Asia week ahead: It’s going to be quiet

The spread of the coronavirus casts a shadow over the Lunar New Year celebrations due to start from Friday

It’s quiet… too quiet

The markets in China will be closed next week and some other regional markets won’t open for the first couple of days of the week. The usual, month-end economic releases will be released in an otherwise quiet week, though they are likely to be overshadowed by holiday-related slack.

| 50.1 |

Consensus on China manufacturing PMI |

Still, something matters

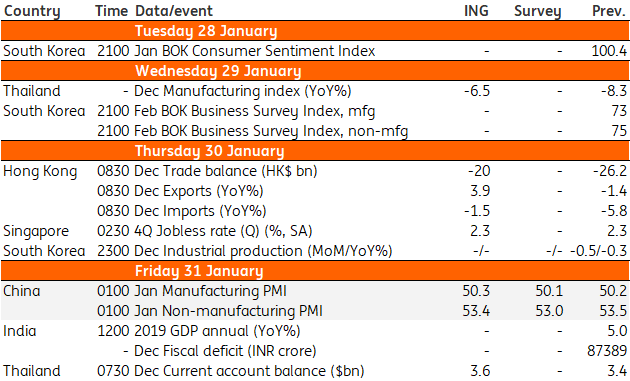

The usual standout on the calendar around this time of the month is China's Purchasing Manager Index (PMI). The manufacturing PMI returned to positive territory -- above 50 reading signifying expansion -- late last year. The consensus of it staying there in January (albeit down slightly from December's reading of 50.1) probably understates the risk of the ongoing virus hitting both sentiment as well as actual activity. The impact could be more pronounced on services like transport, hotels, restaurant, entertainment, etc. which are typically in high demand during the festive season. This imparts a greater downside risk to the 53.0 consensus forecast of non-manufacturing PMI, down from 53.5 in December.

The December manufacturing data elsewhere in the region (Japan, Korea and Thailand) will likely pass without any fanfare. Instead, the forward-looking indicators, like consumer and business confidence indexes in Korea, will be of some interest as guides to growth coming into 2020. Australia’s CPI figure for the fourth quarter will be closely-watched in light of the recent bushfires, while Singapore’s jobs report is expected to show a still-elevated unemployment rate at 2.3% amid continued anaemic GDP growth.

Finally, does anyone care about Thailand's balance of payment data? Probably just the country's finance ministry and the central bank (Bank of Thailand) as they are stepping up efforts to curb the Thai baht's appreciation after a whopping 9% gain last year. They won't be pleased with our view of a wide current account surplus from the seasonal surge in tourism-related inflows in December.

Asia Economic Calendar

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

24 January 2020

Our view on next week’s key events This bundle contains 3 Articles