Asia week ahead: Central banks in Indonesia and the Philippines to hike rates

Two central bank meetings will be the highlight for the region next week

Bank Indonesia to hike rates as growth beats estimates

Bank Indonesia will likely hike rates by 50bp to help steady the Indonesian rupiah, which has been under some pressure of late. The third-quarter GDP growth report was better than expected, giving the central bank some room to be aggressive with its tightening now that core inflation is moving higher.

BSP governor to make good on his promise

In the Philippines, Bangko Sentral ng Pilipinas (BSP) will increase policy rates by 75bp next week. Governor Felipe Medalla pre-announced his intention to match any rate hike by the US Federal Reserve and will likely make good on that promise to push the policy rate to 5.0% next week.

China to leave rates untouched

China's central bank, the People's Bank of China, should keep the 1Y Medium Lending Facility rate unchanged at 2.75% and rollover with no change for the net injection of liquidity. Put simply, we expect no change in monetary policy in terms of interest rates and liquidity. The economy has weakened with the rising number of Covid cases and the relaxing of restrictions since August will not have helped the economy much as the main weakness stems from the partial lockdowns of some cities.

Japan’s GDP and inflation

Third quarter GDP in Japan is expected to grow 0.5% quarter-on-quarter, seasonally adjusted, which is a slower pace than the previous quarter. Reopening effects still led the overall growth but higher inflation and the weak yen partially offset the recovery. Meanwhile, CPI inflation should rise to 3.5% year-on-year in October with utilities and other imported goods prices rising.

Other important releases: China’s activity data and Australia's jobs report

China will also release activity data next week and we expect almost no growth in retail sales in October despite a long holiday for the month, as shown by the recent PMI numbers. Industrial production should also be slower than the previous month due to soft orders from the external market. Investment activity should speed up slightly due to a pickup in infrastructure investment. However, property investment activities should continue to be in contraction. Meanwhile, October is a quiet month for the job market, and therefore we expect no change in the surveyed jobless rate at 5.5%.

Lastly, Australia releases its jobs report for October. The market consensus expects the unemployment rate to remain at 3.5%.

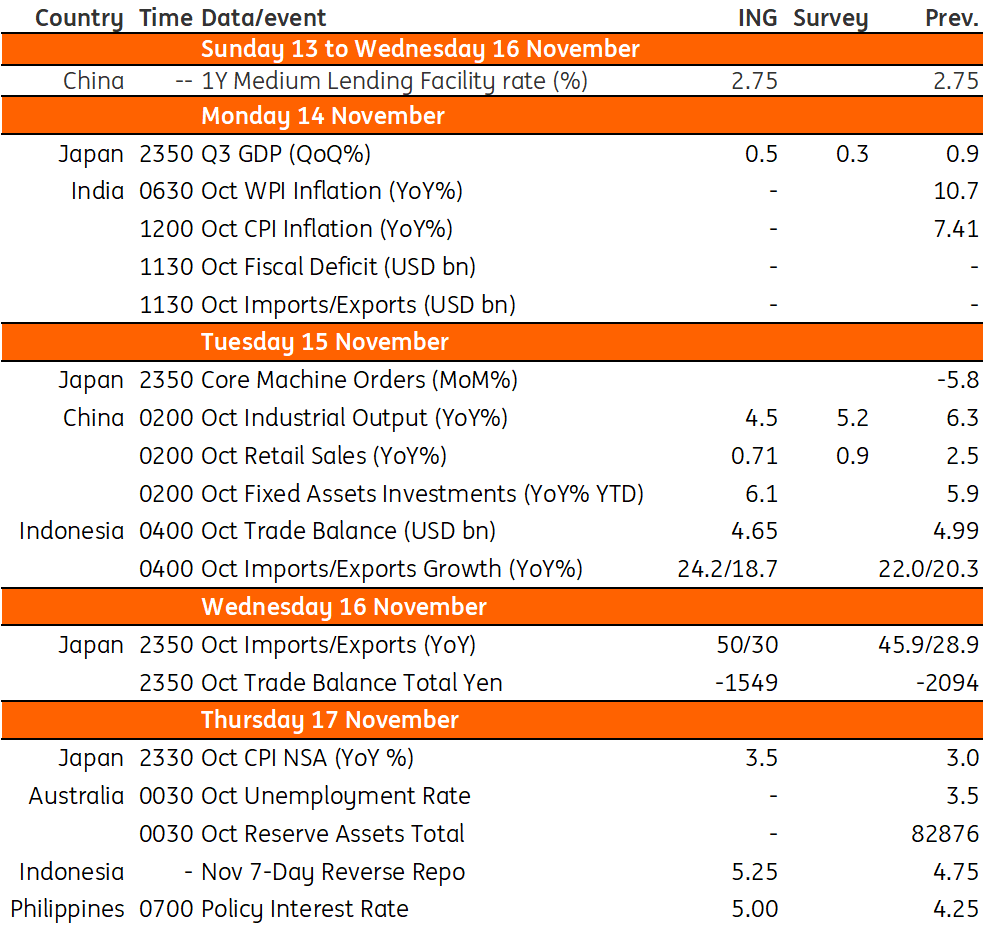

Asia Economic Calendar

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

10 November 2022

Our view on next week’s key events This bundle contains 2 Articles