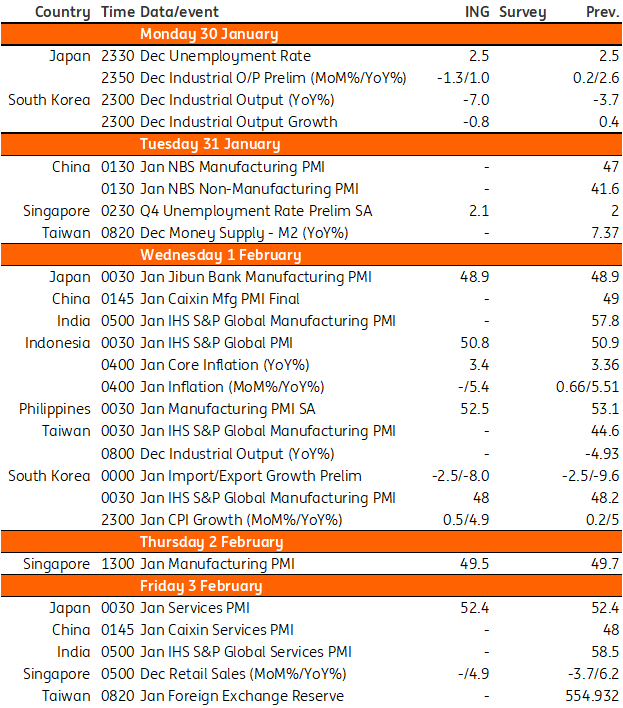

Asia week ahead: PMI data from China and India

Next week we'll get PMI data from China and India plus several data reports from Korea

India’s budget deficit and PMI data release

India is set to release the fiscal deficit figures for December. The deficit numbers for the second half of 2022 were significantly higher than the 6.4% budget deficit target. If the rise in deficit does not slow over the coming three months, we expect a deficit of about INR930bn for December 2022 and last year’s 6.7% deficit is likely to be exceeded.

Additionally, the January PMI data for India is to be released. Recent trends have been positive for both the manufacturing and service sectors, though given the tough external backdrop, a small statistical pullback may be due.

China PMI and Taiwan industrial production data expected

China will release PMI data for December next week and manufacturing PMI should remain in contraction while non-manufacturing PMI should recover slightly. A similar pattern should be expected for the Caixin PMI report.

Also reported in the coming days will be Taiwan export orders and industrial production. Both indicators should record even deeper contractions in December as external demand weakened.

Flurry of data from South Korea

As weak fourth-quarter GDP suggested, we believe that industrial production should continue to drop in December. Meanwhile, exports are expected to decline for a fourth consecutive month. Sluggish exports of semiconductors and petrochemicals should be the main reason for the decline.

Meanwhile, the Bank of Korea will be keenly watching inflation, which is expected to slow to 4.9% YoY in January (vs 5.0% in December). Gasoline and electricity fee hikes will result in a sharp rise in prices on a month-on-month basis but the base effect should anchor the year-on-year headline number. Finally, the manufacturing PMI will likely decline from the previous month, staying below the 50 threshold for the seventh month in a row.

Japan reports unemployment and industrial activity

Japan will release its jobless rate and December industrial production next week. Japan’s jobless rate is expected to remain unchanged at 2.5%. Services hiring is expected to increase with a strong pickup in the hospitality and travel industry offsetting a decline in manufacturing. December industrial production should drop sharply based on weak business surveys and export data, which adds more downside risk to 4Q22 GDP.

BI to monitor core inflation for cues on monetary policy

Price pressures in Indonesia have abated somewhat as evidenced by the decline in headline inflation from the peak of 6%YoY last year. We could see a further deceleration in headline inflation to 5.4%YoY, although core inflation remains elevated at 3.4%YoY.

Bank Indonesia (BI) Governor Perry Warjiyo warned that inflation could stay elevated in 2023 and this could weigh on the growth momentum. We believe BI will be monitoring core inflation on top of the performance of the IDR for cues on monetary policy this year.

Singapore retail sales likely to moderate

Retail sales in Singapore are expected to moderate further to 4.9%YoY from 6.2%YoY given elevated prices and slowing economic activity. We expect the trend of contraction for supermarkets and convenience store sales to continue while sales at department stores and recreational goods are expected to stay positive.

Meanwhile, the increase in the goods and services taxes to 8% this year should be another reason for retail sales to slow further in the coming months.

Key events in Asia next week

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

26 January 2023

Our view on next week’s key events This bundle contains 3 Articles