Asia week ahead: Spotlight on China and Korea

China’s 3Q GDP and the Korean central bank policy meeting are the key highlights of next week. While growth slowdown in China is pretty much priced in by the markets, the Bank of Korea’s policy decision looks like it'll be a close-to-call event

China: Engineering a soft-landing as the trade war escalates

China is due to publish its first GDP report since the trade war kicked off in early July, and we think it is likely to show only a negligible impact. However, it is entirely possible that third-quarter data might not even capture the full impact of the trade war.

This is because the first formal salvo of the $34bn of US tariffs hit on 6 July, followed by $16bn on 23 August and a further escalation to an additional $200bn a month later. Moreover, exports were little affected with still high single-digit year-on-year growth. This is what, we think, underpins the consensus view of 6.6%, a meagre drop from the 6.7% in the previous quarter. Our forecast is 6.5%.

Among the remaining economic indicators due in September, consensus expectations indicate a slight slowdown in exports and industrial production growth, steady retail sales growth, and a pick-up in fixed asset investment growth - all consistent with the forecast of a slight dip in GDP growth.

Beijing is trying to offset potential export weakness (as a result of higher tariffs) by boosting domestic infrastructure spending and dialing back on deleveraging and manufacturing sector reforms. With macro policy geared towards a soft-landing, our house view remains that the economy continuing to eke out GDP growth at an excess of 6% during the tariffs era.

| 6.5% |

China's 3Q GDP growthING forecast |

Korea: A close-to-call central bank policy decision

The Bank of Korea will meet next Thursday (18 October) while also releasing its quarterly Economic Outlook simultaneously which includes the central bank's revised economic forecasts.

The consensus appears to be split between ‘no change’ and ‘a rate hike’ as the central bank seems to be under political pressure to rein in the property market. Based on the Kookmin Bank home price index, home price inflation in Seoul has come in at 10% year on year in September, but we don’t see much signs of overheating elsewhere. Apart from the current low levels of interest rates sustaining the risks of overheating in the real estate market and swelling the household debt further, there are no solid economic grounds to resume tightening just yet - after the one-off rate hike in November 2017.

It's true monetary easing was one of the reasons behind the rise in apartment prices, but there were other factors such as housing imbalance and Seoul’s development plans that boosted investors’ confidence in the future of real estate – Governor Lee

Asia’s heavily export-dependent economy is at the forefront of bearing the brunt of the trade war impact as export growth has slowed sharply to 4.7% YoY in the first nine months of this year from 18.5% a year ago. This is despite the fact the full impact of the trade war is yet to come through.

This makes another downgrade to the BoK’s GDP growth forecast (2.9% for 2018 and 2.8% for 2019) imminent. While this will weaken the argument for tightening, consumer price inflation has gained momentum recently, but a policy status-quo is our baseline for the upcoming meeting.

| 1.5% |

ING forecast of BoK policy rateUnchanged |

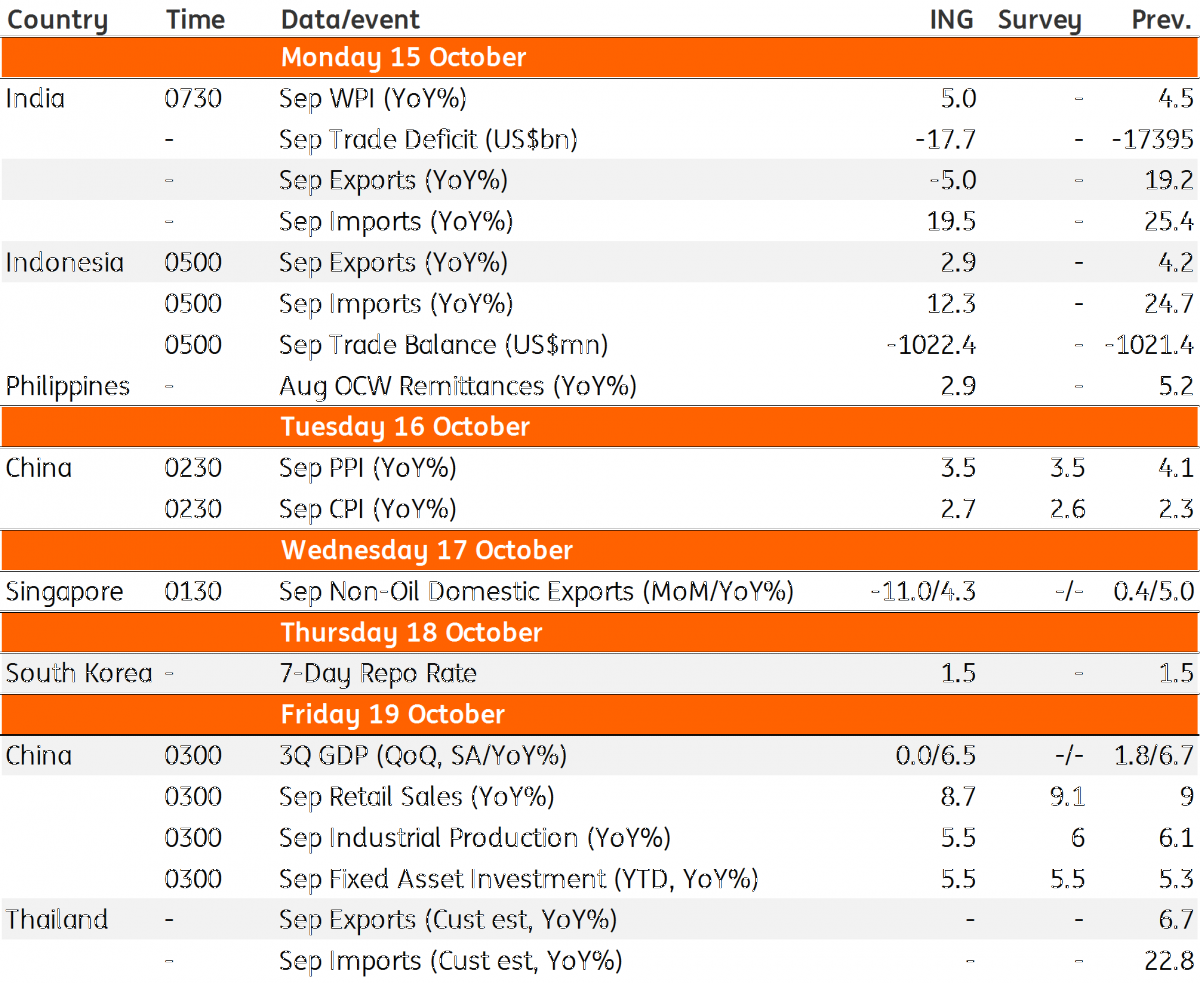

Asia Economic Calendar

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

11 October 2018

Our view on next week’s key events This bundle contains 3 Articles