Asia week ahead: Where is sentiment headed in the third quarter?

Sentiment-driven indicators like PMIs and business and consumer confidence will be in focus for what they say about growth in the current quarter as more 2Q GDP report cards arrive from the region

Soft indicators

China’s July manufacturing and service sector purchasing manager indices will be the highlight of next week.

We may see some softening in PMIs amid rising tensions with the US, but we think both manufacturing and services indices should stay above 50 - the expansionary territory as the economy builds on a strong rebound in the last quarter. Meanwhile, further acceleration of industrial profits growth in June should help shore up investor sentiment.

Korea fell into a recession this week with a second straight quarter-on-quarter GDP contraction in 2Q20. The upcoming consumer sentiment and business survey index should set expectations of how things pan out in 3Q. We believe it’s a long way before sentiment recovers to its pre-Covid-19 levels. Probably not possible for the remainder of the year.

Hard indicators

Besides China’s industrial profits numbers, the calendar is packed with many hard or real activity indicators, including another batch of 2Q GDP releases in Hong Kong and Taiwan.

Hong Kong has been already in recession for over a year and we believe the pain continued last quarter. And, Taiwan looks to have slipped into a recession as well in 2Q -- our house forecast of a 0.5% YoY GDP fall implies a 1.5% QoQ fall (-0.9% QoQ in 1Q).

Data pipeline in Southeast Asia includes June manufacturing numbers from Thailand and trade in Malaysia. The steeper export declines continued to depress manufacturing and GDP in both countries. June releases will help us to refine our views of 2Q GDP growth of these economies.

Singapore’s 2Q labour report will be interesting given the strong emphasis in the Covid-19 stimulus on protecting jobs. We expect the jobless rate to rise to 3% from 2.4% in 1Q. That’s still not the worst given the unprecedented economic crisis. The previous record was 4.8% during the SARS pandemic in 2003, followed by 3.3% during the global financial crisis in 2009. The stimulus measures should keep it from re-testing the SARS level, though we won’t rule out it breaching the financial crisis high by the last quarter of 2020.

And, some relief from volatility

The upcoming public holidays in most Southeast Asian countries should provide markets with a pause from volatility arising from economic data, the Covid-19 developments and turbulent geopolitics. Thailand celebrates King's birthday on 28 July and Indonesia, Malaysia, and Singapore celebrate Hari Raya Haji on 31 July.

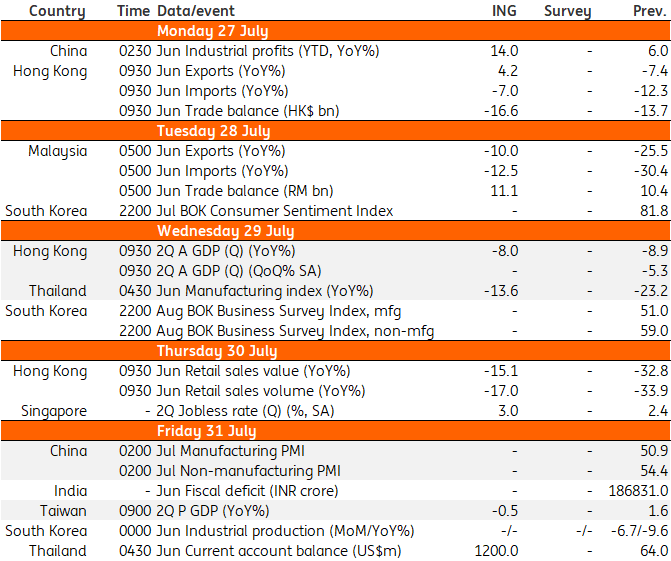

Asia Economic Calendar

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

23 July 2020

Our view on next week’s events This bundle contains 3 Articles