Asia week ahead: Malaysian central bank decides policy

Monthly data dump in China and Japan packs the Asian economic calendar next week, but our focus will be on Malaysia's central bank's decision

China and Japan data dump

August activity data from China including trade, foreign reserves, inflation and monetary indicators will be under the spotlight for the economic recovery in the current quarter.

Exports are back in play to be the key driver for Asia's biggest economy. At $237.6 billion in July, China's monthly exports were just shy of the $238.3 billion record level achieved in December 2019. If materialised, our forecast of a 16% year-on-year rise in August will lead to a new record of $249 billion. The persistently large trade surplus and hot money inflows in the global risk-on rally in August should shore up foreign reserves. Inflation should remain subdued and monetary data should underscore continued accommodative policy.

Exports are back in play to be the key driver for Asia's biggest economy. At $237.6 billion in July, China's monthly exports were just shy of the $238.3 billion record level achieved in December 2019

The Japanese economy has been reeling under the Covid-19 impact on consumer and business spending. Labour cash earnings and household spending growth is likely to remain in negative territory in July, although to a lesser extent than in June. Businesses continued to observe caution on their capital spending given low confidence currently, as the July core machine orders and 3Q BSI Confidence Index releases will likely confirm.

| 1.50% |

ING forecast of BNM policy rateAfter a 25bp cut next week |

Malaysia central bank meeting

The Malaysian central bank will meet next week in a two-day meeting to be concluded on Thursday, 10 September. We have long been calling a 25 basis point rate cut at this meeting, taking the overnight policy rate down to a fresh low of 1.50%.

Even as Malaysia remains largely immune to the Covid-19 outbreak, its economy was one of the hardest hit in Asia with a 17% YoY GDP plunge in 2Q. Things are looking better as we move into 3Q with a second straight monthly export bounce in July boosting the trade surplus to the highest ever, 25 billion Malaysian ringgit (MYR). While this bodes well for GDP growth, a couple more quarters of negative GDP growth still looks inevitable.

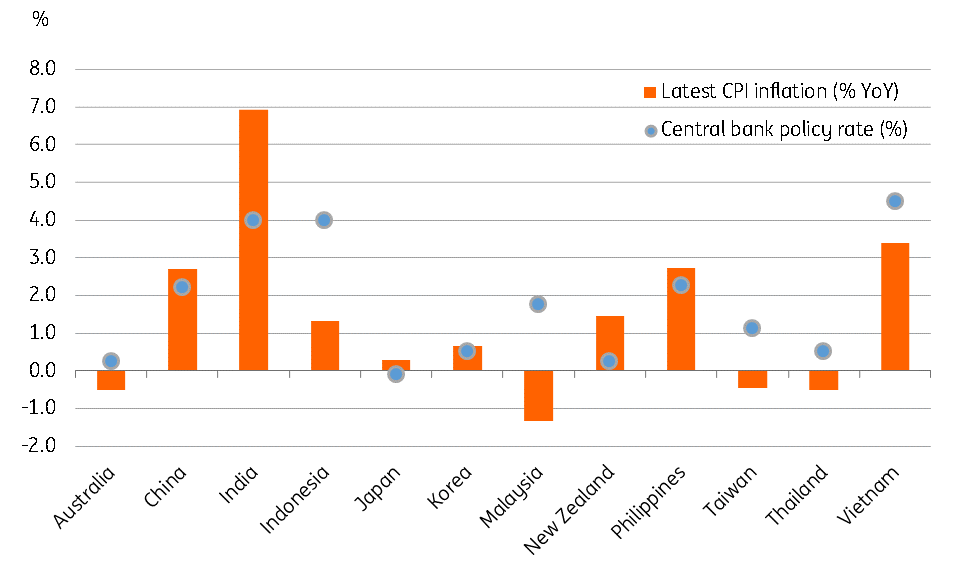

Substantiating the rate cut argument further is the negative CPI inflation streak that’s likely to prevail through the rest of the year as a result of anaemic domestic demand. With -1.3% YoY inflation in July, the real policy interest rate is one of the highest in Asia (see figure) -- not a good backdrop for economic recovery.

And, the relative outperformance of the MYR in the emerging market rally since June should provide more comfort to the central bank in cutting rates to stimulate growth.

Real interest rate* in Malaysia is one of the highest in Asia

Asia Economic Calendar

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

3 September 2020

Our view on next week’s events This bundle contains 3 Articles