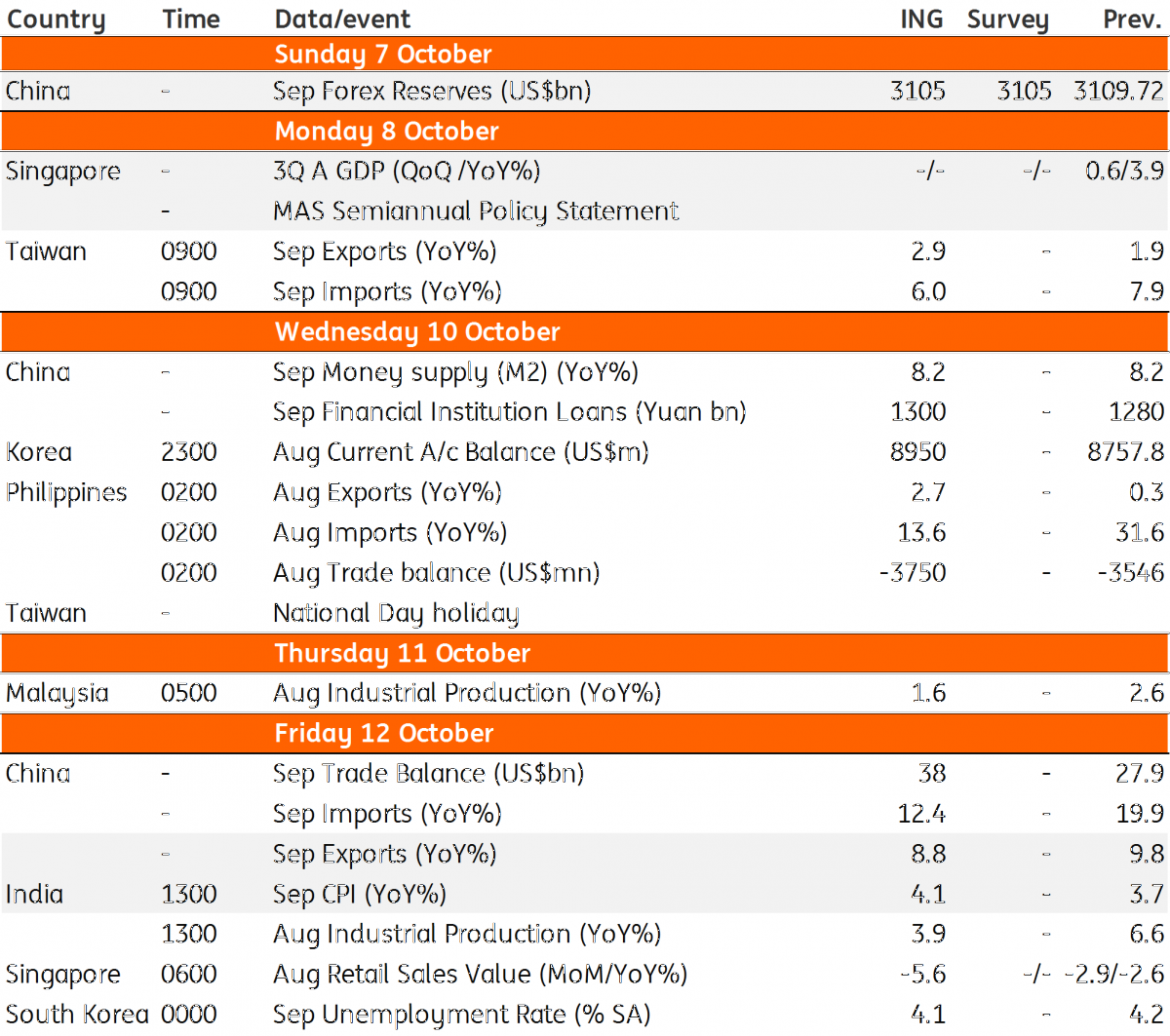

Asia Economic Calendar

Download

Download article

4 October 2018

Our view on next week’s key events This bundle contains 3 Articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).