Asia week ahead: More central bank rate hikes

Asian central banks in Indonesia and the Philippines look poised to follow the US Fed in raising interest rates again to support their currencies, as new US tariffs on $200 billion of Chinese goods, and talks of more to come, cast a shadow over markets

Trade war: New US tariffs on China effective Monday

The week kicks off with the next round of US tariffs on $200 billion of Chinese products on Monday (24 September). China’s retaliatory tariffs on US products take effect at the same time, possibly setting in motion the next phase of US tariffs on $267 billion of imports from China.

As markets have long been pricing in the intensification of the US-China trade conflict, deliberations continue about the gravity of consequences on respective economies and the rest of the world. While we will hear more about this from the US Fed (the third rate hike this year to come with the Fed’s revised economic outlook), China's Purchasing Managers Index (PMI) for September may provide a glimpse of the impact on that economy. We anticipate both manufacturing and services PMIs to have ticked down from their levels in August, with new export orders and employment persisting as drags on the manufacturing side.

Monetary policy: Further tightening in Indonesia and Philippines

Central banks in Indonesia (BI), the Philippines (BSP), and Taiwan (CBC) will announce policy decisions on Thursday (27 September). It’s not about whether they will raise interest rates again, but by how much. Accelerated tightening by both since May this year – BI hiked the policy rate by 125 basis points, and the BSP by 100bp – haven’t been of much support for their respective currencies in the recent emerging currency rout.

Some market stabilisation this week doesn’t mean that the worst is over just yet. Indonesia and the Philippines (and also India) share a weak economic backdrop characterised by rising twin-deficits (trade and fiscal) and elevated inflation, which will continue to subject their currencies to intense weakness in the event external risk rears its head again. This and already negative real interest rates in the Philippines lead us to expect the BSP to catch-up with another 50bp policy rate hike, while BI is likely to hike by 25bp next week.

We expect Taiwan CBC to keep policy on hold at the forthcoming meeting. Taiwan’s export-driven economy is one of the most vulnerable in Asia to the trade war. Not only that, the US-China trade war prompting Taiwanese companies to relocate supply chains out of China will weigh on the island's growth going forward. As such, an on-hold CBC policy through the forecasting horizon up to 2020 is our baseline.

Activity data: August manufacturing dominates

August industrial production releases from Taiwan, Singapore, and Thailand will help to fine-tune GDP growth forecasts for the third quarter of the year. Underlying our forecast of moderate production growth in all three economies are slower exports in August.

We think the cyclical peak of Asia’s growth is behind us. What’s in store for the future? It could be that the export-dependent region drags its feet amid greater trade protection. Or conversely, a possible reallocation of resources and diversion of trade flows to overcome tariff barriers could unleash better growth prospects. Only time will tell.

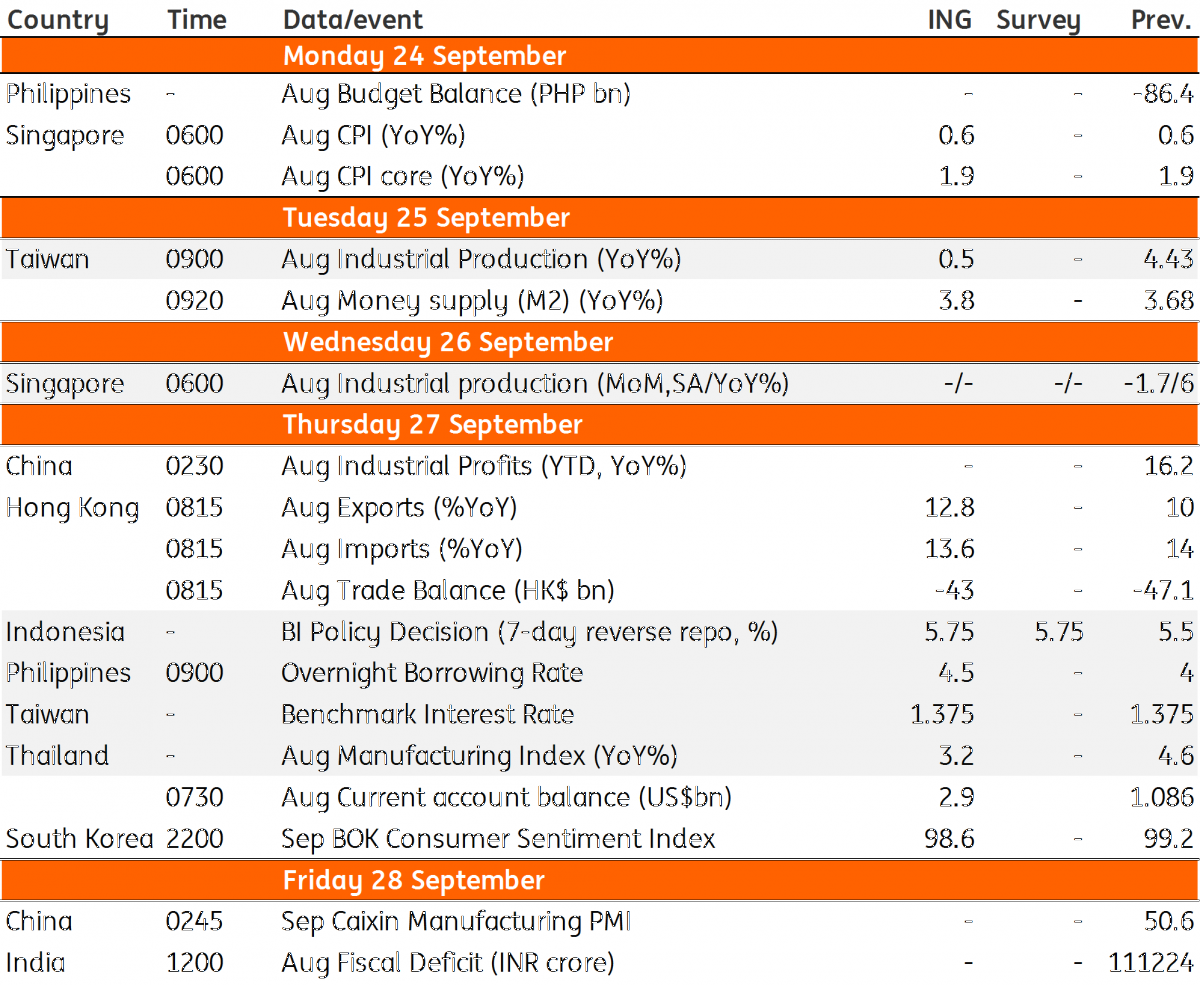

Asia Economic Calendar

Download

Download article

21 September 2018

Our view on next week’s key events This bundle contains 3 Articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).