Asia week ahead: Reserve Bank of Australia meeting plus regional inflation data

The Reserve Bank of Australia (RBA) meeting will be the highlight for the week while several regional economies report inflation data

More confirmation needed before pausing rate hikes in Australia

Following the larger-than-expected decline in January’s inflation figures, coupled with a slowdown in GDP growth in the fourth quarter, we expect that the upcoming RBA meeting is going to be much more interesting than has been the case recently. Although the January inflation rate had dropped a full percentage point, inflation still stands at 7.4% year-on-year – way higher than the RBA will be comfortable with. The RBA will want to see confirmation of a downward trend in inflation, not just a reversal of seasonal spikes to even consider pausing its current 25 basis point per meeting tightening strategy.

The softer-than-expected 4Q22 GDP number was encouraging but we would need to see confirmation from other data to conclude that a slowdown is underway, and of a sufficient magnitude to see inflation fall back within the RBA’s 2-3% target range.

Consumer prices expected to fall in Korea

Consumer inflation is expected to fall to 4.9% in February (vs 5.2% in January). The recent increase in utility fees likely raised prices for eating out and manufactured products. On the other hand, gasoline prices continue to decline and the impact of the drop in jeonse prices (rental) is expected to appear in the index. Thus, we expect consumer prices to cool out gradually in February.

Foreign reserves and trade data from China

China will report its February foreign exchange reserves data next week. The weaker yuan should lead to some capital outflows for the month and a slight fall in foreign exchange reserves. As capital flow channels have widened via stock and bond connects, capital movements in 2023 will be more reflective of exchange rate movements.

China will also release international trade data for January and February. We expect the yearly contraction to continue for exports and imports in the first two months. Import growth should contract less than exports due to strong consumption demand in China. However, imports for processing trade should continue to be affected by slowing global demand.

Trade data and CPI from Taiwan

Taiwan will report trade data for February. Both exports and imports should continue to be in yearly contraction, around 15% to 20%. This reflects falling demand for semiconductor chips as global demand weakens.

Meanwhile, Taiwan's CPI inflation should edge lower as the economy faces external demand headwinds that should have driven wage growth lower. This trend should allow the central bank (the Central Bank of the Republic of China) to pause its rate hike cycle. The central bank will likely be watching the Fed fund rate movements closely. There is a possibility that the CBC could cut interest rates in the fourth quarter.

Philippine inflation to sustain upward trend?

Price pressures in the Philippines remain evident and we could see another month of elevated inflation. The January report caught many by surprise and we could be in for another upside surprise for headline inflation again. We expect headline inflation to be 8.7%YoY or higher as food inflation is still expected to be substantial. This should prompt another rate hike from the Bangko Sentral ng Pilipinas (BSP) at its March meeting although BSP Governor Felipe Medalla signalled his preference for only a 25bp rate hike given the supply-side nature of the price increases.

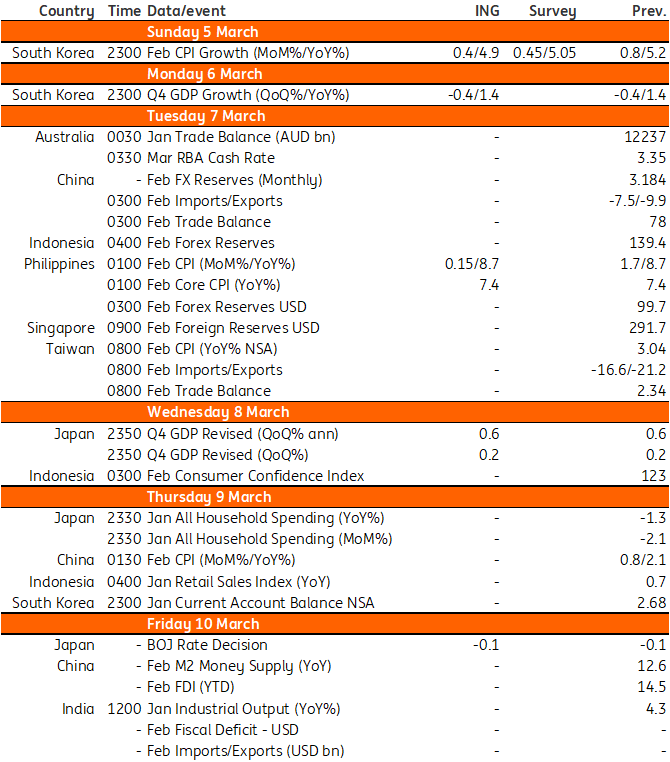

Key events in Asia next week

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

2 March 2023

Our view on next week’s key events This bundle contains 3 Articles