Asia week ahead: What’s in store for the Trump-Xi meeting?

The outcome of the G-20 summit this weekend, especially the Trump-Xi meeting on trade will set the tone for Asian markets next week. The Reserve Bank of India’s policy meeting and inflation and trade releases will be the other market drivers

The Trump-Xi trade truce talks?

The much-anticipated meeting is here, and it's fair to say the rhetoric ahead of the Trump-Xi summit has been mixed. The trade war is already on, tariffs on $260bn Chinese goods have already come into effect, and, considering President Trump's persistent bashing, any u-turn from here looks to be a remote possibility. However, the fact that the two sides are coming to the table to discuss the issue further is in itself a positive development. Any breakthrough from their talks may even blunt the next salvo of hikes in the tariff rate from 10% to 25% on $200bn of Chinese goods, and keep additional tariffs at bay.

Another thing to look out for this weekend is the diplomacy at work between the US, Saudi Arabia, and Russia, which is critical for the global oil price and, in turn, for Asian economies challenged by the steep prices.

The Reserve Bank of India’s policy tight-walk

The central bank of India's bi-monthly policy meeting next week will be yet another test of the central bank’s autonomy. In a strong majority, 20 out of 23 analysts surveyed by Bloomberg anticipate the central bank leaving policy on hold. We agree with the majority, but this isn't a non-event, especially when there is speculation about the RBI giving in to government pressure to ease monetary policy.

India's central bank meeting next week will be yet another test of its autonomy

At the last meeting in October, the RBI shifted the policy stance from ‘neutral’ to ‘calibrated tightening.’ We don’t think it will revert to neutral policy, let alone an outright rate cut. Unless it succumbs to government demands to boost liquidity in the banking system to support GDP growth. So far, the RBI has followed on measures to ease the ongoing liquidity crunch by using policy tools other than interest rates.

We don’t think the argument for a rate cut is strong enough just yet. And if we get one next week, it won't be great for the rupee

Growth is indeed slowing, but it’s not crashing. Look out for GDP data tomorrow, and inflation has been contained under the central bank’s 4% comfort level in recent months, which is where it’s expected to stay until the end of the current financial year with low oil prices.

We don’t think the argument for a rate cut is strong enough just yet and if we surprisingly get one next week, it won't be great for the rupee. Recall what happened to the currency when the government and central bank row was at its peak a month ago.

| 6.50% |

RBI repo rateNo change anticipated in December meeting |

Lower oil prices - a boon for Asian inflation

The recent downward trend in global crude oil price comes as a boon for most other Asian economies. Given that oil is down by more than 30% from its early October peak, all November consumer price data from around the region will be scrutinised for the impact.

Inflation data from Indonesia and the Philippines will be closely-watched as central banks in both countries continue to tighten policies this month despite the significant consolidation in their respective currencies over the past two months. Inflation in Indonesia has hovered around the 3% level in the last six months. Our forecast of a slight uptick to 3.4% in November from 3.2% last month comes from the low base effect rather than underlying price pressure, which will largely go unnoticed. But in the Philippines, the expected slowdown in inflation to 6.2% from 6.7% over the same months will be viewed positively by the markets.

Korea, Taiwan, and Thailand are the other countries reporting CPI data. Inflation in Korea is close to its peak but has already started to ease in the other two countries.

| 31% |

Fall in crude priceFrom the peak in October |

Balance of risks tilted toward growth

A raft of November manufacturing purchasing manager index and export data from across the region will help form our view on growth.

In the third quarter, GDP growth has slowed pretty much everywhere in Asia. It’s hard to imagine any reversal, as what the trade data will likely reinforce. November exports from Korea and Taiwan’s will be interesting given the recent collapse in technology stocks, and we forecast slower export growth for both countries.

We see the balance of risks for Asian economies as being tilted toward growth, not inflation.

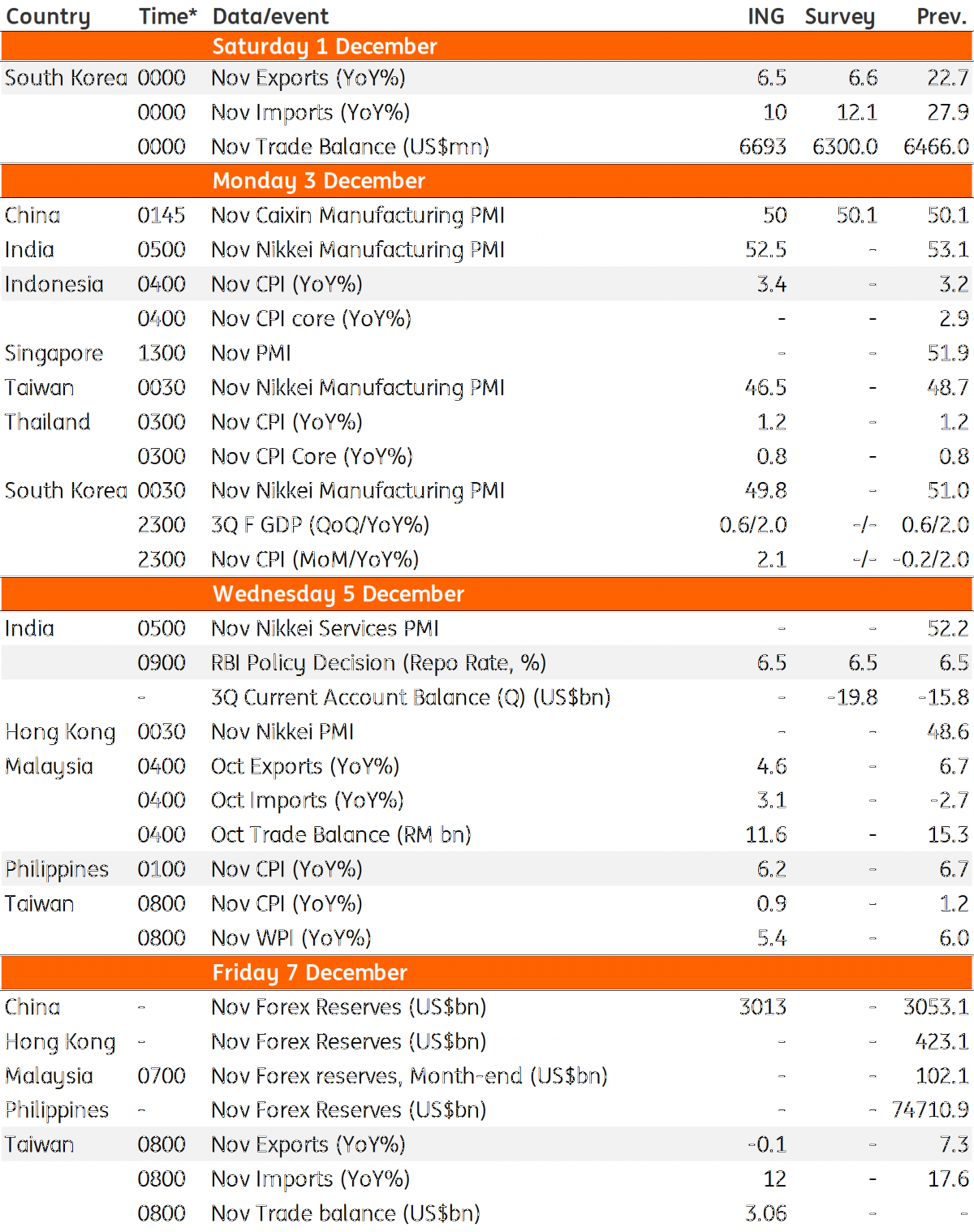

Asia Economic Calendar

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

29 November 2018

Our view on next week’s key events This bundle contains 3 Articles