Asia week ahead: Spotlight on Indonesia’s central bank

Expect Indonesia's central bank to hike rates by another 25bp to stem the rupiah's weakness. The other highlights include manufacturing releases for May from Korea, Singapore, Taiwan and Thailand

| 5% |

ING forecast of BI policy rateUp by 25 basis points |

Bank Indonesia to tighten policy ... again

Bank Indonesia’s monetary policy meeting is the key highlight of the week ahead.

Financial stability will be the main focus of the meeting as an escalation of global trade tensions keep domestic financial assets and the rupiah (IDR) under a weakening pressure. Following its Philippine counterpart, BI moved to tighten policy in May and raised interest rates by a total 50bp, two 25bp moves taking the main policy rate to 4.75%. Alas, the hikes did little to stem the currency weakness in both countries. Philippine's central bank raised rates by another 25bp this week, and we expect Bank Indonesia to follow suit next week.

On a positive note, however, Indonesia’s trade data for May due next week is likely to show a swing in the trade balance to surplus from a deficit. A swing to about $1bn surplus in May from $1.6bn deficit in the previous month is what we anticipate, should bring some life into the currency.

| 52.3 |

China manufacturing PMIING forecast |

Trade tension weighs on China’s manufacturing

The soft data on China manufacturing PMI for June may not capture the impact of trade war just yet. At least that’s what appears from our house forecast of a rise in PMI to 52.3 in June from 51.9 in May. However, we aren’t ruling out a downside risk.

The manufacturing PMI has been bouncing around 51 over the past two years, the level associated with about 6% year on year industrial production growth. Any dent in trading from tariffs will also dent manufacturing.

The good news is that China has started pre-emptive measures to cushion potential trade war impact.

So far so good, exports still supporting manufacturing elsewhere

The industrial production releases for May from Korea, Singapore, Taiwan, and Thailand should benefit from firmer exports from these countries. Apart from Thailand, the growth of exports from other economies reporting industrial production data accelerated in May, led by firmer electronics exports.

Industrial production growth closely tracks real GDP growth in most Asian economies, and the combined April-May data will offer a good insight into GDP growth in the current quarter.

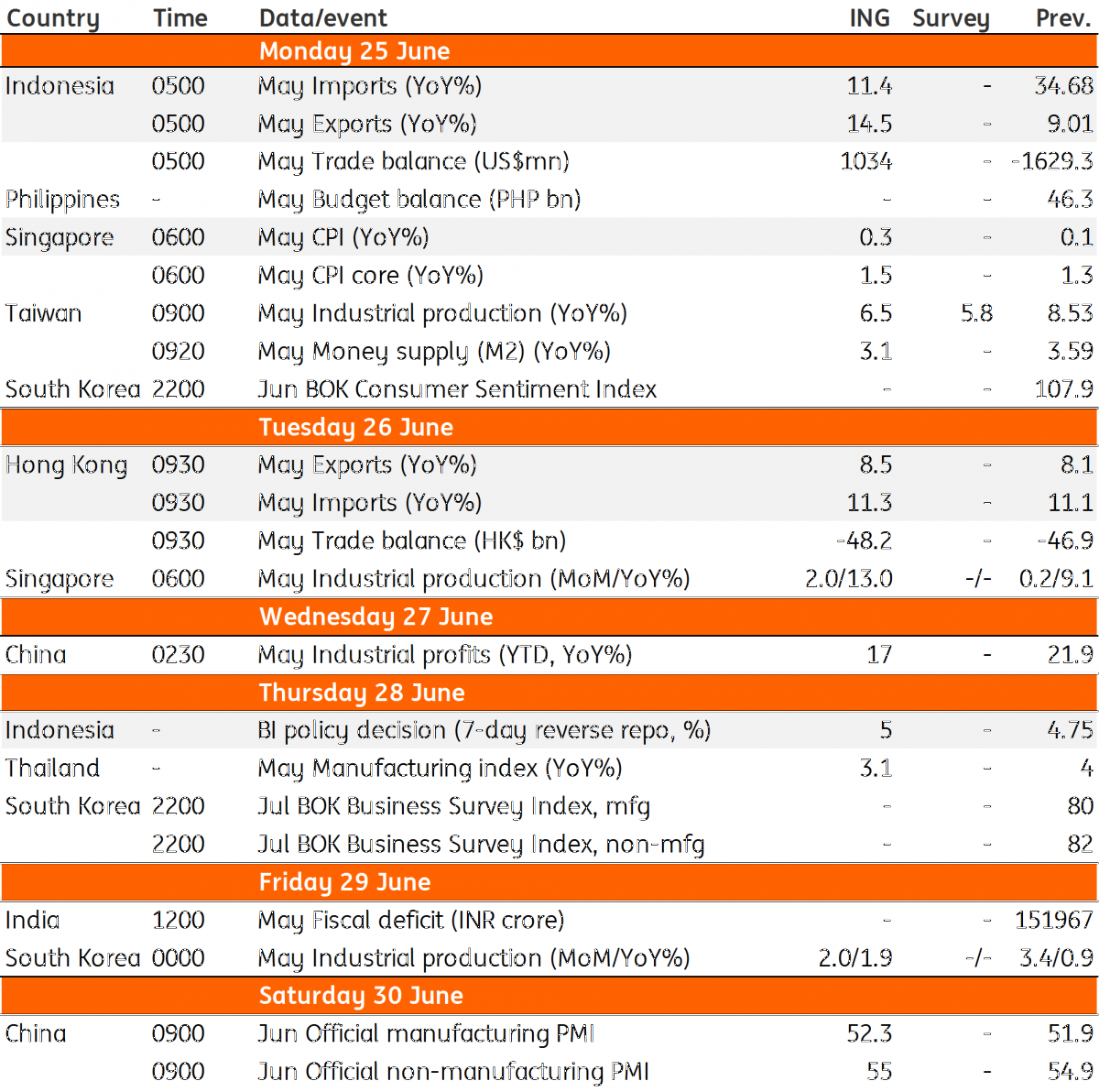

Asia Economic Calendar

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

21 June 2018

Our view on next week’s key events This bundle contains 3 Articles