Asia week ahead: Who’s next to fall into a recession?

Korea’s 2Q GDP figure will be the highlight of next week in Asia alongside all the inflation, manufacturing and trade releases in a jammed-pack week ahead

Will Korea be next to fall into a recession?

China might have technically averted a recession, despite falling retail sales and fixed-asset investment but Singapore wasn't as lucky as it plunged into its worst-ever recession this week.

Korea seems to be next in line as it reports 2Q GDP next week. Exports, imports, manufacturing and services output - everything was falling in the last quarter, while the second wave of Covid-19 outbreak kept confidence close to a record low.

Our house view of a 2.5% quarter-on-quarter (seasonally adjusted) GDP contraction follows a 1.3% fall in 1Q which should confirm a technical recession, marking the first recession since the SARS pandemic in 2003, and it's likely to be worse. Hopefully, it will also mark the bottom of the current downturn.

Heavy data calendar elsewhere

Inflation, manufacturing, and trade releases for June dominate the data flow – all reflecting weak demand and falling GDP in the region.

CPI inflation has been nil to negative in Japan, Malaysia, and Singapore, as has Korea’s PPI inflation. The export contraction is running in double digits in Japan and Thailand. And, weak exports and domestic demand are weighing on manufacturing in Singapore and Taiwan, although both countries have thus far been relatively unscathed by weaknesses so far this year, with Singapore supported by pharmaceuticals and Taiwan by electronics exports.

Their June manufacturing data will help to fine-tune GDP forecast for 2Q. I in the case of Singapore, it will show the extent of a likely revision in the -12.6% YoY advance estimate of 2Q GDP growth released this week.

A slow central bank week

Nothing much is going on next week in terms of macro policymaking aside from the monthly adjustment by the People’s Bank of China to its prime lending rates.

Both 1-year and 5-year PLRs have been steady at 3.85% and 4.65% respectively since 10-20 basis point cuts in April.

We expect these levels to hold next week.

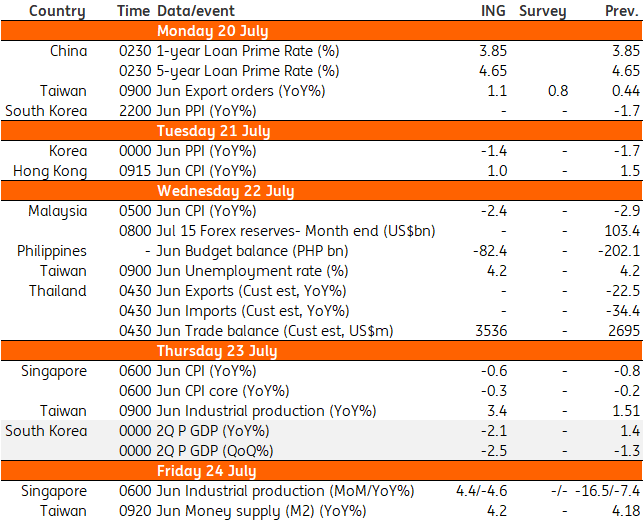

Asia Economic Calendar

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

Asia week aheadDownload

Download article

17 July 2020

Our view on next week’s events This bundle contains 3 Articles