Asia week ahead: Malaysia goes to the polls

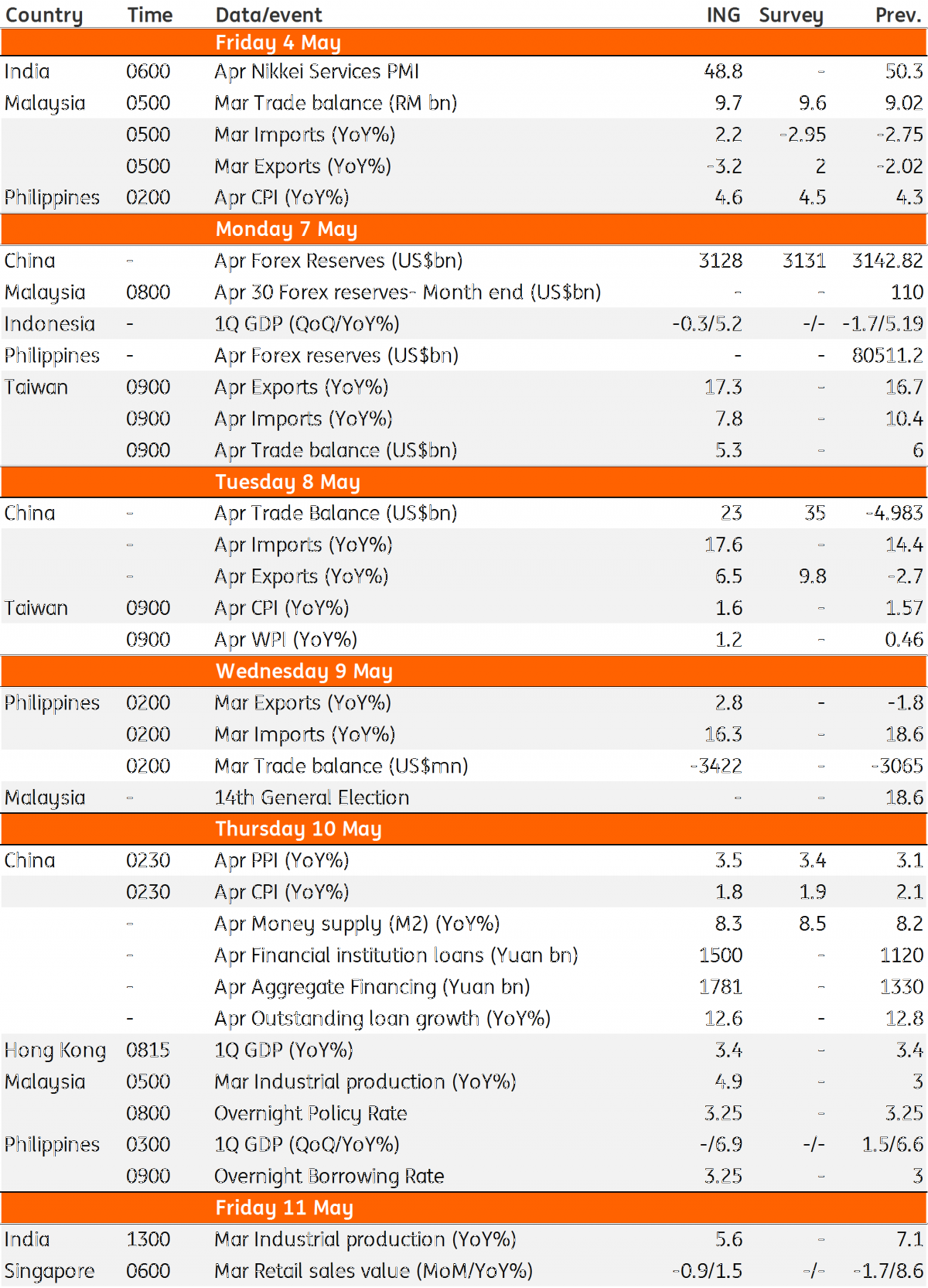

It’s an eventful week in Asia, as Malaysians decide the fate of incumbent Prime Minister Najib Razak, the Philippines gets set to tighten rates and US-China trade talks either reduce or refuel risks to the region's export-led growth

China: April data dump begins

China’s activity data for April will shed light on the economy’s performance coming into the second quarter of the year, while the trade war clouds the outlook. After underperforming in 2017, China’s exports have performed well so far this year. The 13% year-on-year export growth in 1Q18 was the third best after Vietnam and Malaysia. The consensus of 8% growth in April indicates some tapering of the strength.

Will the US Treasury Secretary's mission to China bear fruit? There is scepticism stemming from President Trump’s “walk out” threat if talks don’t move in the US's desired direction. Hopefully, we should have some clarity on this before the weekend. The outcome of trade talks, rather than hard data, will set the tone for both Chinese and global markets in the coming week.

Hong Kong GDP for 1Q18 and Taiwan trade and inflation are other data releases from Northeast Asia.

| 8% |

Consensus on China export growth in April |

Malaysia: Politics overshadows economics

Malaysia’s 14th General Election will be held on Wednesday, 9 May. The incumbent Barisan Nasional coalition of Najib Razak has been losing its grip on power since the last two elections. It could be even worse this time with contests against stronger opposition under the veteran leadership of Dr. Mahathir Bin Mohamad. Our base case is that BN loses some more ground to the opposition but retains overall control. Yet we think the vote is too close to call (see “Malaysian elections: Too close to call?”).

Politics will certainly put the economy on the backburner. Malaysia’s central bank (BNM) will announce its monetary policy decision the day after the vote and in all likelihood, it will not alter policy. While Malaysia’s growth-inflation dynamics continue to favour stable macro policy, we retain our view of monetary policy normalisation with one more 25bp rate hike in the third quarter, once the political jitters lift.

Indonesia and Philippines: Increased policy risks

We will also get the 1Q18 GDP data from Indonesia and the Philippines. Our forecast of steady GDP growth close to the 4Q17 pace of 5.2% YoY for Indonesia and 6.9% for Philippines, is at risk from weak exports in the first quarter. While weak currencies failed to propel exports from these economies, high inflation weighed on domestic demand. The central banks in both countries have been flagging policy tightening to rein in inflation and stem currency weakness, prompting a shift in our view of the rate policy in both from no change to two 25bp rate hikes this year.

The Philippines central bank (BSP) holds a policy meeting on Thursday, 10 May. Our Philippines economist, Joey Cuyegkeng, now expects the BSP monetary policy board to raise rates by 25bp to 3.25%.

| 3.25% |

ING forecast of BSP policy rate |

Asia Economic Calendar

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

3 May 2018

Good MornING Asia - 4 May 2018 This bundle contains 3 Articles