Asia week ahead: Regional inflation data, Taiwan trade numbers and Indonesia’s GDP

Next week’s calendar features inflation readings from Australia, India, the Philippines and China, plus Indonesia’s growth performance and trade data from Taiwan

Has inflation peaked in Australia?

On 7 February, the Reserve Bank of Australia (RBA) is expected to hike rates by 25bp. Some months ago, when the RBA adopted the smaller 25bp hike approach, it became obvious that the central bank was not operating on a data-dependent policy. As it got closer to the peak in rates, it would simply proceed at a slower pace to avoid, or at least limit, the risk of overtightening. Considering the much higher-than-expected inflation readings over the past two months, we have increased our peak RBA cash rate forecast to 4.1% from 3.6%, assuming that there are two further months of 25bp hikes ahead.

We see a slight softening of the labour and housing markets, but this is not likely to be decisive for future rate decisions. There will be a subsequent statement on monetary policy on 10 February and this will likely provide more clarity on direction.

India expected to pause hikes

We can expect to see further central bank action from the Reserve Bank of India (RBI) on 8 February, and the outcome is much less certain than the RBA. The current repo rate is at 6.25%, which is 55bp higher than the prevailing rate of inflation, which has since fallen back into the top end of RBI’s 2-6% tolerance range.

Our contention has been that the RBI is at or close to the peak, and we believe that the RBI will put a pause on the hikes to give growth a chance.

Philippine inflation to stay elevated as supply shortages persist

Philippine inflation is expected to dip to 7.8% year-on-year in January, down slightly from 8.1% in the previous month. However, we expect inflation to remain at elevated levels as supply shortages persist. Low domestic production resulted in surging prices for basic food commodities, Meanwhile, still-elevate global energy prices have resulted in high utility costs and rising gasoline prices.

The Bangko Sentral ng Pilipinas (BSP) is expected to retain its hawkish stance for the time being although Governor Felipe Medalla has hinted at a possible reversal later in the year.

Price pressures expected to slow in China

China’s January CPI inflation should rise faster given the post-Covid lockdown reopening and extended holiday. Our estimate is 2.4%YoY. Despite the acceleration, it’s too early to say whether this is a trend and is still below the warning level of 3%. Inflation should be slower in February after the holiday.

PPI on the other hand should stay at a slight year-on-year contraction level due to the combination of lower commodity prices and a high base effect. Construction activities have yet to pick up, leading to lower metal prices. We expect construction activities to start to recover after winter which should give some support to PPI inflation.

Headwinds in Taiwan’s semiconductor industry

Taiwan’s trade data should show a dire picture as the western market has placed fewer orders on semiconductor chips while the Mainland China market has yet to fully recover. We expect a contraction for both exports and imports of around 20%YoY.

This might lead to more uncertainty about the projected central bank’s hike in the first quarter of the year. Taiwan’s central bank should consider opting not to follow the Fed or hike at a slower pace due to the headwinds in the semiconductor industry.

Other data reports: PBoC’s decision on RRR, reserves and Indonesia’s GDP report

We do not expect the People's Bank of China (PBoC) to change the interest rate or RRR this year. The main monetary policy should be through a re-lending programme, which is more focused and helpful for economic recovery. Meanwhile, China is going to release credit data (from 9-15 February) and we expect a jump in January despite being the month of the Chinese New Year. New yuan loans will be the key engine of credit growth in the first month of the year. More credit growth from the debt market should follow during the first quarter.

FX reserves should rise as indicated by the strengthening of the yuan which implies capital inflows into China. Further capital inflows are possible, especially portfolio inflows. But due to uncertain geographic tension, multinational companies might defer direct investments into China.

Lastly, Indonesia reports fourth-quarter GDP and we expect growth to hit 4.9%YoY, taking 2022 full-year growth to 5.2%. Softer commodity prices weighed on both export performance and industrial output, however solid domestic demand was able to offset the downturn.

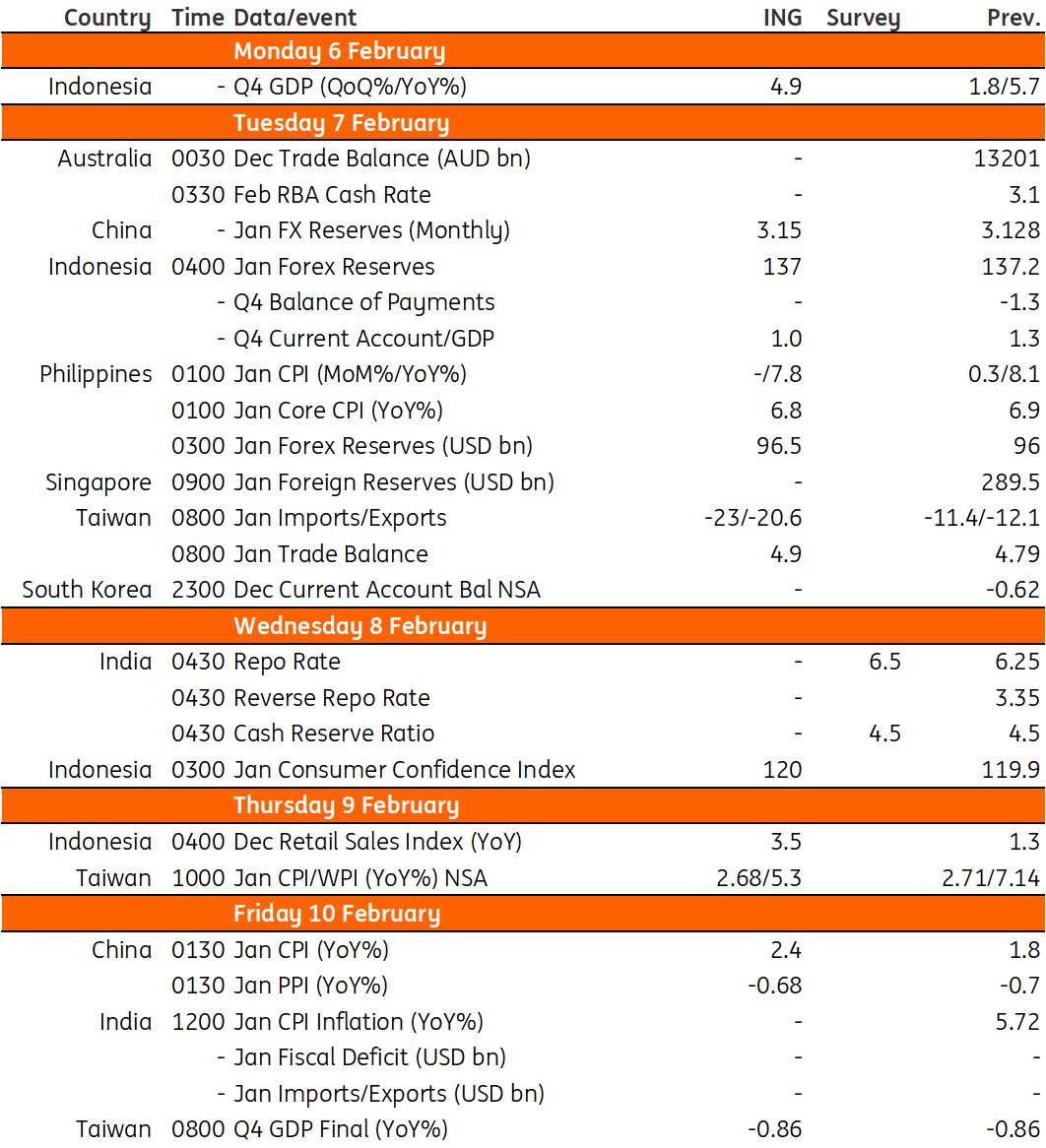

Key events in Asia next week

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

2 February 2023

Our view on next week’s key events This bundle contains 3 Articles