Asia week ahead: Is a technical recession lurking?

Some Asian economies are already showing signs that a 'technical recession' may be around the corner, but low inflation gives central banks some room to avert one. But aside from that, April economic data should provide a glimpse of where GDP growth and inflation are headed in the second quarter

Is a 'technical recession' lurking?

1Q19 GDP reporting season is catching up with more Asian countries reporting data next week.

Aside from China, the slowdown in Asian economies gained traction in the first quarter of the year. China’s GDP growth was steady, thanks to the fiscal stimulus, but Korea and Singapore posted sharp growth slowdowns in 1Q19, and the countries reporting next week – Hong Kong and Taiwan – are likely to join this camp too.

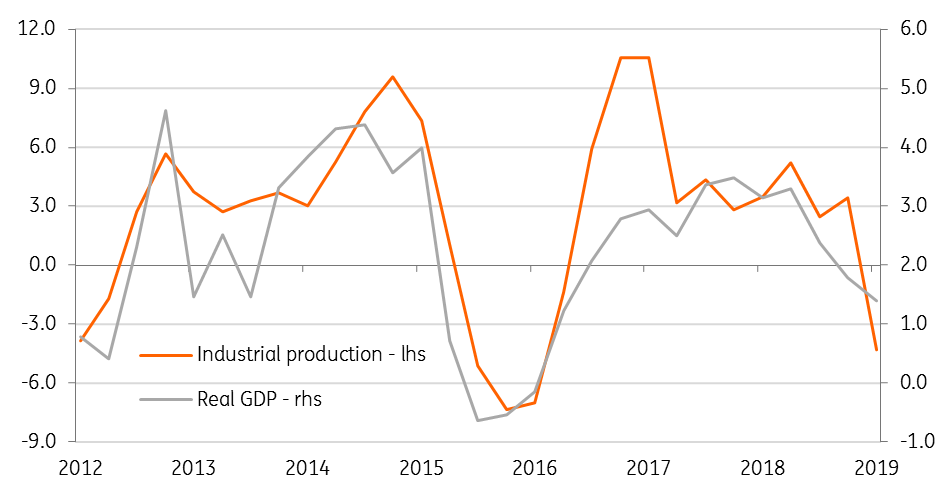

The critical question is whether a recession is around the corner. Korea was the first in Asia to report quarterly GDP contraction in 1Q19. Taiwan could follow suit, judging by a steep fall in its manufacturing in the last quarter. As things stand now, we can’t rule out another quarter of GDP contraction in 2Q, and after today's GDP numbers from Korea, we think a 'technical recession' is quite plausible.

Taiwan's manufacturing is dragging GDP lower (% YoY)

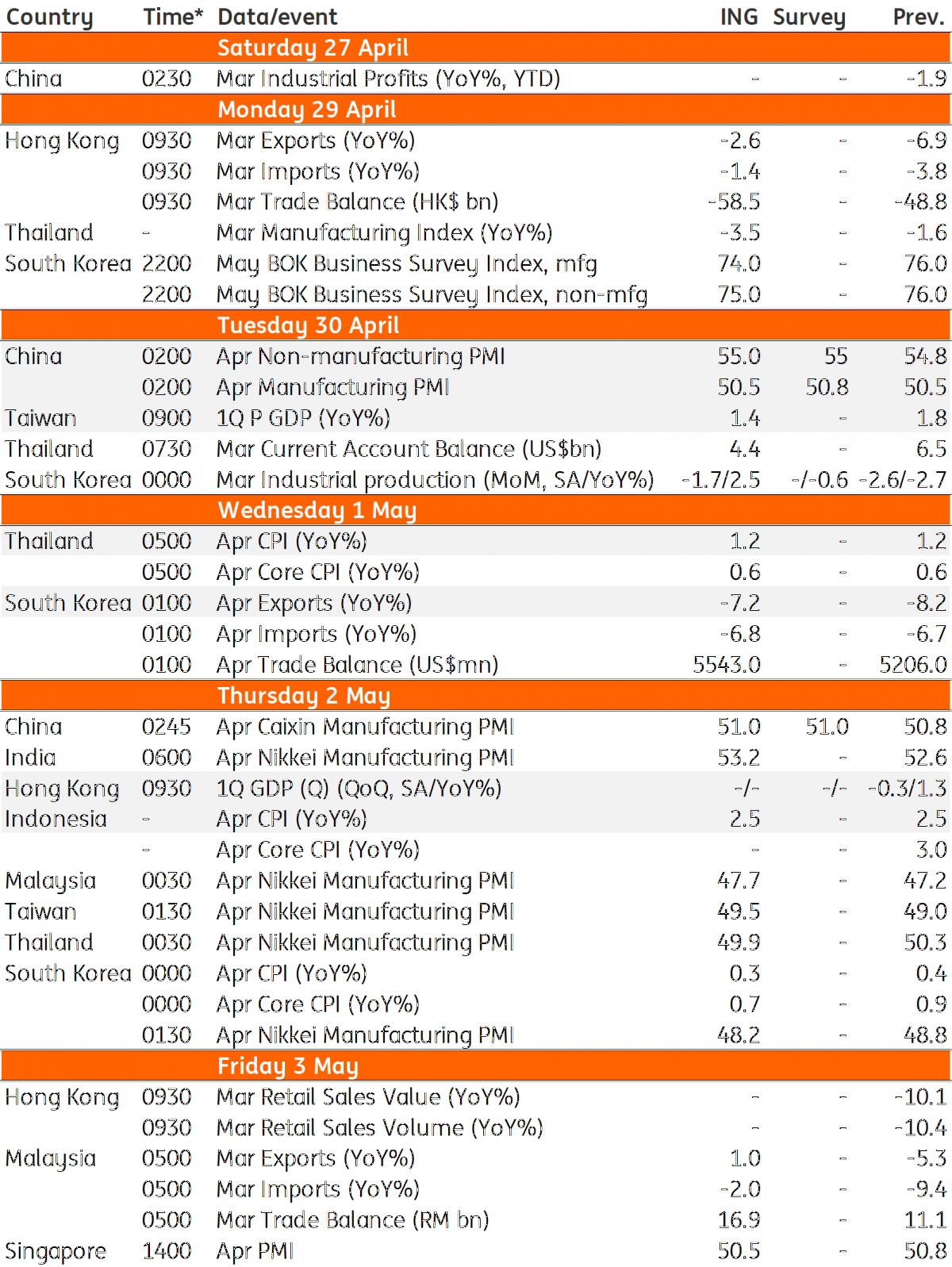

April data should give a glimpse of 2Q growth

April trade data and purchasing managers' index should provide a glimpse of where GDP growth is headed in 2Q. Preliminary manufacturing PMIs from developed countries bode well for those due from Asia next week. The export order components of PMI will be judged for the trade story, which doesn’t seem to be getting any better though.

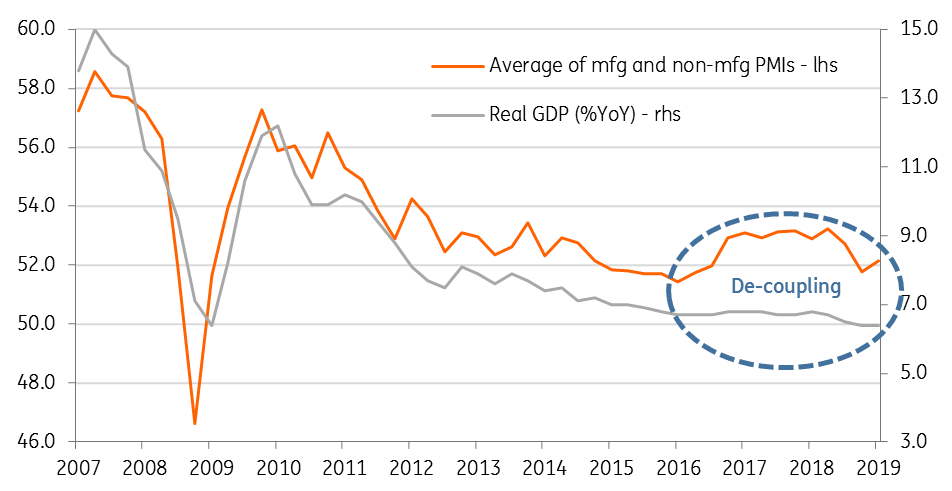

Chinese data will be under scrutiny to see if the economy’s better-than-expected performance in the first quarter was a blip and if the slowdown has been delayed. This may be hard to judge from soft data like PMIs, given its de-coupling from real GDP growth in recent years. But it’s still a key sentiment driver for markets. A slight improvement as implied by consensus forecasts for both manufacturing and non-manufacturing PMI will be good enough to put a positive spin on China’s growth story.

Korea is the first economy in the region, and probably the world, to release trade figures for April, and should prove to be a good guide to trade from the rest of the region. We see no respite from the falling trend in Korean exports which have been reeling under the global tech slump.

China: De-coupling of PMI and GDP growth

Low inflation allows for more policy support

Korea also reports consumer price data for April along with Indonesia and Thailand.

Aside from the upward pressure on global oil prices, there is nothing to worry about inflation in Asia. And an oil-driven rise in inflation isn’t something we expect to see in an environment of slowing growth. But the current low level of inflation across the region does give central banks the scope if needed to ease policies to support growth.

Asia Economic Calendar

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

Asia week aheadDownload

Download article

25 April 2019

What’s happening in Australia and around the world? This bundle contains 9 Articles