Asia week ahead: Central bank decisions, RBA minutes and activity data from Japan

Next week features decisions from central banks across the region plus the minutes from the latest RBA meeting. Meanwhile, Japan reports activity data and India's PMI will be released

RBA minutes and wage price inflation

The minutes of the February Reserve Bank of Australia (RBA) meeting will be published next week. It was a no change decision, but the RBA removed a phrase about the possibility of further monetary tightening and added another in its place about not being able to rule out further tightening – which could be viewed as a modest relaxation of its tightening bias. It’s unlikely that we will learn too much more from the minutes.

The ongoing evolution of inflation will provide us with better clues as to the likely path of rates, rather than any scrutiny of official texts – though that won’t stop the market from trying.

We also get the release of 2023's fourth quarter wage price inflation figures. These extremely lagged figures are forecast to deliver an annual wage growth rate of 4%, unchanged from the third quarter. The last RBA statement said that wage price inflation is not expected to rise much more and remain consistent with the inflation target. That suggests that it should not be much over 4%, though it could come in a shade above that – maybe 4.1% YoY.

India PMI out next week

PMI releases for February will confirm that India's economy continues to grow strongly. The service sector PMI in particular is likely to remain above 60 and manufacturing PMI should remain in the high 50s, both signalling decent growth.

PBoC likely on hold

The People's Bank of China (PBoC) will announce its interest rate decisions for the MLF on Sunday, and the LPR on Tuesday. Our baseline case remains for no changes in this month’s key interest rates.

As the PBoC’s room for easing is limited before global central banks start easing, a rate cut may be used in conjunction with a broader policy package following the Two Sessions in March. With that said, given the recent emphasis on stabilising the markets, the probability for a February rate cut providing a boost to markets as they reopen after the Lunar New Year holiday has risen somewhat over the past several weeks. Aside from the PBoC, we will also get an update on the January 70-city housing prices on Friday, where data will likely show a continued decline in prices to start 2024.

Hawkish pause from BoK expected

The Bank of Korea (BoK) will meet on Thursday, and another hawkish pause is expected. Inflation came down to the 2% level but household borrowing reaccelerated despite tight monetary conditions. Survey data is expected to improve to support the BoK’s hawkish stance. Meanwhile, business sentiment should improve on the back of a solid recovery in exports and the semiconductor sector.

Activity data out from Japan next week

Over the coming week, Japan will release core machinery orders, January trade, and flash PMI, which will likely advance. The recent rebound for the semiconductor sector coupled with solid demand of vehicles should be the main driver for the improvement. We don't believe that the January earthquake should have a significant negative impact on the outcome.

Singapore inflation to pickup in January

Singapore’s headline inflation could accelerate to 3.9% year-on-year, up from the 3.7%% reported in the previous month. The latest round of implementation for the goods and services tax coupled with still-vibrant demand could have pushed up headline inflation. Meanwhile, core inflation should also rise to 3.6% YoY from 3.3% previously. Elevated inflation should keep the Monetary Authority of Singapore (MAS) from adjusting policy settings anytime soon and we expect possible changes only in the second half of the year.

Bank Indonesia likely to pause

Bank Indonesia (BI) will likely keep rates untouched at 6% next week, with Governor Perry Warjiyo remaining wary of a potential flare up in inflation in the first half of the year. Warjiyo did, however, indicate that he believes he will have the space to cut rates in the latter half of the year.

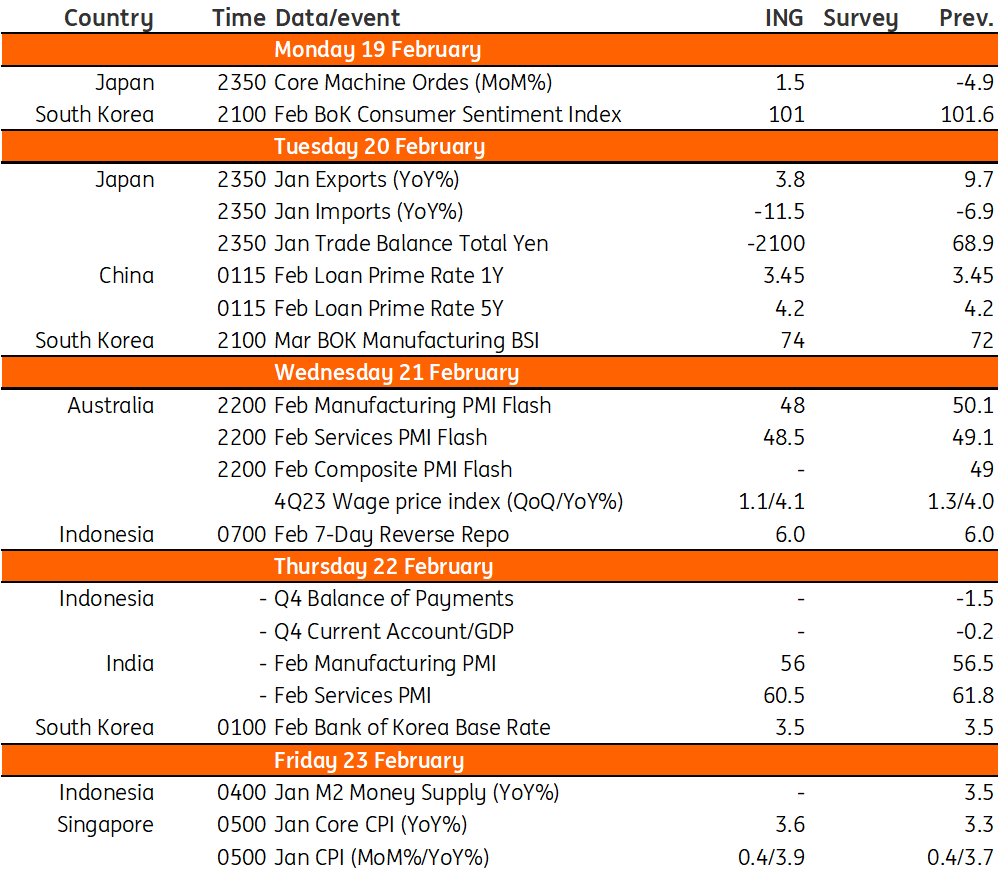

Key events in Asia next week

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

15 February 2024

Our view on next week’s key events This bundle contains 3 Articles