Asia week ahead: Singapore unveils budget for FY19

The outcome of the ongoing US-China trade negotiations will set the tone for Asian markets next week.Singapore’s proactive macro policies give authorities some wiggle room to cushion the economy from the trade-related global slowdown. Indonesia's central bank meets next week too but despite the raised hopes of a policy cut, we think it'll stay on hold

Singapore: Embarrassment of riches

Next week in Asia kicks off with Singapore’s trade data for January on Monday, followed by the budget statement by the country’s finance minister later that day. An outsized slump in non-oil domestic exports (NODX) in December suggests some retracement of that is in order while the likely front-loading of shipments ahead of the Lunar New Year holiday should have helped the bounce. However, with semiconductors remaining a weak spot – taking a cue from the large fall in Korea’s chip exports in January – our baseline remains a persistent weak NODX trend.

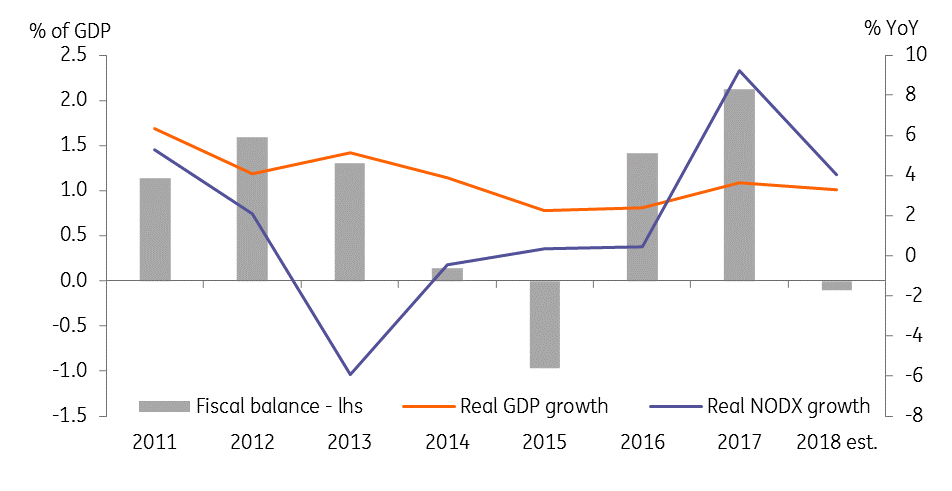

Undoubtedly, the FY19 budget will focus on supporting the economy from the adverse impact of the widely-anticipated slowdown in global demand this year. The public finances have surpassed the government’s expectations in recent years. With decent 3.3% GDP growth and better revenue performance so far, the budget is likely to produce a surplus contrary to the initial forecast of a fiscal deficit in 2018, and this leaves scope for more growth supportive fiscal policy in 2019.

Among the popular budget measures in 2019, there are more incentives for the workforce to improve their skill set, more help for low-income households, increase in provision for healthcare for the elderly, possibly a sugar tax, and greater support for small-and-medium enterprises towards digital transformation.

Singapore: Wide fiscal surplus allows for growth-friendly budget

Indonesia: Central bank to leave policy on hold

Indonesia's central bank meets next Thursday (21 February), and we expect no change to the policy rate of 6.0%. A total of 175 basis points rate hikes over June-November 2018 was aimed at curbing the depreciation pressure on the rupiah. Although the Indonesian rupiah has been an Asian outperformer so far in 2019, the depreciation risk from widening current account deficit prevails and could be further intensified by political uncertainty surrounding the elections in April.

The year-to-date rupiah performance combined with well-behaved inflation has raised hopes of policy rate cuts. However, the deputy governor Dody Waluyo recently thrashed such hopes, noting still ‘cautious’ policy preference to financial stability over growth. We aren’t ruling out further rate hikes this year. But for now, we think BI policy will take a backstage until the political uncertainty is lifted.

Thailand: 4Q18 report card arrives

Thailand’s GDP data for the final quarter of 2018 is due on Monday. Underlying our view of a pick-up in growth to 3.5% year-on-year from 3.3% in 3Q18 is improved manufacturing growth even as exports continued to weaken. It’s still not an exceptional starting point for the government looking for 4% GDP growth in 2019.

Besides global factors depressing exports, political uncertainty is likely to overshadow the economy this year. We expect annual GDP growth to slide to 3.8% in 2019 from an estimated 4.1% in 2018. We don’t think this will be a sufficient reason for the Bank of Thailand to reverse December’s 25bp rate hike, while persistently large current account surplus supports the baht's outperformance.

Asia Economic Calendar

Download

Download article

14 February 2019

Our view on next week’s key events This bundle contains 3 Articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).