Asia week ahead: Is relief from the currency sell-off transitory?

Positive economic data out of Indonesia and the Philippines is unlikely to come as lasting relief for their respective currencies. Meanwhile, few are betting on a rate hike from the Thai central bank as the currency enjoys strong external payments support

Relief from currency sell-off but how long will it last?

In keeping with broader emerging markets, Asian currencies received some support from a softer US dollar this week. But as the US Federal Reserve is set to hike rates again later this month and once more before the end of the year, just how long will the relief last? This will remain the question for some time, but for now, we anticipate that Asian currencies hit hardest by the recent contagion will see some support from friendly economic releases.

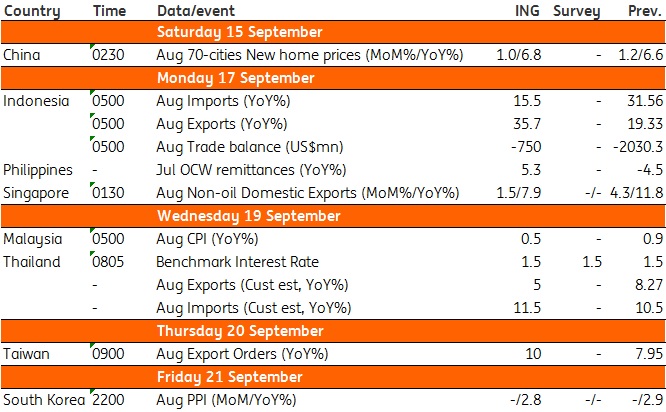

The trade data dominates the Asian economic calendar, with Indonesia, Thailand, and Singapore releasing numbers. We think Indonesia’s trade figures will be closely-watched for clues about where the trade deficit is heading. We are hoping for some good news of a narrower deficit, which on our house forecast falls to $750 million from over $2 billion in July. But we don’t think this is enough to stem the currency (IDR) weakness. With our forecast for August, the cumulative deficit of $3.8 billion in the first eight months of the year is a huge swing from a $9.1 billion surplus a year ago. We expect no break in the Bank Indonesia rate hike cycle just yet.

Thailand stands at the opposite spectrum with a large trade surplus driving the currency's (THB) outperformance. We estimate an August trade surplus of $1.2 billion, a sharp positive swing from a $516 million deficit in July. Likewise, the continued strength of Singapore’s non-oil domestic exports- albeit with some anticipated electronics weakness in August- and the central bank policy of a ‘gradual and modest’ appreciation of the trade-weighted exchange rate is keeping the Singapore dollar (SGD) among Asia’s outperforming currencies.

Philippines’s July overseas workers remittances and the August balance of payments position also are expected to be positive for the local currency (PHP). Remittances were unusually weak in June this year despite seasonal inflows for school fee payments but we expect some improvement in July helped by the stabilisation of the peso. A bounce in foreign exchange reserves in August also heralded some improvement in the overall balance of payments in the last month. Still, with remittances insufficient to cover the trade deficit on a sustainable basis and the current account in deficit, this isn’t a long-term positive for the Philippine peso.

Anyone betting on Thai central bank policy move?

The Bank of Thailand’s Monetary Policy Committee meets next Wednesday (19 September). Only five of the 22 analysts who participated in a Bloomberg survey published on 29 August expect a 25 basis point policy rate hike in the current quarter, or at the upcoming meeting. We don’t think this will happen. In the same survey, expectations for a rate hike in the fourth quarter increased, with another seven analysts predicting such a move. We still don’t buy it.

We don’t see a pressing need for a policy move just yet. Growth has started to moderate in 2Q18 and is likely to slow further in the second half of the year. Despite a full percentage point rise in inflation since the start of the year to a four-year high of 1.6% in August, core inflation has been firmly below 1%. And above all, the currency (THB) continues to enjoy a strong standing among regional peers. Like at the August meeting, we aren’t ruling out some hawkish rhetoric, but policy inaction remains our baseline for the remainder of the year.

Asia Economic Calendar

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

14 September 2018

Our view on next week’s key events This bundle contains 3 Articles