Asia week ahead: Key China updates

Next week will provide further insight into the regional economic consequences of China’s zero-Covid policy, with labour, inflation, trade, and GDP data all released

China’s zero-Covid policy bares its fangs

China will release retail sales, industrial production and fixed asset investment data on Monday. The focus will be on the degree of contraction in the retail sales figures, as well as the corresponding extent of growth in infrastructure investment to cushion the economy. These two opposing forces may not net out against each other. In addition, the issue of whether or not (or rather, how) China’s leaders will continue the zero-Covid policy will continue to be a talking point in markets. Following that, the Loan Prime Rate (LPR) decision next Friday should reflect the change in the Medium Lending Facility (MLF) later this week. The regular government meeting stated that monetary policy should not result in a flood of liquidity into the market, although the market continues to price a 5bp cut in the MLF – and therefore, in the 1Y LPR as well.

Higher prices and weaker growth in Japan

We expect 1Q22 Japanese GDP to have contracted by 0.6% from the previous quarter (on a seasonally-adjusted basis) as both domestic demand and exports were dampened. We think that consumption bottomed out at the end of 1Q22 after the government lifted some mobility restrictions. But investment is likely to remain soft as uncertainty grew rapidly throughout the quarter. In addition, the contribution of net exports will have been weak - mainly due to higher energy imports. This trend is expected to be confirmed once again in the April trade data, with imports likely to have grown at a faster pace than exports.

The consumer price index for April is also expected to rise above 2%, which will be its highest reading since 2015. Last year’s one-off cuts in mobile phone rates create an environment for low base effects to take hold. When taken together with a weaker yen and rising energy prices, this should translate to higher price pressures overall.

Labour market tightness in Australia may lead to lowest unemployment rate ever

April unemployment in Australia is on track to reach its lowest-ever rate of 3.9%, as the number of unemployed people in the labour force is expected to dip slightly for a third consecutive month, while higher wages should also help deliver a mild uptick in total employment. This tightness in the labour market, coupled with comments from the Reserve Bank of Australia that their regional surveys are reporting higher wages growth, leads us to expect the wage price index growth rate for 1Q22 to come in close to 3% - in line with the RBA’s previous benchmark required for “sustained” inflation. And that could set us up for another rate hike as soon as June.

Trade and GDP data affected by supply chain tightness

Recent trends for both exports and imports are likely to persist in next week’s April trade report in Indonesia. Exports should sustain double-digit gains, benefiting from rising commodity prices. Meanwhile, imports should also show strong gains as imported crude oil prices stay elevated. Exports, however, may take a hit in the coming months following Indonesia’s decision to ban select palm oil products to help stabilise domestic supply.

Over in Taiwan, export order growth should continue pushing on at a double-digit pace. But disruptions to supply chains and sudden electricity outages will pose problems throughout the hot summer season. Orders will reflect the ongoing growth in demand, but delivery is an issue that is somewhat out of the producers’ control (primarily in the semiconductor industry).

Foreign inflows expected to grow in the Philippines

Overseas remittances will be reported next week and we expect foreign inflows to grow by 3%. Remittances have been a consistent source of foreign currency, and should offset the widening trade deficit to some extent.

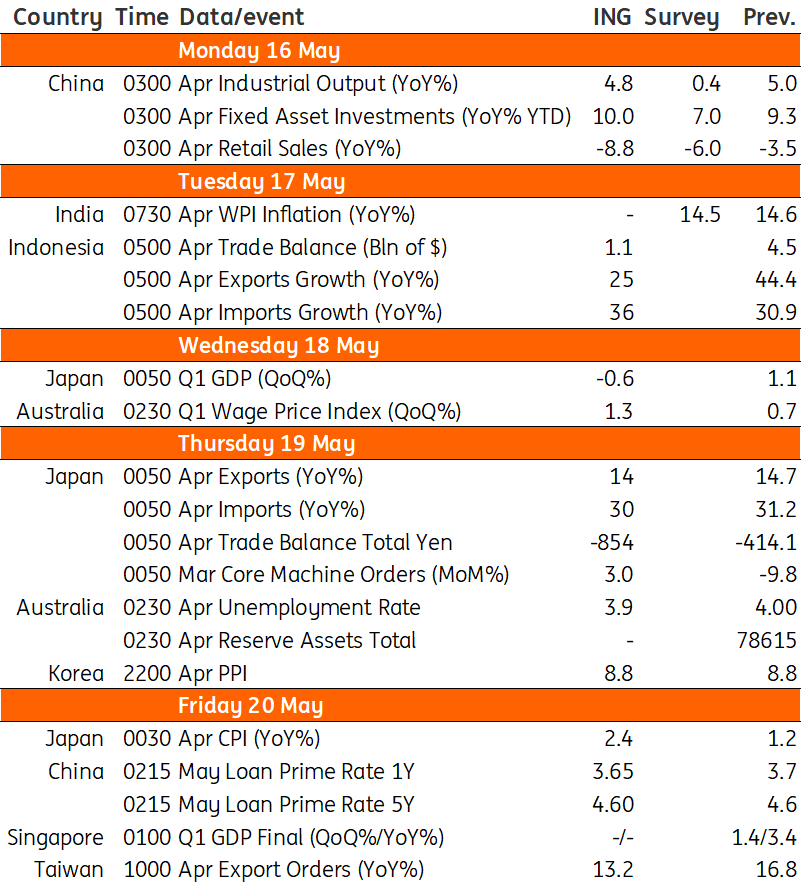

Asia Economic Calendar

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

12 May 2022

Our view on next week’s key events This bundle contains 3 Articles