Asia week ahead: Weak trade and FX, high inflation

Inflation data crowds the calendar with Korea, Taiwan, Indonesia, Thailand and Philippines reporting CPI for June. As an all-out trade war looms, it'll be a challenging period ahead for Asian central banks to strike the growth-inflation balance

Trade war is upon us

The threat of an all-out trade war will continue to dominate the headlines before the US implements $34 billion of tariffs on Chinese goods on 6 July. China has vowed to retaliate on an equal scale and intensity. The stakes are high but so are the hopes that the two countries will come to terms in averting the war in a last-minute deal.

Meanwhile, the tensions will weigh on trade from the rest of Asia. Korea’s trade data for June will be a testimony of this. The 4.8% year-on-year fall in Korean exports in the first 20 days of June was alarming, a sign of already weakening export momentum. The weak trade sentiment is further reflected in the Korean won as Asia’s worst currency with 4.1% month-to-date depreciation.

| 2.3% YoY |

Korean export growth in JuneING forecast: down from 13.5% in May |

Currency weakness is inflationary

Inflation data crowds the calendar next week as Korea, Taiwan, Indonesia, Philippines, and Thailand report CPI for June. The usual focus here is on Indonesia and the Philippines, Asia’s high inflation economies.

We anticipate some inflation relief in Indonesia, with our forecast slowdown below 3% year on year for the first time in two years on the lower transport component. The risk to this view stems from the seasonal food price spike during the Muslim holy month of Ramadan. In the Philippines, 4.6% YoY inflation in May was the highest since 2011. We expect a further rise to 4.7% in June.

Inflation in other reporting countries is benign so far. But the risk of trade-related currency weakness fuelling inflation in the future is on the rise. The Asian central banks will have a challenging time in striking a growth-inflation balance in the event of an all-out trade war.

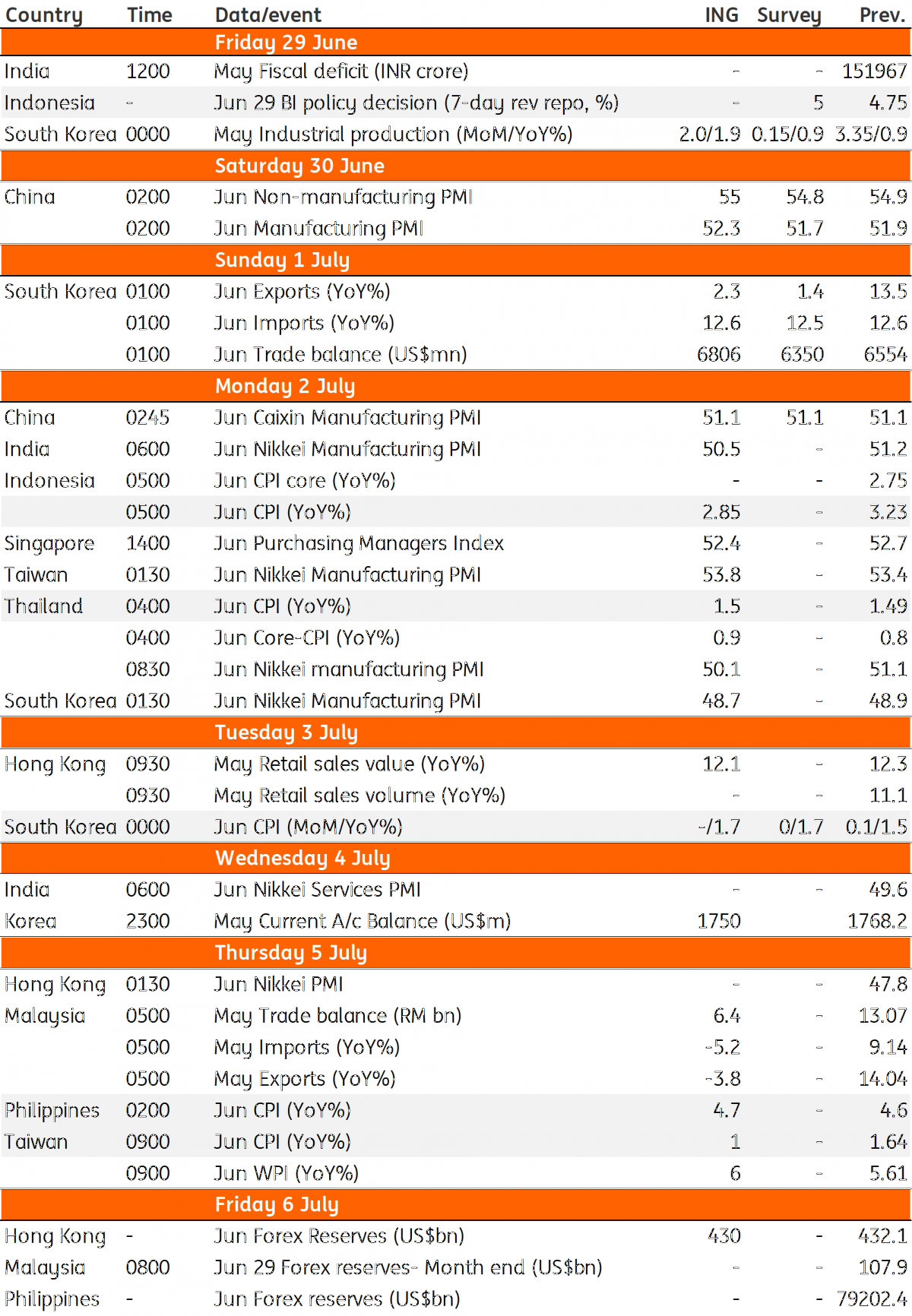

Asia Economic Calendar

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

28 June 2018

Our view on next week’s key events This bundle contains 3 Articles