Asia week ahead: three central banks to meet

Three Asian central banks are due to meet next week but all thinking and no action means they are most likely to be non-events - though the Philippines central bank could steal the spotlight

| 4.5% |

Philippines inflation in FebruarySurpassing the 2-4% medium-term target |

| Higher than expected | |

Philippines central bank defies tightening

The recent spike in Philippines’ consumer price inflation (CPI) above the central bank's 2-4% target has put monetary policy under the spotlight ahead of the March 22 policy meeting.

Inflation jumped to 4% year-on-year in January and further to 4.5% in February from 3.3% in 2017. The impact of tax reforms, rising food and utility prices are the main reasons which we expect to continue in the coming months.

However, Bangko Sentral ng Pilipinas's (BSP) policymakers have flagged their intention of not rushing into tightening to curb inflation. They argue that inflation would return to the target zone within the next 12 months and given the 12-18 months of policy lag, any tightening now would be ineffective anyway.

ING revises rate hike forecast

ING's economist for the Philippines, Joey Cuyegkeng expects inflation to peak within the next three to six month and expects no rate hike next week. He has also revised his forecast to no change from two 25bp rate hikes this year.

The stable monetary policy and widening trade and current account deficits will keep the Philippine Peso Asia’s underperforming currency this year.

Expect no change in Indonesia or Taiwan

The other two Asian central banks to meet next week are Bank Indonesia (BI) and Taiwan’s Central Bank of China (CBC), and there is a unanimous consensus that there will be no policy change by either. We expect both central banks to maintain the current policy settings throughout 2018.

Running little over 3% inflation has faded to be a policy concern in Indonesia. The expectations are that it remains well-anchored within BI’s 2.5-4.5% medium-term target. Growth is a bigger concern in Taiwan and weakening exports will put it above inflation as the policy goal this year. Taiwan data on export orders and industrial production will capture more attention next week.

A slew of inflation releases

February CPI inflation releases in Hong Kong, Malaysia and Singapore will be closely watched, and Malaysia and Singapore data will be of particular interest.

Our forecast of a further dip in Malaysian inflation below 2% means no pressure on the central bank to change policy anytime soon.

In Singapore, seasonally high food prices in the Lunar New Year month will pressure inflation up from zero percent in January, though these effects are transitory. We aren’t so confident about our forecast of the Monetary Authority of Singapore (MAS) moving to tightening in April.

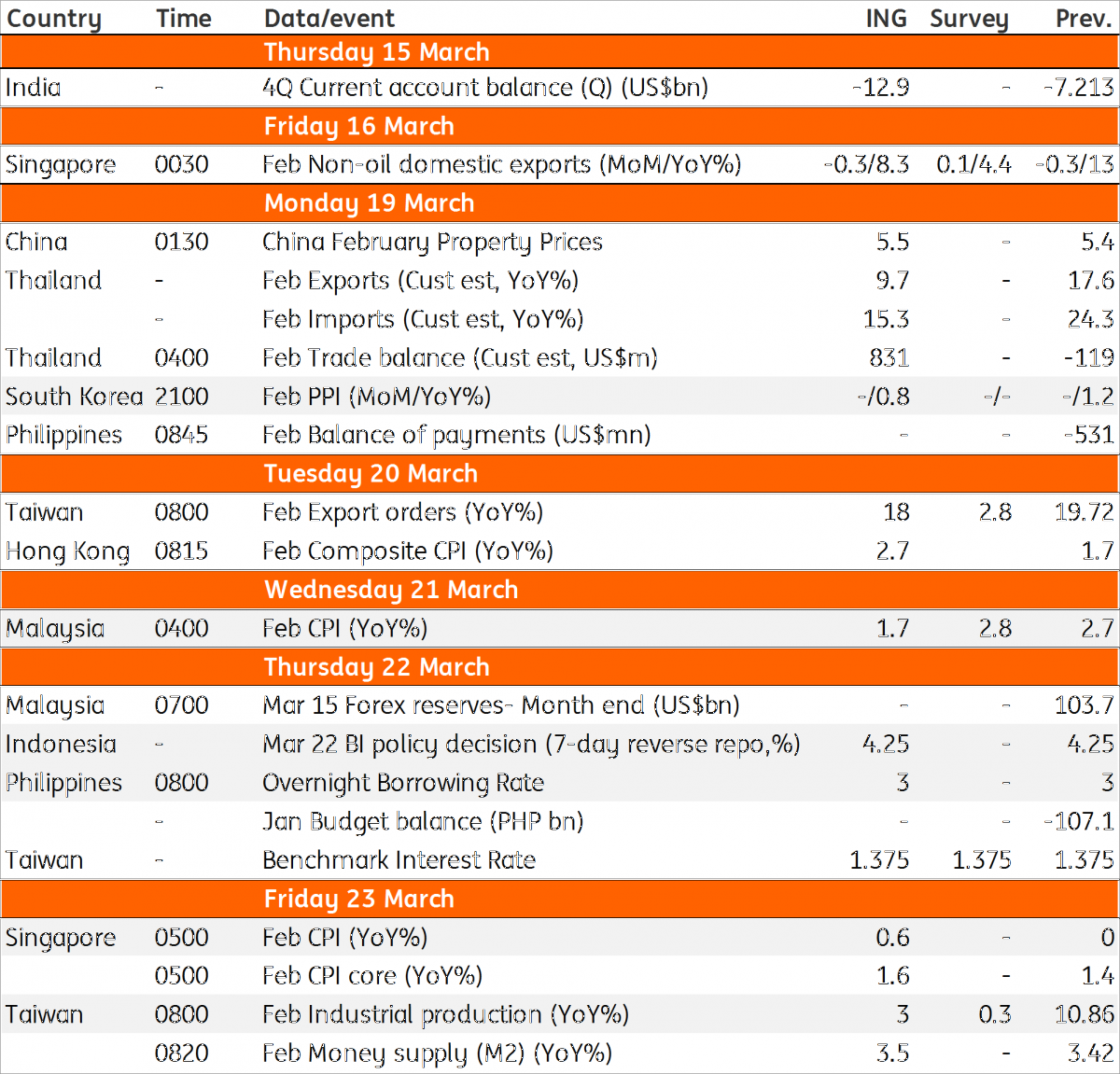

Asia Economic Calendar

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

15 March 2018

Our view on next week’s key events This bundle contains 3 Articles