Asia week ahead: Increasing headwinds to growth

Manufacturing releases crowd the Asian economic calendar, but India’s 3Q18 GDP and the central bank of Korea's monetary policy meeting are the main highlights of next week

Asia: Some sense of 4Q18 GDP growth

China’s manufacturing PMI for November coupled with hard manufacturing data from Japan, Korea, Singapore, and Thailand for October will give a sense of where GDP growth of these countries is headed in the final quarter of the year.

We don’t see China's manufacturing PMI drifting far off the threshold level of 50; where it has hovered around since September. Even though export growth has held up since the onset of the trade war, export orders have been contracting at an increasing pace. This has dragged industrial production growth below 6% in the last two months, supporting our view of GDP growth slipping below 6.5% in the final quarter.

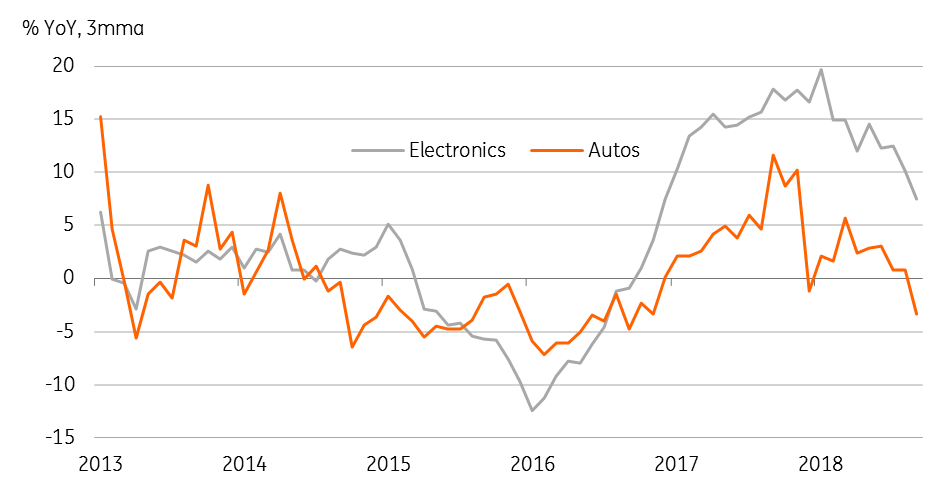

Electronics matter more for the rest of the Asia reporting manufacturing data and judging by the ongoing sell-off in electronic stocks; things don’t appear to be looking great. Electronic exports from Korea are still growing on an annual basis, but those from Japan, Singapore, and Thailand have either been flat or contracting. Not only electronics, but weak automobile demand has been an added drag on manufacturing in Japan and Thailand.

As such, GDP growth across Asia is poised for a sustained slowdown in the fourth quarter.

Electronics and automobile exports seem to be declining

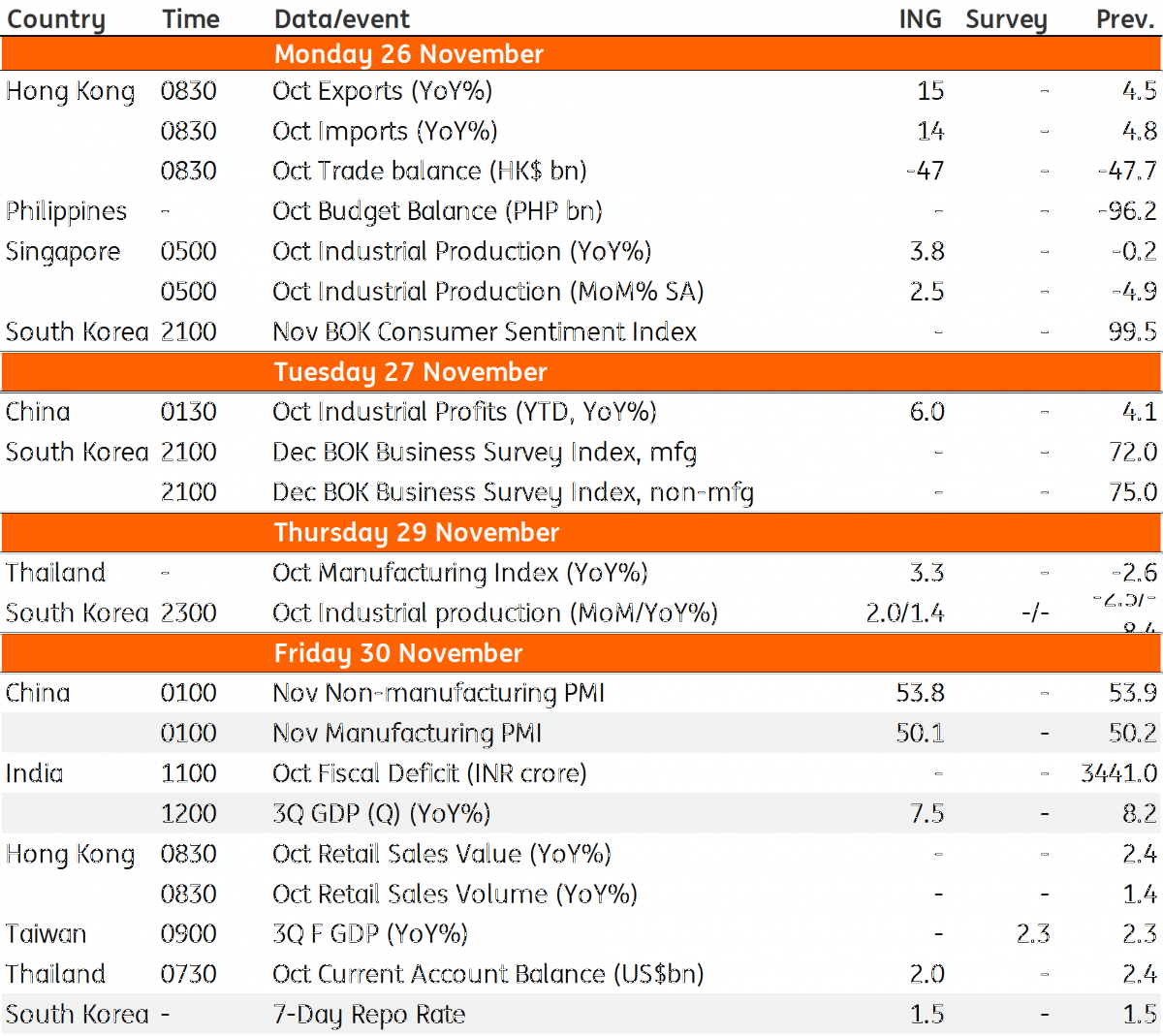

Korea central bank policy hangs in balance

Bank of Korea will announce its policy decision on 30 November and the rhetoric has been swinging between a rate hike and staying on hold.

Contrary to the message from a chunky 22% annual export growth in October, there is little room for growth optimism. Manufacturing continues to be weak, the inventory-to-shipment ratio remains elevated, and the risk of a downturn in the global electronic cycle is lingering. Supply disruptions due to nationwide factory workers’ strike against labour policies is another thing.

The last central bank rate hike by 25 basis point to 1.50% was in November 2017. Even if the central bank is under pressure from the government to resume tightening to rein in rising house prices and household debt, the newly appointed finance minister Hong Nam-ki admits the next year will be “considerably difficult” for the economy. And the central bank governor Lee Ju-yeol has resisted calls of a rate hike to cap house price, despite the downward pressure on the economy.

We continue to see the BoK leaving the policy on hold until the third quarter of 2019, and even this may get pushed back if things worsen further.

| 1.5% |

ING forecast of BoK policy rateNo change until 3Q19 |

India: The GDP peak cycle is behind us

Our view of a slowdown in India’s GDP growth to 7.5% YoY in the July-September cycle from 8.2% in the previous quarter, which was the fastest rate of growth in two years, is consistent with the median consensus estimate in the latest Bloomberg survey. GDP data is due on Friday, 30 November.

After a sharp slump from late 2016, demonetisation growth started to pick in 2Q18 and gathered significant momentum over the next two quarters. While this high base effect is at work to depress the annual increase, weaker exports and private consumption, and increasing drag from net trade support expectations of GDP slowdown.

GDP slowdown and stable inflation under 4% will give more reasons to the central bank to leave the monetary policy on hold, as this is what we now forecast for the December policy meeting.

| 7.5% |

India's 2Q FY19 GDP growthBloomberg consensus median |

Asia Economic Calendar

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

23 November 2018

Our view on next week’s key events This bundle contains 3 Articles