Asia week ahead: The trade data test

Trade data may provide a test of risks from the global trade war, while inflation continues to be subdued in most Asian economies except the Philippines

Korea trade may inform about trade war risks

A week ago, we noted that so far, there has been scant evidence of a trade war on Asia’s GDP growth. We may start getting some early hints in the April trade figures. Korea is the first economy in Asia, and probably in the world, to report trade data for this month.

Underlying our forecast of a slowdown in Korea’s exports in April- to 0.5% year-on-year from 6.1% in the previous month- is a double whammy of the high base effect and a hit to sentiment from the trade war.

Our main focus will be semiconductors, the backbone of Korea’s exports. An upswing in the global electronics cycle last year boosted semiconductor exports from Korea by a whopping 57% on the year in 2017. The strength continued in 2018 with a 46% rise in the first quarter of the year. However, the recent downgrade of sales forecasts by key chipmakers in Asia and abroad clouds the prospects for continued strength.

| 46% |

Korea semiconductor export growth in 1QYear-on-year |

PMIs may shed light on export-led growth

A slew of manufacturing PMI releases from across Asia may shed more light on the export-led manufacturing recovery.

China’s PMI data is the most market-sensitive of all, and our Greater China Economist Iris Pang forecasts a lower print of 51.3 from 51.5 in March. China is the main player in the global trade war. Hopes remain pinned on possible reconciliation as hinted by US Treasury chief Steven Mnuchin, who’s considering a trip to China in ‘a few days’.

| 4.6% |

ING forecast of Philippine inflation in AprilUp from 4.3% in March |

Philippines CPI may bring BSP closer to tightening

The Philippines has been in the news recently for rising consumer price inflation, and possible tightening of the central bank (BSP) monetary policy.

The CPI data for April is expected to reveal a continued acceleration of inflation. Joey Cuyegkeng, our expert on the ground, forecasts a rise to 4.6% YoY from 4.3% in March. While short-term rates in this economy are grinding higher, the BSP’s Governor Nestor Espenilla Jr. has also warned of a hike in the policy rate (read here). The markets are now looking for a policy rate hike either at the May or June BSP meeting. We are reconsidering our view of stable policy this year, which was based on earlier signals of steady policy from the central bank.

Not much inflation risk elsewhere in Asia

Indonesia also reports CPI data for April. Inflation has been in the central bank’s (BI) target zone of 2.5% to 4.5% since mid-2017 and we expect it to remain there in 2018. However, our view of stable BI monetary policy this year remains at risk from a weak currency.

Other economies to release CPI data are Korea and Thailand. Both economies will continue to ride a benign inflation trend, while their strong currency exchange rates provide a deflationary buffer from rising global oil prices.

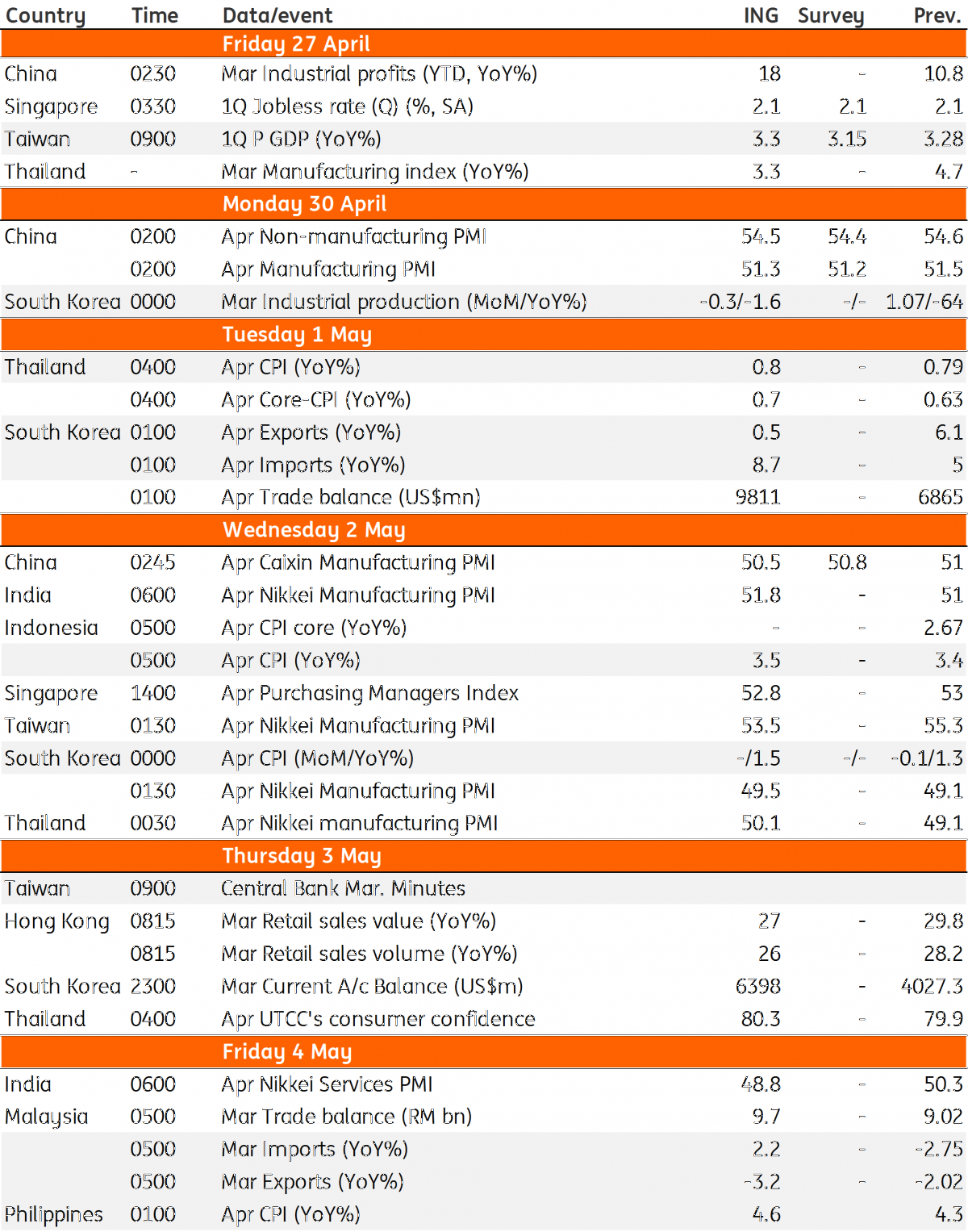

Asia Economic Calendar

Download

Download article

26 April 2018

Good MornING Asia - 27 April 2018 This bundle contains 3 Articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).