Asia week ahead: India’s central bank to ease policy, again

The current round of US-China trade talks may do little to cheer the markets next week in an otherwise busy period for economic data. The main highlight will be India’s central bank (RBI) policy meeting. Riding the wave of global monetary easing, the RBI is likely to deliver another 25 basis point rate cut

US-China trade talks – an unfinished agenda

US and Chinese trade negotiators are going back and forth between Beijing and Washington, but doubts about a deal abound. Speculation that it could take months to reach an agreement suggests the current round of negotiations may not produce any tangible result. If that's the case, the markets will have little to celebrate in the coming days.

With neither side apparently in a rush to bridge their trade differences, a continued truce seems to be the best course for markets, for now.

Asian growth slowdown – more to go

There's no denying that the trade conflict is already adversely impacting the economy, particularly the Chinese economy, which is clearly negative for the markets. This weekend’s release of China’s manufacturing and non-manufacturing purchasing manager indexes (PMIs) will tell us more about this. The manufacturing PMI has been in sub-50, contractionary territory since December, which is where we see it staying in March. Weak PMI surveys square with the hard data on industrial production showing a sharp slowdown in the first two months of the year, which sets GDP growth on course for a further slowdown in 1Q19.

A host of PMI and trade figures from the rest of Asia will also help to cement expectations for GDP growth in the first quarter. Besides trade protectionism, a slowdown in global electronics demand has been a drag on Asian exports growth. March trade data from Korea could highlight this trend.

India’s central bank – riding the wave of global easing

The Reserve Bank of India’s Monetary Policy Committee unveils the outcome of its bi-monthly policy review on Thursday, 4 April. The RBI was the first Asian central bank to ease policy this year, cutting key interest rates by 25 basis points at the last meeting in February. And now there is a near-unanimous consensus for another 25 basis point cut next week. We have joined the consensus, revising our earlier forecast of stable rates for the rest of the year.

Does the economy really need more monetary stimulus when fiscal policy has been extremely stimulatory? We don’t think so, especially now that inflation has started to grind higher, and growth remains well-supported by domestic demand, thanks to loose fiscal policy. But the political pressure from the government to ease remains intact, although we are sceptical that a monetary boost will really help the government to win an edge over its rivals in the coming elections (see India: Rising odds of another rate cut).

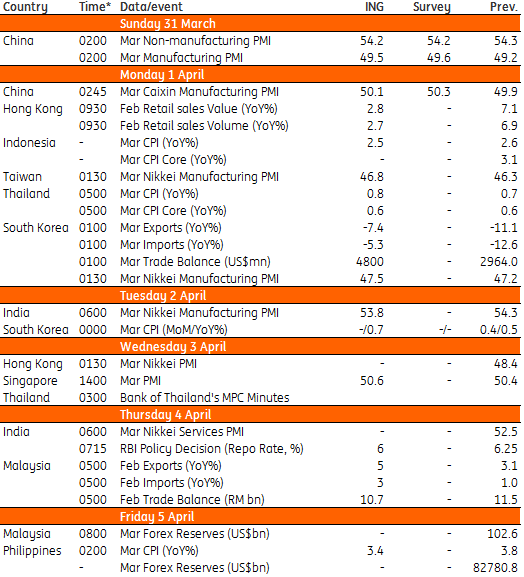

Asia Economic Calendar

Download

Download article

29 March 2019

Our view on next week’s key events This bundle contains 3 Articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).