Asia week ahead: Redefining US-China trade relations

A positive turn in the US-China trade dispute following a phone call between Presidents Trump and Xi last weekend will get a reality check at the trade talks on 7 January

Another round of US-China trade talks

After the dismal manufacturing numbers from China and Apple's downgrade of their earnings forecasts, the forthcoming US-China trade talks on 7th January offer some hope for the two sides to come to terms with the adverse consequences of their ongoing trade dispute.

President Trump hailed the ‘positive progress’ on trade after his latest phone call with President Xi. Having suffered heavily from intensified uncertainty since the Trump-Xi and G-20 summit, markets will cheer if there is a further push towards a trade deal by the end of March. However, any backtracking on the imposed tariffs isn’t really something one can hope for, which means the negative medium-term impact on both economies and thereby on the rest of the world will be inevitable.

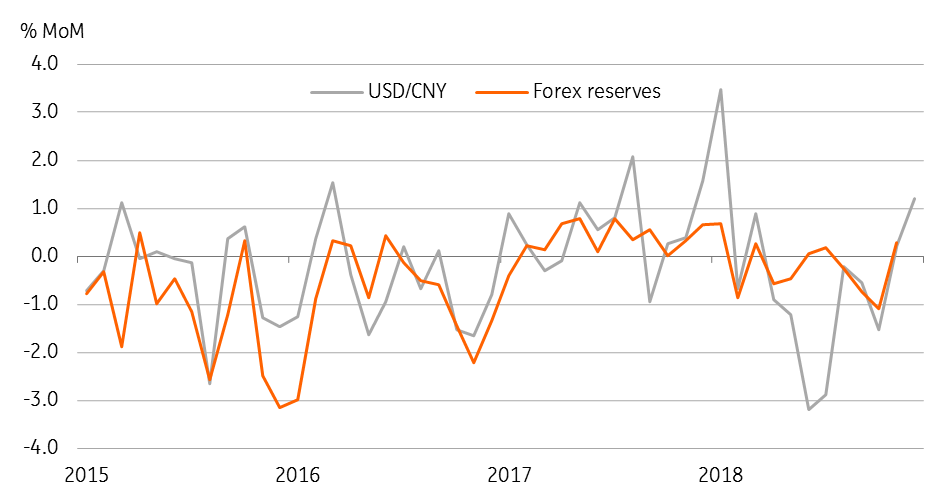

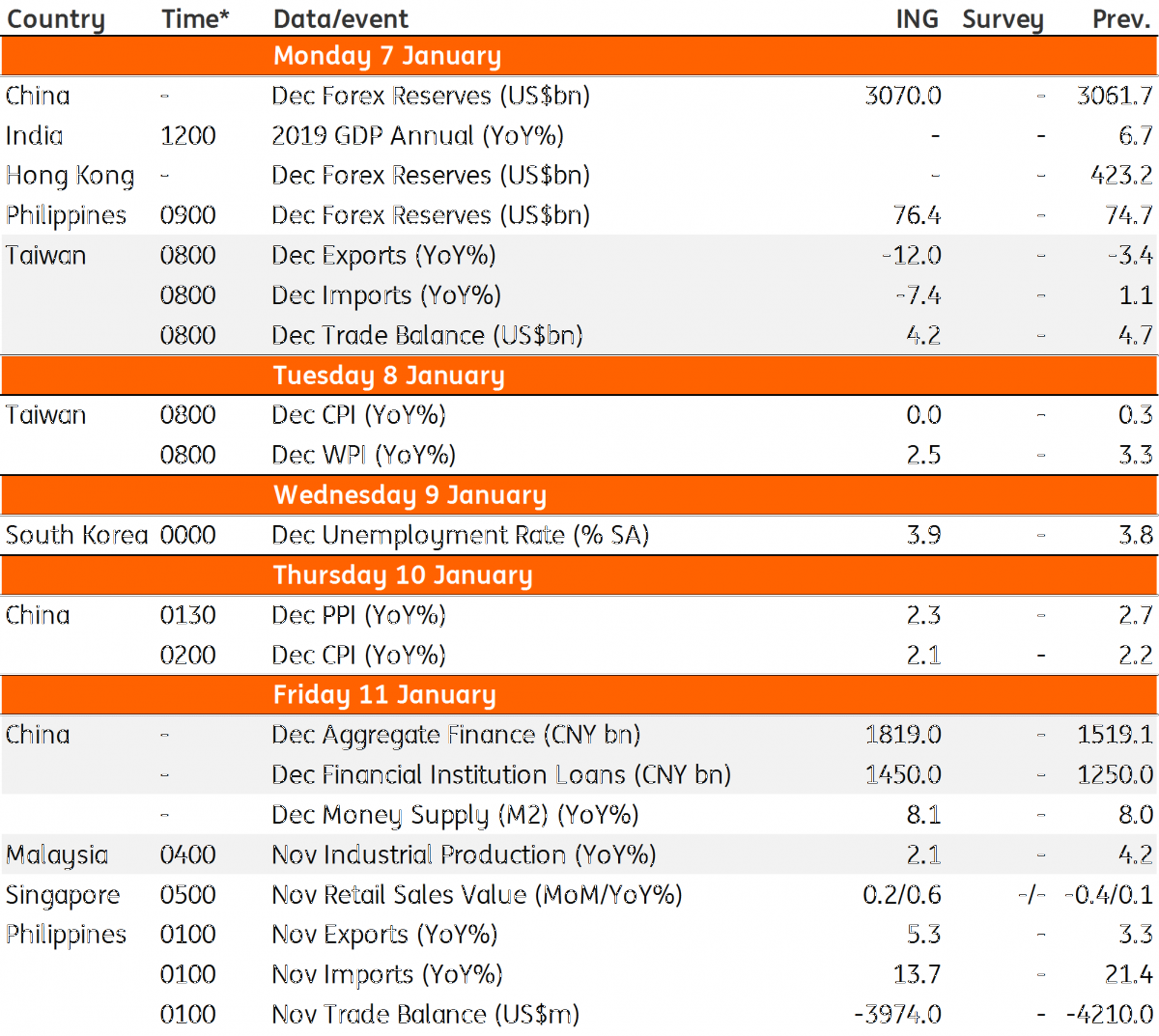

China’s economic data will continue to be gleaned for the trade war impact. We think the monetary data (aggregate financing and new bank lending) will be closely watched for evidence of stimulus. Meanwhile, the yuan’s 1.2% appreciation in December, the most in the last twelve months, augurs well for sustained improvement in China’s foreign exchange reserves after the decline in reserves in November.

China's FX reserves and USD/CNY exchange rate changes

Otherwise, a light economic calendar

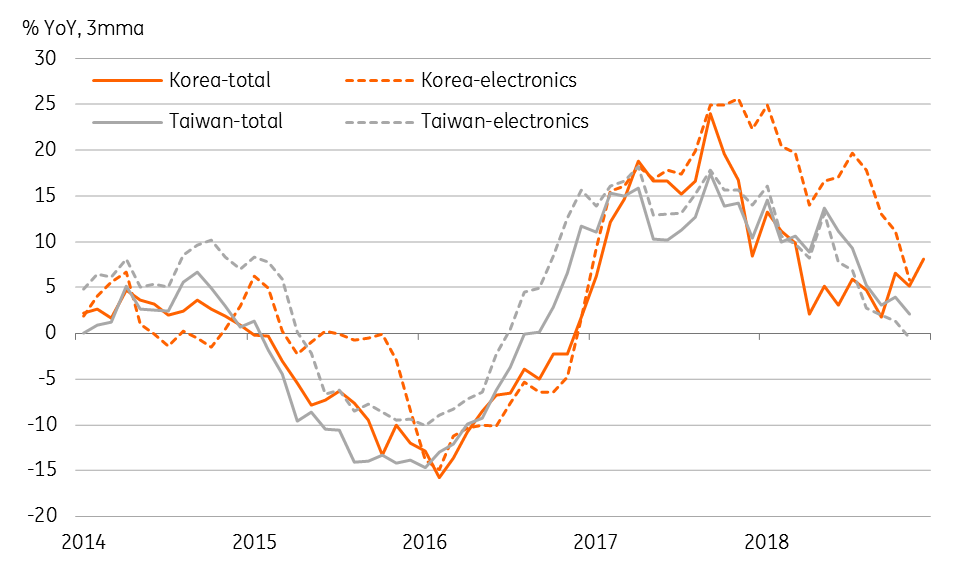

Aside from Taiwan’s December trade figures, there isn't a whole lot to be excited about in Asia. Like Korea, Taiwan’s exports are the front-line victims of the potential slump in global demand and the slowdown is already underway in the heavy-weight electronics segment. Judging from Korean exports in December, we believe the annual contraction in Taiwan’s exports deepened in December (ING forecast -12.0% YoY vs -3.4% in November).

Finally, Malaysia’s trade and industrial production data will be key for the central bank meeting later this month (24th January) as these indicators will tell us about GDP growth in the last quarter of 2018. An all-time low manufacturing PMI in December wasn’t really great news here, and this tips the balance of risks for the central bank policy towards easing - though we don’t think the central bank will rush in that direction just yet.

Korea and Taiwan export growth

Asia Economic Calendar

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

Asia week aheadDownload

Download article

3 January 2019

Our view on next week’s key events This bundle contains 3 Articles