Asia week ahead: Not much on the way to stem market sell-off

An intensified emerging markets sell-off will keep Asian financial assets under pressure and there is little the region's central banks can do about it

India: FY18 probably ended on a weak note

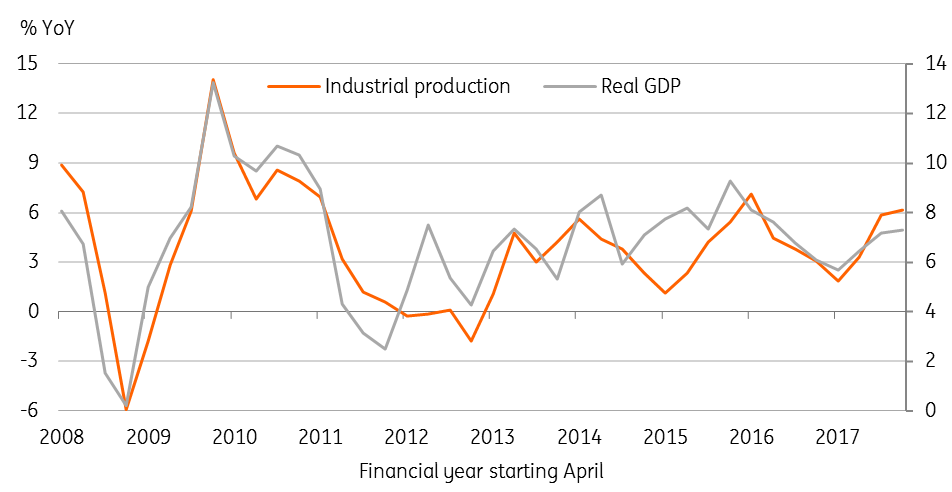

India’s GDP data for the final quarter of FY18 (ended in March 2018) is due on 31 May. The main positive for GDP growth in that quarter was the low base, while monthly indicators point no significant leap from the 7.2% year on year pace recorded in the previous quarter. Slower exports and wider trade deficit will drag GDP growth, while inflation accelerated above 5% to weigh down consumer spending.

However, slightly better industrial production growth informs the same about GDP growth, still supporting the consensus of a 7.3% GDP growth in the last quarter, though not enough to resuscitate investor confidence in the Indian rupee (INR).

The 5% year-to-date INR depreciation against the USD is the most among Asian currencies this year. Unlike its Turkish counterpart, the Indian central bank has no history of thrashing policy measures, as markets set their eyes on the Reserve bank of India (RBI) policy meeting in early June. The recent market rout makes the next RBI decision as good as a coin toss.

A close correlation in India’s GDP and IP growths

China: Was April manufacturing bounce a blip

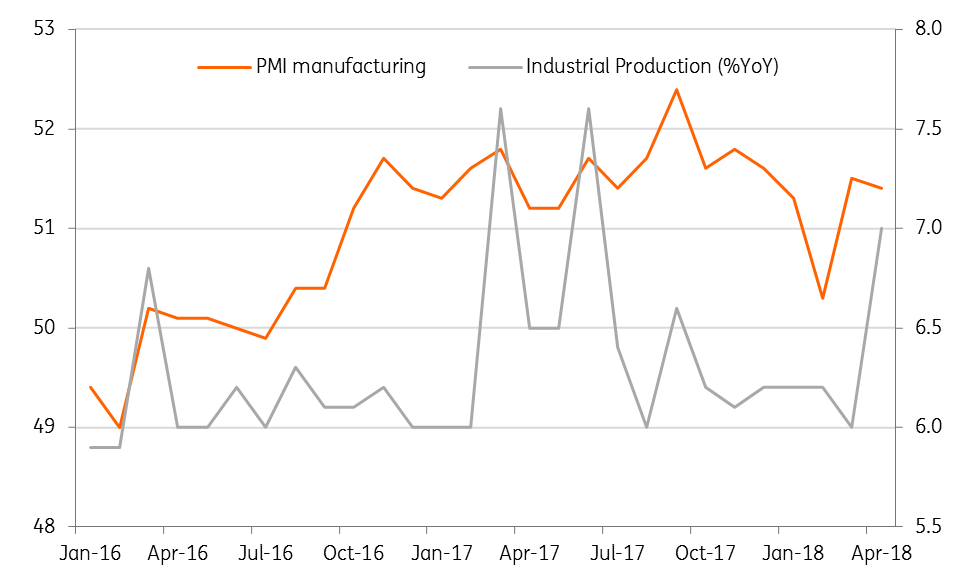

China’s manufacturing PMI and profits data will indicate if the acceleration of industrial production growth in the last month sustained in May. The manufacturing PMI has been bouncing around 51 over the previous two years, and so is the industrial production growth of 6% YoY. There was nothing to shock these from their long-held levels.

Advance manufacturing PMI for May from the US, Eurozone, and Japan tips the balance of risk for China’s data on a weaker side. As such, we think April acceleration of China’s IP growth to 7% could just be a blip that’s likely to be corrected in May. Industrial profits growth slowed coming into 2018, which bodes ill for manufacturing performance in the period ahead.

Short-lived spikes in China's manufacturing activity

Korea: How far will exports support the economy?

A data-packed week in Korea may show economic activity reinforcing recent dovish rhetoric by policymakers.

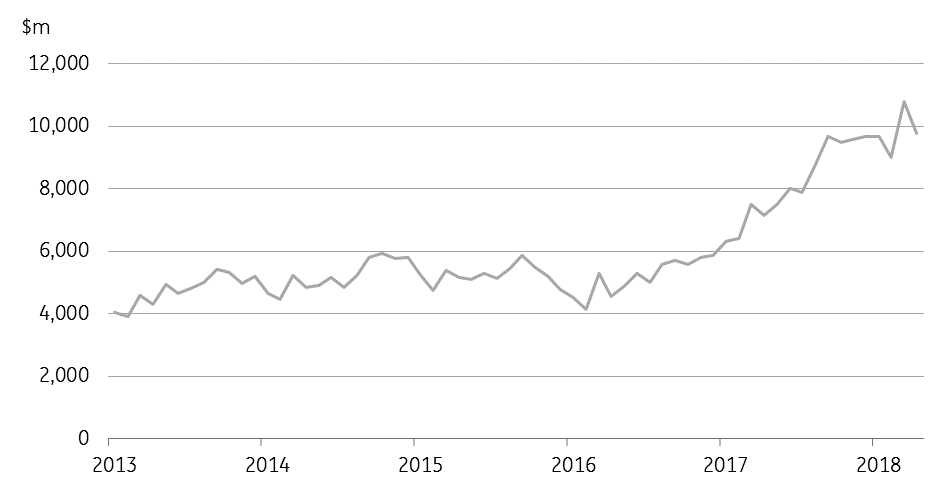

Of more significance, however, is export data, the key driver of the economy led by electronics exports. After staging an impressive surge in the last two years, semiconductor exports appears to have plateaued around $10bn/month this year, which if sustained will mean a sharp swing to year-on-year contraction by the second half of the year from 44% growth year-to-date. And non-electronics exports have contracted year-on-year basis in the last three months. Absent continued export strength Korea’s GDP growth will remain under pressure as what the policymakers worry.

Among other Korean releases are business and consumer confidence, consumer price inflation and industrial production. According to our chief economist, Asia-Pacific Rob Carnell, the sub-target inflation, softening consumer spending, and anaemic industrial output added to the sense that Bank of Korea’s policy is unlikely to change imminently.

Rob has also pushed his forecast timing of the next BoK rate hike from the third to the fourth quarter of the year.

Korea's semiconductor exports appear to be plateaued

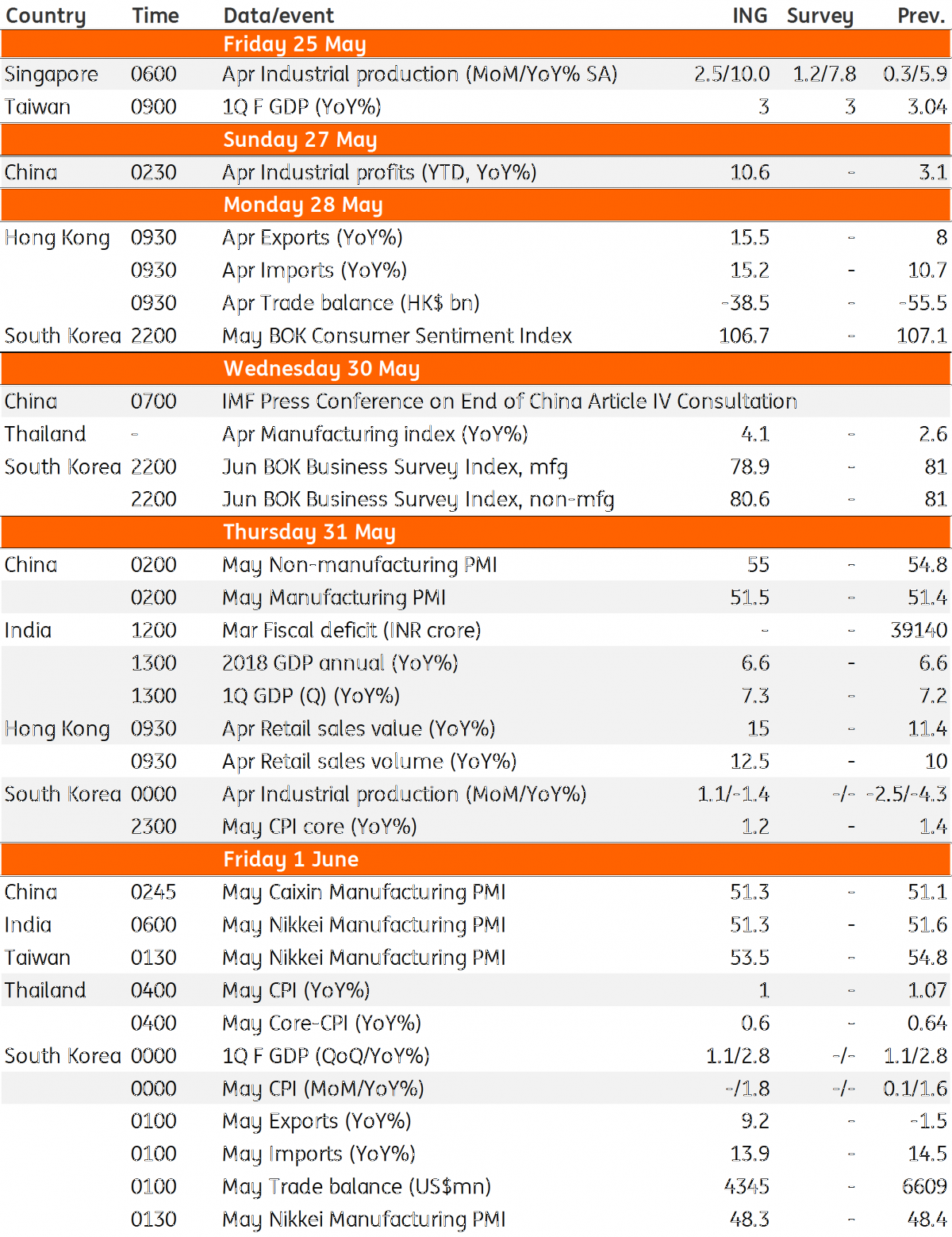

Asia Economic Calendar

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

24 May 2018

Good MornING Asia - 28 May 2018 This bundle contains 2 Articles