Asia week ahead: Key central bank moves and inflation reports

The coming week features key central bank decisions from the Bank of Korea and Bank Indonesia, plus inflation data from Japan and Singapore

(Central bank) decisions decisions decisions…

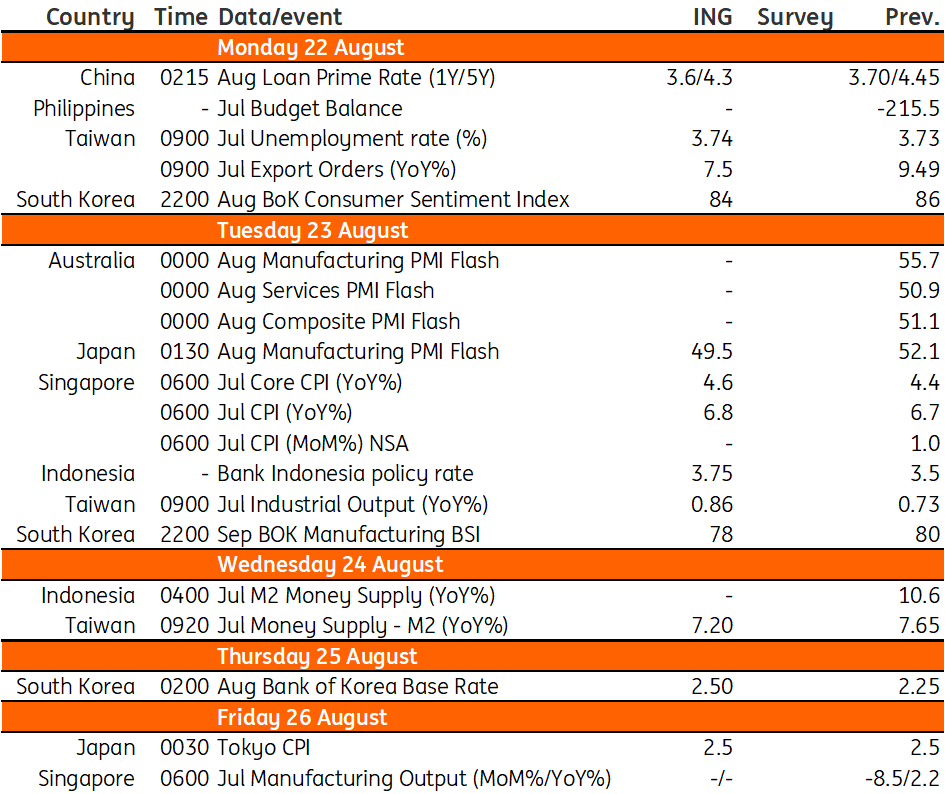

Next week’s Asia calendar features key central bank decisions. We expect the Bank of Korea (BoK) to raise rates by 25bp on 25 August. On the same day, the BoK will release its latest economic outlook. The 2022 GDP outlook could be downgraded slightly to 2.6% from the current 2.7%, while the CPI inflation outlook should rise sharply to 5.3% from 4.5%. Surveys for consumers and businesses are also likely to worsen as the recent nationwide floods will likely take a toll on sentiment.

Bank Indonesia (BI) is also meeting next Thursday and we could see BI Governor Perry Warjiyo whipping out a surprise 25bp rate increase after staying on hold for all of 2022. BI has held firm despite tightening from regional players, indicating that inflation has stayed “manageable”. Recently, however, plans to decrease the energy subsidy, floated by President Joko Widodo, suggest that the price of subsidised fuel could increase in the near term. A jump in fuel prices could be enough to nudge core inflation past the target and this could be reason enough for BI to hike rates as early as next week.

Meanwhile, we expect banks in China to cut the Loan Prime Rate for 1Y to 3.6% from 3.7%, and 5Y to 4.3% from 4.45%. The market consensus points to banks cutting both the 1Y and 5Y by only 10bp, however. Our more aggressive projection of the 5Y rate cut comes from the government’s request to support economic growth and a larger 5Y cut should help existing mortgagors lower their interest cost burden.

Inflation from Tokyo and Singapore

Inflation reports are also the highlight for next week and Tokyo CPI inflation is expected to stabilise with lower global oil prices and a weaker yen.

For Singapore, both headline and core inflation are expected to heat up further. This should keep the Monetary Authority of Singapore (MAS) on notice for additional tightening with a move likely at the October meeting. Headline inflation could heat up to roughly 7% while core inflation could pick up further to 4.5%.

Other key reports out next week: Key Taiwan data and Japan’s PMI

Other key data reports in the coming week are from Taiwan, which releases export orders, industrial production, and unemployment figures in the coming days. We expect that global demand for semiconductors will slide and therefore put downward pressure on export orders and industrial production. As such, we also expect that the unemployment rate could edge up as economic activity slows. Lastly, we round the week off with Japan’s preliminary manufacturing PMI data, which is likely to drop below 50 on concerns about slowing growth from developed markets and China.

Asia Economic Calendar

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

18 August 2022

Our view on next week’s key events This bundle contains 2 Articles