Asia week ahead: Australia and India’s central banks to meet

Inflation data will dominate central banks thinking in Asia as two regional central banks meet next week and both are expected to stick to their current policy course

Inflation data to dominate

In next week's Asian calendar, inflation data stands out as four countries – China, Taiwan, the Philippines and Thailand release figures for March.

The Philippines will take the spotlight for its runaway inflation that has surged past the central bank’s 2-4% target (ING forecast 4.9%, up from 4.7% in February) and is becoming the main contender against India’s 5.1% inflation in February to be the highest in Asia. Like India, supply shocks to food and transport prices are pushing inflation higher, while demand-side price pressures remain muted amidst rising Covid-19 cases and renewed lockdowns.

The Philippines will take the spotlight for its runaway inflation that has surged past the central bank’s 2-4% target

The central banks can unfortunately not do much but raise inflation forecasts. The Bangko Sentral ng Pilipinas raised its forecast for 2021 to 4.2% from 4.0% but left policy rates unchanged. We expect the Reserve Bank of India to take the same course at the upcoming meeting next week on 7 April.

There isn’t much inflation in China or Thailand, which will also release their inflation numbers next week. Taiwan’s March trade figures are likely to take prominence over inflation as the latter remains under control. Released earlier this week, the Korean trade figures show sustained strong growth and we expect the same for Taiwan’s exports – both powered by the global semiconductor cycle that’s going full steam ahead amidst the ongoing chip shortage.

Downunder, the Reserve Bank of Australia will hold its policy meeting on 6 April. Like the Fed, the Australian central bank is likely to stick to the dovish rhetoric and maintain its current stance until 2024, when it expects inflation to recover to the 2-3% policy target. Although such inflation expectations appear to be misplaced against the rapid rise in jobs recently. We share the consensus view that governor Phillip Lowe is going to keep the policy interest rate and yield curve targets at 0.1% next week.

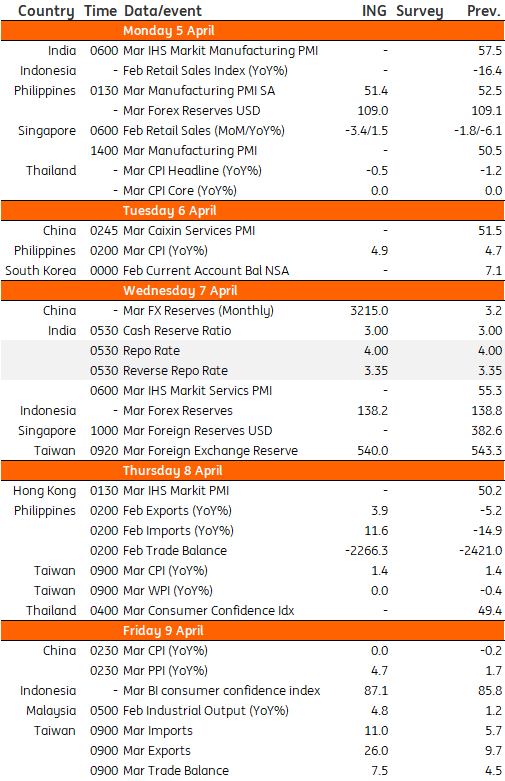

Asia Economic Calendar

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

Asia week aheadDownload

Download article

1 April 2021

Good MornING Asia - 5 April 2021 This bundle contains 4 Articles