Asia week ahead: Big policy week in India

India takes the spotlight next week with its FY21-22 budget and the central bank meeting shaping expectations of the economy’s recovery. Sustained easier policies remain the order of the day, not just in India but elsewhere too

India: Not the right time for policy reversal just yet

Next week, India unveils its FY21- FY22 budget on 1 February.

With close to 10% GDP contraction sharply denting revenue and record stimulus spending, the fiscal deficit is going to be through the roof in the current fiscal year (new fiscal year starts on 1 April). Our forecast for the deficit is 7.1% of GDP, which is twice the initial target of the government at 3.5% for the year (and up from 4.6% in the previous year). The risk to this forecast is tilted to the upside.

The government may strive for some fiscal consolidation without losing sight on the policy objective of supporting recovery.

This may call for some fiscal consolidation in FY21-22, of course without losing sight of the main policy objective of supporting recovery and, at the same time, boosting investor confidence and thus keeping sovereign downgrade risk at bay. It’s a balancing act.

There has been news of possible hike on import duties, which aside from raising more revenue also serves the government’s ‘Make in India’ drive. There may be some spending curbs in the pipeline too. We anticipate the deficit being programmed to fall below 6% of GDP. Yet, we don’t think it’s time for fiscal consolidation given that the headwind to the economy from Covid-19 pandemic is likely to remain strong.

The key question for the RBI meeting is whether the central bank see through the recent dip in inflation and leave policy on hold?

The Reserve Bank of India also meets on 5 February. The return of inflation to the RBI’s 2-6% policy target zone in December, after a year of remaining above-target, could tip the central bank to resume its easing cycle. However, any such move could prove to be premature, especially as the inflation risk isn’t yet fully eliminated.

The banking system remains flushed with liquidity, which is potentially inflationary. Nor do we think it’s the right time to unwind policy accommodation just yet.

Rest of Asia: Data-packed calendar

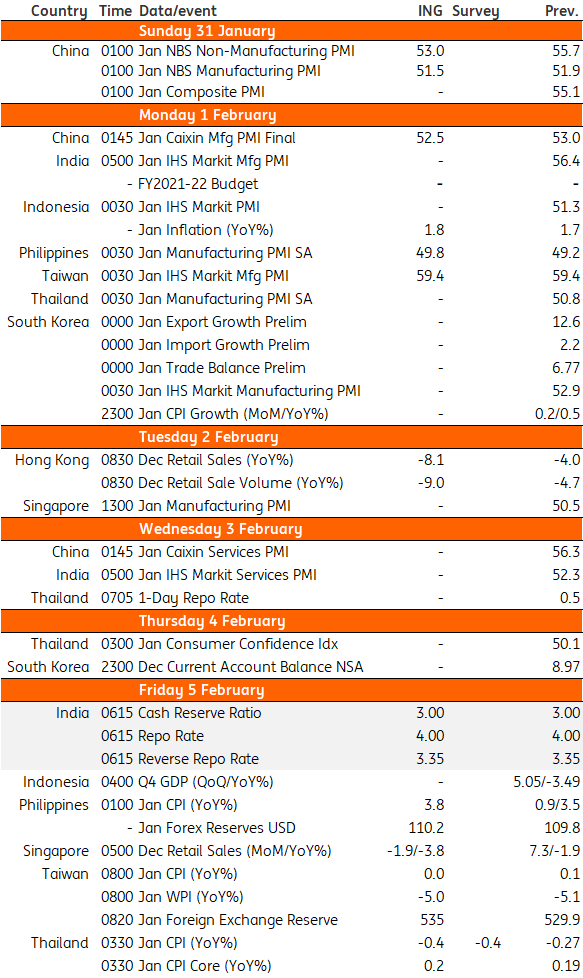

China’s official purchasing manager indices due over the weekend and the Caixin counterpart due out on early Monday will set the tone for Asian markets.

The January data may reflect some front-loading activity ahead of the Lunar New Year holiday in mid-February. Likewise, Korea’s trade figures for January, which will be the first to provide a glimpse of regional exports coming into the new year. We see electronics remaining to be the main exports driver as the global semiconductor cycle is in the full swing.

The January data may bear out some front-loading of activity ahead of the Lunar New Year holiday in mid-February.

Among January CPI inflation data next week, Indonesia and the Philippines should stand out, given that inflation in both countries has started to tick up in recent months and likely remained on the upward path in January, closing the door on more rate cuts. Other countries to release CPI figures are Korea, Taiwan and Thailand and all are extremely low or close to negative inflation. Hong Kong and Singapore also sit in this group as their retail sales data should show.

The Australian and Thai central bank are also due to meet next week and both are expected to stay on hold. The ultra-low policy rates at 0.10% and 0.5% respectively are here to stay throughout 2021.

Asia Economic Calendar

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

Asia week aheadDownload

Download article

28 January 2021

Our view on next week’s key events This bundle contains 3 Articles