Asia week ahead: The trade war is on

Asian activity data doesn’t yet speak about the trade war, which has just started. But it won't be too long

Next week in Asia kicks off with China’s GDP data for the second quarter. This and a slew of trade releases elsewhere in the region will be examined in light of the ensuing global trade war. Indonesia’s central bank has seen no fruits from the 100bp policy rate hikes in supporting the local currency and we don't think it will hike again next week.

| 6.7% |

ING forecast of China GDP growth in 2Q |

China GDP slowdown

A tick down in China’s GDP growth in line with the consensus to 6.7% in 2Q from 6.8% in 1Q does not reflect the trade war impact. Not just yet. The trade war was proclaimed by president Trump in April but the execution only started in early July. However, the downside growth risk from damage to investments in the export sectors cannot be fully discounted. The impact will only be clear from activity data from July. And it could be significant given China’s inability to retaliate on the same scale as the US’s imposition.

We think a growth forecast downgrade cycle for China, and the rest of Asia may be just around the corner.

Now the US is aiming for tariffs of up to US$200bn of imports from China, whereas China imports much less than that amount from the US. As such, qualitative barriers supplementing quantitative restrictions from the Chinese side should be crowding the financial headlines in coming days and weeks. Here is what our Greater China economist Iris Pang thinks about qualitative retaliation.

| 16.6% |

ING forecast for Singapore NODX growth in June |

Who's next to post negative export growth?

A slew of the June trade releases from Indonesia, Singapore, Thailand, and India will also be examined in light of the trade war. Surprisingly, after a strong run in the last year the year-on-year export growth is still holding firm, still in double-digits for some countries like Singapore. But the base effect is becoming more punishing for others. Korea and Philippines have already started posting negative export growth and, based on our forecast, Indonesia will be the next to join this camp.

Underlying our 17% YoY growth forecast for Singapore non-oil domestic exports is almost flat month-on-month growth after a chunky 13% MoM bounce in May. But this will also need steady electronics exports, and the slowdown in electronics exports from Korea and Taiwan in June isn’t a good news for Singapore.

| 5.25% |

Bank Indonesia policy rate |

Bank Indonesia to take it easy after 100bp rate hike

Indonesia’s central bank (BI) will be in the spotlight for the policy meeting next Thursday (19 July). BI’s interest rate weapon for currency stability may have run out of the steam after a cumulative 100bp policy interest rate hike since mid-May failed to curb the IDR weakness. We aren’t expecting BI to use this weapon further, at least not in the forthcoming meeting. There are domestic factors, like wider current account deficit, responsible for the currency weakness. But there is also the global currency contagion from restrictive trade policies and the strong US dollar.

Judging by accelerated depletion of Indonesia’s foreign reserves in recent months, exchange market intervention appears to be at disposal to stave off the IDR depreciation. This is further reflected in the USD/IDR rate meeting a strong resistance at 14,400 since late-June, possibly the BI line in the sand for the pair that’s being protected. We remain sceptical of the policy success with our end-2018 forecast of 14,850.

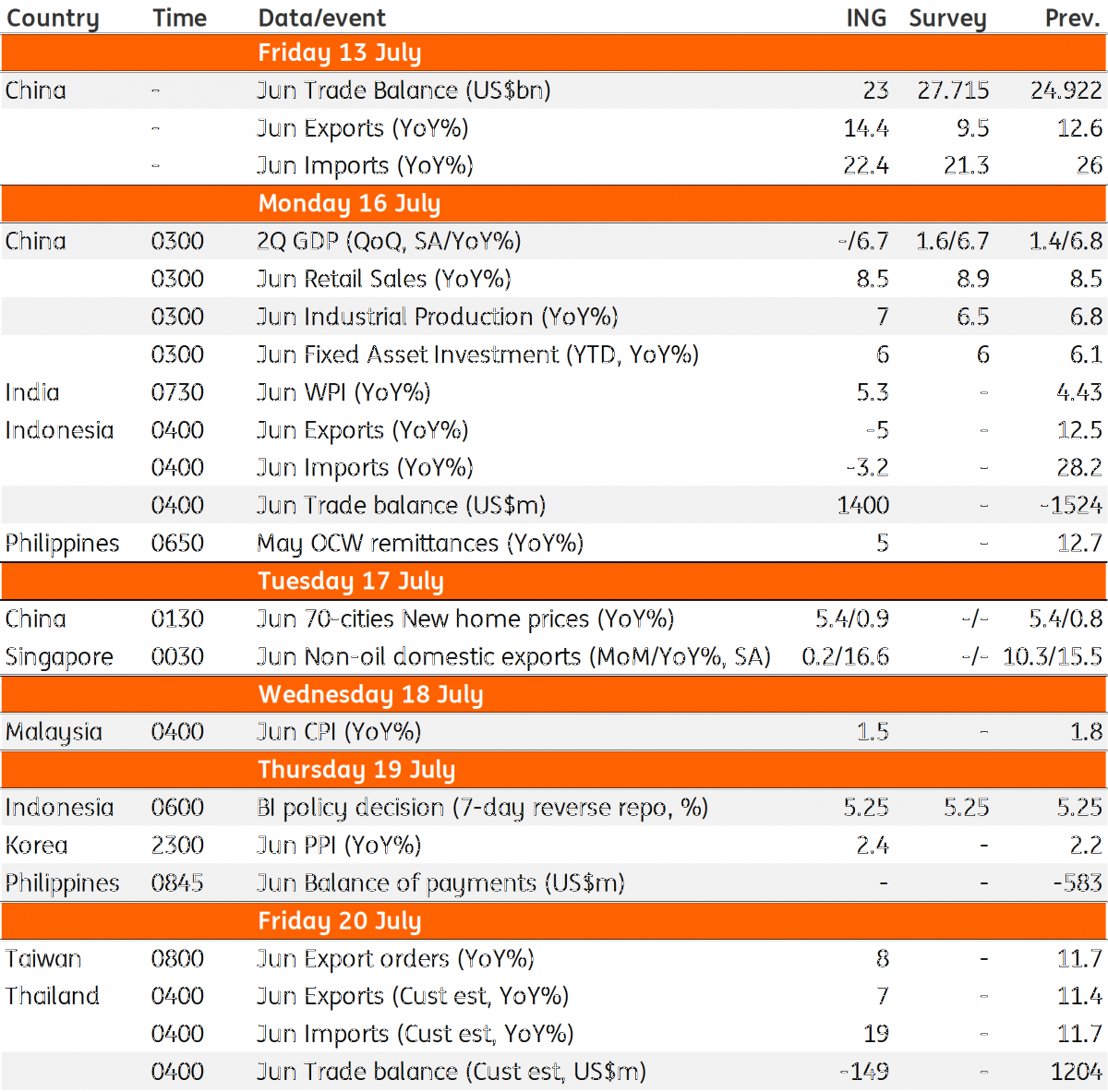

Asia Economic Calendar

Download

Download article

12 July 2018

Good MornING Asia - 16 July 2018 This bundle contains 4 Articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).