Asia Week Ahead: Weak won may comfort Korean central bank

We have scaled back our Bank of Korea policy forecast from two rate hikes this year to only one in the third quarter

South Korean data deluge

A Bloomberg headline this week that “S. Korea’s Household Debt Hits Record $1.3 Trillion in 2017” punches monetary policy hawks ahead of the Bank of Korea (BoK) monetary policy meeting on Tuesday, February 27. The article cited an 8% rise in household debt in the last year led by surging mortgage debt. The pace of debt growth has slowed from 11.6% in 2016 but it’s still too rapid for an economy growing at only 3%. The article also cited the risk of rising debt defaults as interest rates go up. High household debt has prominently appeared as a risk in BoK policy statements.

The BoK started raising policy interest rates in November 2017, in what now looks like it will be a very slow tightening cycle. The pressure on further tightening has ebbed since, thanks to a sharp slowdown in GDP growth in the final quarter of 2017 (to 3% from 3.8%) and inflation has also begun to drift well below the target rate. A slew of Korean activity data, including forward-looking consumer and business confidence indexes and hard data on exports and industrial production, will inform on the current state of the economy. The recent global market rout could dent confidence indicators while the Lunar New Year holiday will distort real activity data.

Bank of Korea rate decision

Moreover, the recent market turbulence should have laid to rest the BoK’s concern over the Korean won (KRW). The selloff once again exposed the KRW’s “VIX currency” status, e.g. appreciating more than most other Asian currencies during 'risk-on' market sentiment and depreciating more than most during 'risk off'. While markets do not expect the BoK to change their policy at the forthcoming meeting, they will pore through the statement for signs of future policy moves. We have scaled back our BoK policy forecast for this year from two 25bp rate hikes to only one in the third quarter of the year.

Singapore PMI

Singapore’s industrial production for January and manufacturing PMI for February will help show how GDP growth is shaping up in 2018. The 13% year-on-year growth in non-oil domestic exports (NODX) in January was an upside surprise but electronics shipments growth, the mainstay of Singapore’s exports, remained in negative territory. We expect NODX growth to return to the mid-single digit range this year. The April central bank decision remains a very tough call, and we are still somewhat uncomfortable with our long-standing tightening forecast. But following the recent stimulative budget announcement, some very modest offsetting tightening by the Monetary Authority Of Singapore seems more probable than it did.

Hong Kong Budget

Hong Kong’s Budget for 2018 is due on February 28. Just as in Singapore, a significant fiscal surplus leading to a payback to households will not come as a complete surprise. Innovation is the buzz-word in both Hong Kong and Singapore with greater policy initiatives.

Indian GDP

India also reports GDP data for the October-December quarter. The majority of Asian economies posted a year-on-year growth slowdown in the last quarter of 2017, thanks mostly to a high base a year ago. India’s growth, however, benefits from low base effects. Consistent also with the run of high-frequency data over the period, we anticipate a slight acceleration in growth to 6.5% YoY in the October-December quarter from 6.3% the previous quarter. But it will take a big upside growth surprise to put some lift in the Indian rupee, Asia’s worst performer this month.

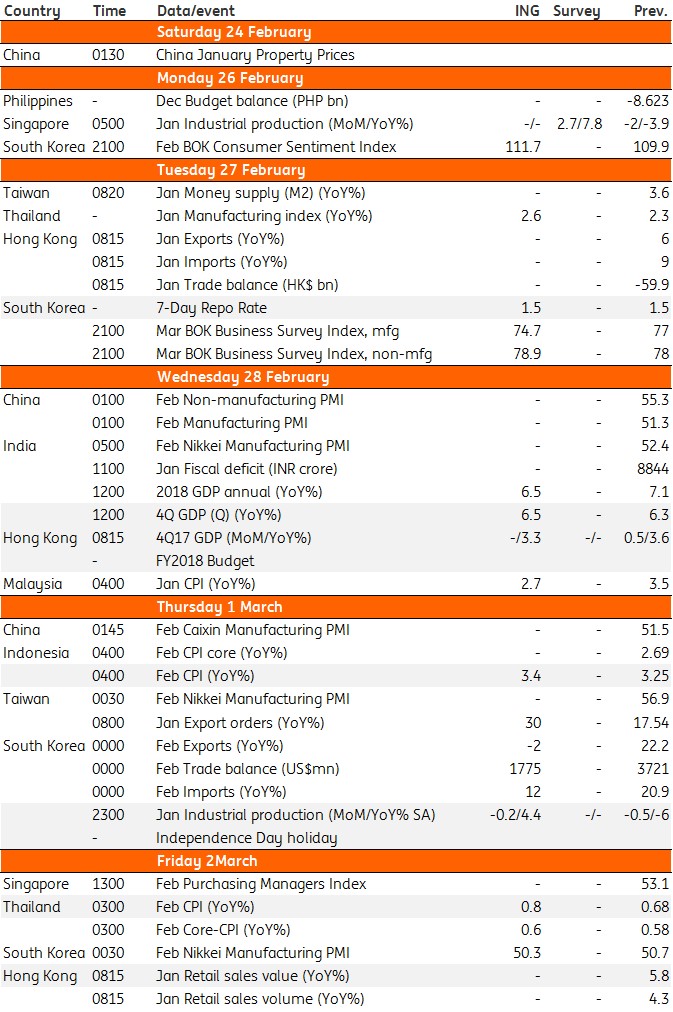

Asia Economic Calendar

Download

Download article

22 February 2018

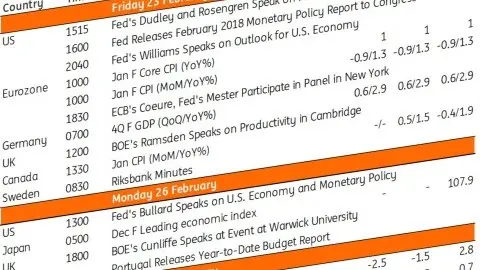

Our view on next week’s key events This bundle contains 3 Articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).