Asia week ahead: Singapore central bank to stay on hold

Lots of data coming out of China next week, but export growth will be the one we'll be looking out for. Elsewhere, Singapore's central bank meets, but expect no fireworks

China's fiscal stimulus is working

China's trade, inflation and monetary indicators are due for March, and we expect the numbers will give an undistorted view of the economy as the data from the first two months of the year is affected by the Lunar New Year seasonality. Indeed the most significant will be export growth for what it says about the trade war impact, while lending growth will tell us about the government stimulus.

From the better manufacturing PMI reading, we infer the fiscal stimulus is working and expect hard activity data to reinforce this message.

Singapore - stable policy this year

Singapore's central bank releases its semi-annual monetary policy statement next week, and this comes alongside the advance estimate of GDP growth in the first quarter of 2019.

The Monetary Authority of Singapore tightened policy in April last year, but there is no denying that downside growth risk has intensified since. A sharp plunge in both exports and manufacturing in the first two months of 2019 foreshadowed sharp GDP slowdown in the first quarter. Inflation pressure also has abated, apart from the food component. Headline inflation has been less than 1% for more than four years now, and core inflation, which ticked up to the top end of the MAS’s 1-2% forecast recently, has also started to slow.

With these trends likely getting stronger in 2019, we believe the MAS will prefer to leave policy on hold next week. As such, we expect no change in the MAS's target band for Singapore Dollar Nominal Effective Exchange Rate (SGD-NEER) – no change to the level, the width, or the slope of the band. Our base case is one of stable policy this year.

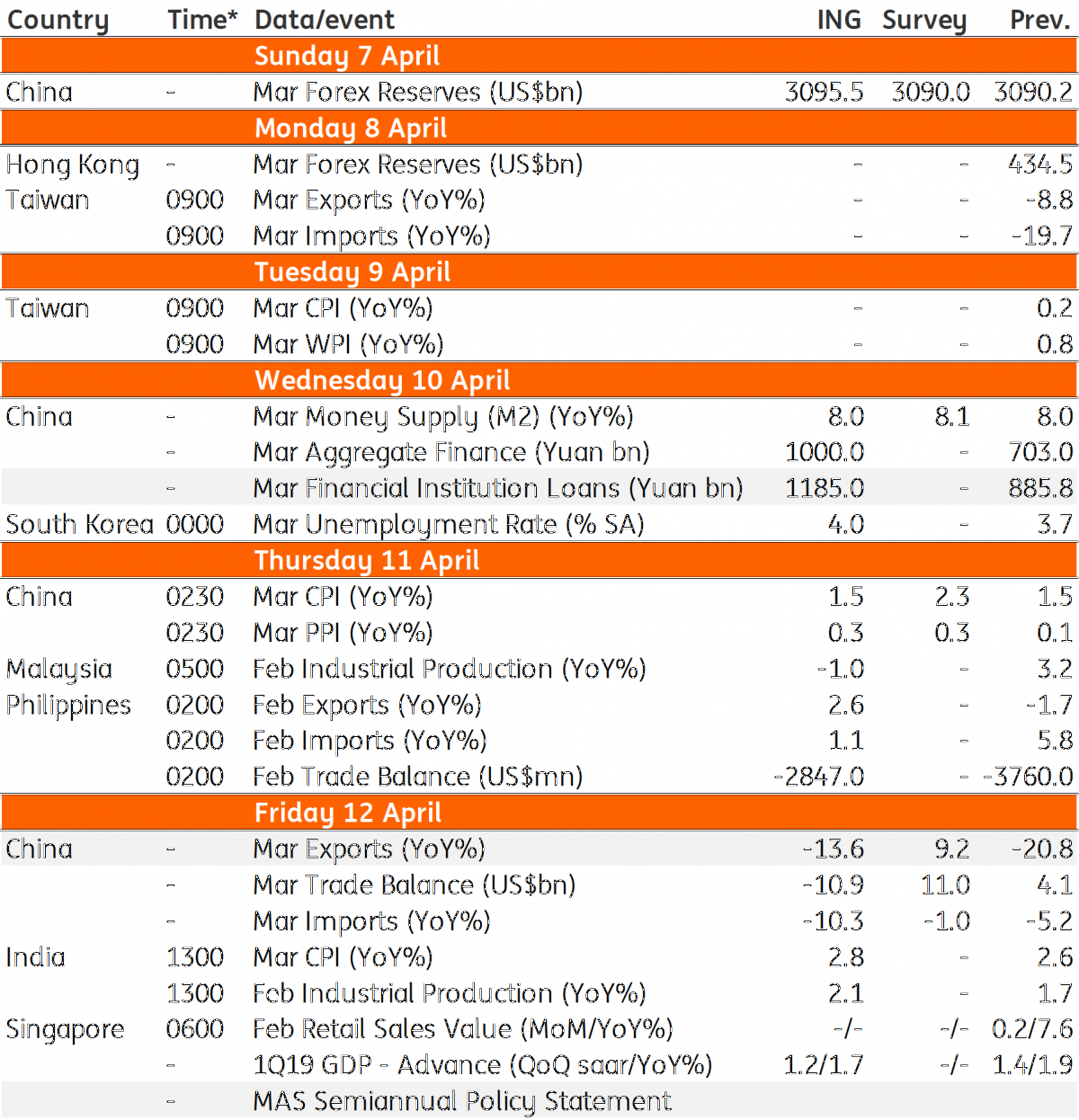

Asia Economic Calendar

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

4 April 2019

What’s going on in Australia? This bundle contains 6 Articles