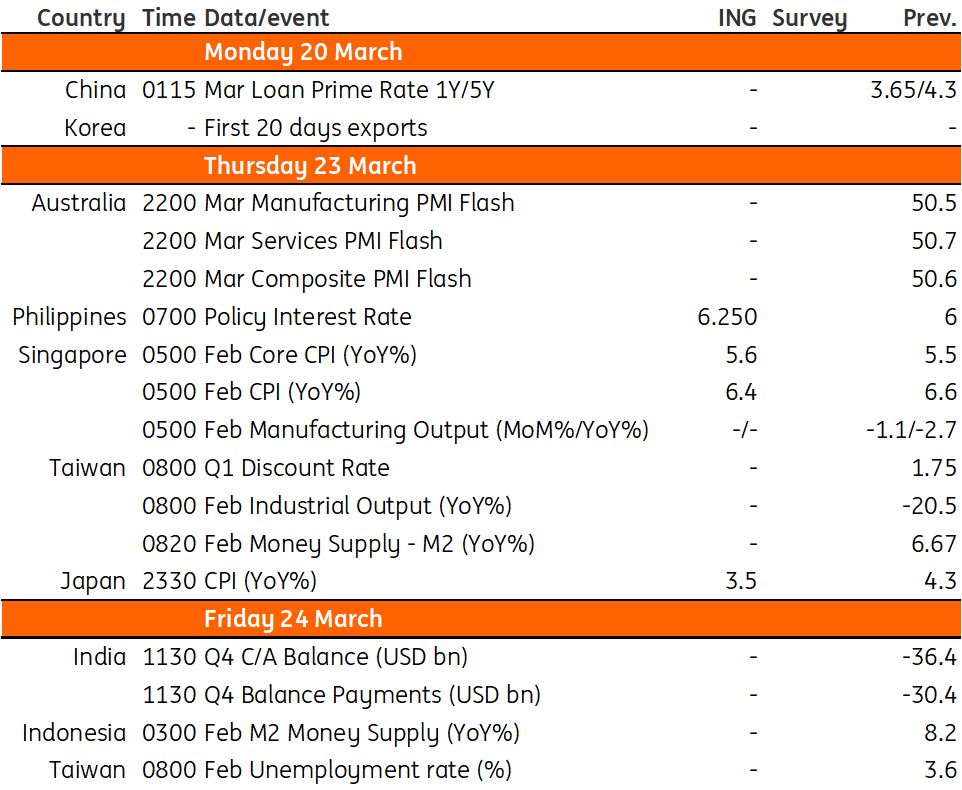

Asia week ahead: Regional central bank meetings and trade data

Next week’s calendar features policy meetings from several regional central banks, trade numbers from India, Korea and Taiwan, activity data from Japan and Taiwan plus inflation readings from Japan and Singapore

Expected slowdown in India’s current account deficit

India’s current account deficit has widened substantially and although the trade deficit slowed its increase in the last three months of the year, the consensus forecast for a narrowing of the broader current account deficit looks optimistic.

Upcoming RBA minutes of March policy meeting

The minutes from the Reserve Bank of Australia's March meeting next Tuesday could be an interesting read and may shed more light on what appeared to be a hint that peak rates were nearing.

Upcoming CPI and PMI data from Japan

Consumer inflation in Japan is expected to cool to 3.5% year-on-year in February (vs 4.3% in January) due to the government’s energy subsidy programme, helped along by the base effects of a slowdown. For the fresh PMI reports, we believe the trend of weak manufacturing alongside a strong services sector will continue.

Trade data from Korea

Early April trade data will be out from Korea and we expect sluggish exports to continue. The trade deficit however is expected to narrow in April as imports of commodities could decline more sharply.

China to announce target interest rate

Banks in China will announce their loan prime rate and we expect no change at 3.65% and 4.3% for 1-year and 5-year, respectively. The ongoing economic recovery means that banks do not have to ease further.

Busy week for Taiwan

Taiwan’s central bank will decide on policy in the coming days. We believe the recent Silicon Valley Bank collapse will be another factor in the central bank's rate decision. The best way forward for the central bank should be to stay put at 1.75% as hiking further may create concerns for the financial market.

Meanwhile, Taiwan’s industrial production and export orders should continue to reflect slowing growth in the US and European economies. We do not think China's growth can fill the gap. A mid-teen yearly contraction is likely for both reports.

Singapore inflation stays hot

Price pressures remain in Singapore as the impact of the recent implementation of the goods and services tax feeds through. Headline inflation could slow slightly to 6.4% YoY but core inflation is likely to heat up further to 5.6%. Faster inflation is expected to weigh on overall retail sales for at least the first half of the year. Elevated inflation could produce a potential policy response from the Monetary Authority of Singapore (MAS) at the April meeting. We expect MAS to retain its current hawkish stance given the significant challenges faced by Singapore’s growth outlook.

BSP to hike again as inflation remains an issue

Bangko Sentral ng Pilipinas (BSP) meets next week to discuss policy. Although we expect the central bank to sustain its rate hike cycle, we could see Governor Felipe Medalla downshift to a 25bp increase. Medalla recently hinted at a less aggressive rate hike when he called for the rapid deployment of supply-side measures to address the tight supply of basic food items. Recent developments in the global banking system will also be watched closely and thus we believe that next Thursday’s hike could be the last for this tightening cycle.

Key events in Asia next week

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

16 March 2023

Our view on next week’s key events This bundle contains 3 Articles