Asia week ahead: PMI reports to show impact of China restrictions

Regional PMI readings and inflation reports will be the highlight for the coming week

Regional PMIs

Both official manufacturing and non-manufacturing PMIs for China should be in deeper contraction in October as the number of Covid cases increased, affecting both factory and retail activities. This should also be reflected in the Caixin manufacturing PMI numbers which could show a bigger contraction, as smaller factories are more adversely affected given the challenging logistical situation.

Meanwhile, PMI indices for both South Korea and Taiwan should edge lower due to stalling demand for semiconductors from the US, Europe and China.

Inflation from Australia, Indonesia and South Korea

Next week we have Australia's October CPI inflation. Inflation data has typically only been released quarterly so this provides us with much more insight into the evolution of prices and provides much more timely updates than we have been used to. Floods in parts of Australia will have put up fresh food prices and rising gasoline prices should also lift the month-on-month price level increase to almost a full percentage point, which would lift the inflation rate to 7.8%YoY. That ought to be close to the peak for inflation, though there are still higher gasoline prices in November to factor in, and there could still be a little further to go before peak inflation is reached.

Inflation in Indonesia will likely pick up further, with core inflation likely accelerating to 3.5% year-on-year while headline inflation should settle at 5.9% YoY. Elevated price pressures have kept Bank Indonesia busy lately with the central bank recently tightening by 50bp. We expect inflation to inch higher in the coming months which could ensure that BI will stay hawkish going into 2023.

Meanwhile, inflation in Korea is expected to decelerate quite sharply to 5.1% YoY, mainly due to base effects. Fresh food and gasoline prices stabilised during the month while pipeline prices suggest a further deceleration in the coming months.

Growth numbers from India

India releases 3Q22 GDP data next week. The 2Q figure was buoyed by base effects and came in at 13.51%, which although admittedly very high, was a disappointment, and led us to downgrade our GDP forecasts. We have 6.3% YoY pencilled in for the third quarter, as well as for the full calendar year 2023. Deficit data for October is also due, and will likely show that a modest improvement in India’s debt to GDP in 2022/23 remains on track. Something in the region of INR40,000 crore would be in line with recent deficit trends.

Other key data releases

In Korea, November exports will likely be disappointing as suggested by preliminary data reports. We expect a contraction of 10.5% YoY in November as semiconductor exports and exports to China remain sluggish. Slowing export activity should translate to industrial production contracting for a fourth straight month. Semiconductor and steel production will likely be a drag, but auto production should rebound.

In Japan, the jobless rate may edge up to 2.7% (vs 2.6% in September), but overall labour market conditions remain healthy. However, given the disappointing 3Q GDP report, September industrial production is expected to drop 1.0% MoM, seasonally adjusted, with weak external demand pressuring manufacturing activity.

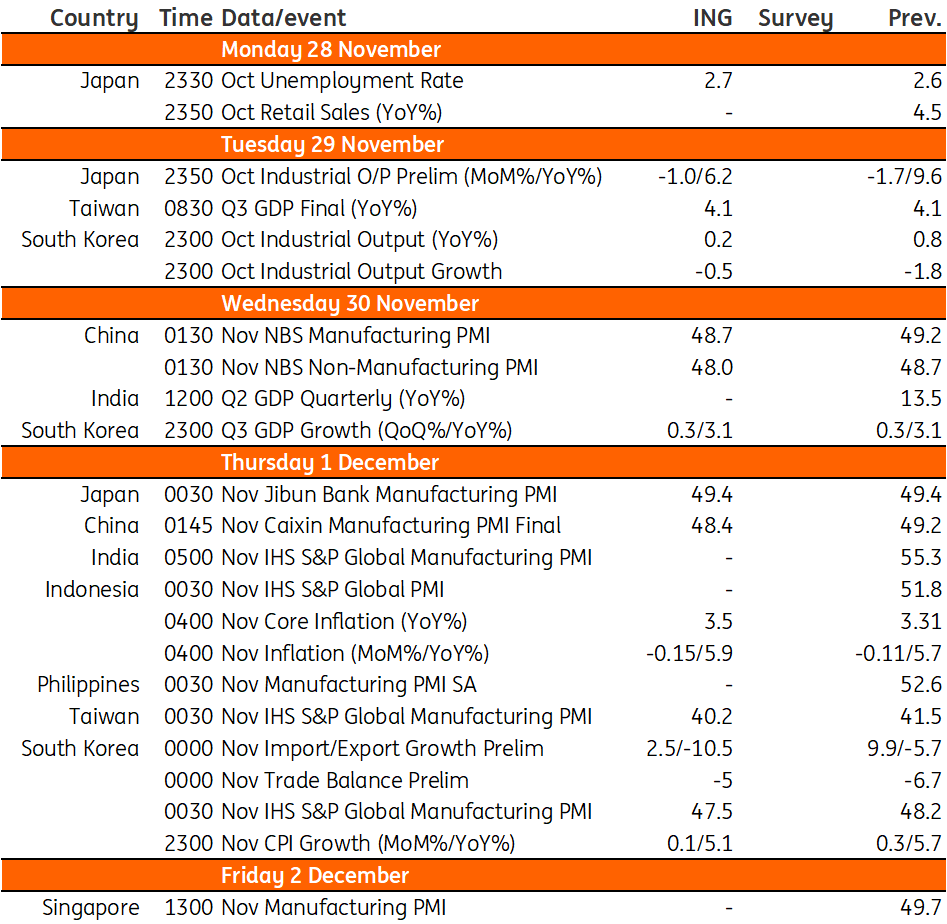

Asia Economic Calendar

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

24 November 2022

Our view on next week’s key events This bundle contains 2 Articles