Asia week ahead: Hong Kong to roll out big stimulus

Hong Kong looks set to follow Singapore's footsteps as it unveils a big stimulus to combat the impact of the epidemic. India may come out with yet another quarter of weak GDP performance. But the key question is will the Bank of Korea join other Asian central banks on the easing bandwagon

Hong Kong SAR 2020 Budget – how big a stimulus?

Hong Kong’s Financial Secretary Paul Chan will announce the budget for the fiscal year 2020 on 26 February. The pro-independence protests have already pushed the economy into a recession - GDP contracted for three consecutive quarters through the fourth quarter of 2019 (the final estimate of 4Q19 GDP is due on the same day as the budget) – and now there is Covid-19 dampening prospects further in 2020.

It is likely that the budget deficit for the new financial year [2020-21] will be the biggest ever – Financial Secretary Paul Chan

The markets are looking for a big, rather unprecedented, stimulus resulting in a very high fiscal deficit. Indeed, the Secretary has signalled a record deficit for 2020 on top of his estimate of about 3% of GDP deficit in the current fiscal year ending in March. Will this be enough to fix the economy's woes still remains to be seen.

Hong Kong: How big could the fiscal deficit be?

Korea central bank policy meeting – cut or no cut?

The key question of the week will be whether the Bank of Korea gets back on the easing path as the central bank easing in Asia gathered pace coming into 2020. Our house view is that the BoK stays on hold this year, assuming that fading trade war and improving tech demand makes it a more positive economic story this year than last.

An emergency situation warrants an emergency prescription – President Moon Jae-in

Of course, Korea isn’t immune to the virus that’s undoubtedly going to hinder the recovery from a sharp growth slowdown last year. And just as I was writing this note, there were reports of the country moving up to the rank of most affected one outside China, overtaking Japan (excluding Diamond Princess), as the number of infections more than doubled to over 100 in just one day with first death in the country. President Moon has declared the spread of the virus as an emergency demanding extraordinary steps to minimise the impact. All this could tip the balance of risk for the BoK policy towards easing next week.

India 4Q19 GDP report – has growth bottomed?

We expect India’s GDP report for the October-December 2019 quarter to show improvement in growth over the 4.5% year-on-year rate posted in the previous quarter. The consensus view about a month ago was 4.9% 4Q19 growth in the last quarter. And our bit longer-held than consensus view is 5.2% assuming a massive fiscal and monetary stimulus of in the early parts of 2019 would have started to revive demand, while the low base year effects also drove it higher.

The high-frequency data hasn’t been fully supportive of acceleration in GDP growth though, imparting a downside risk to our GDP forecast. That said, we believe the expansionary macro policy in India has run its course amid imminent inflation risk ahead.

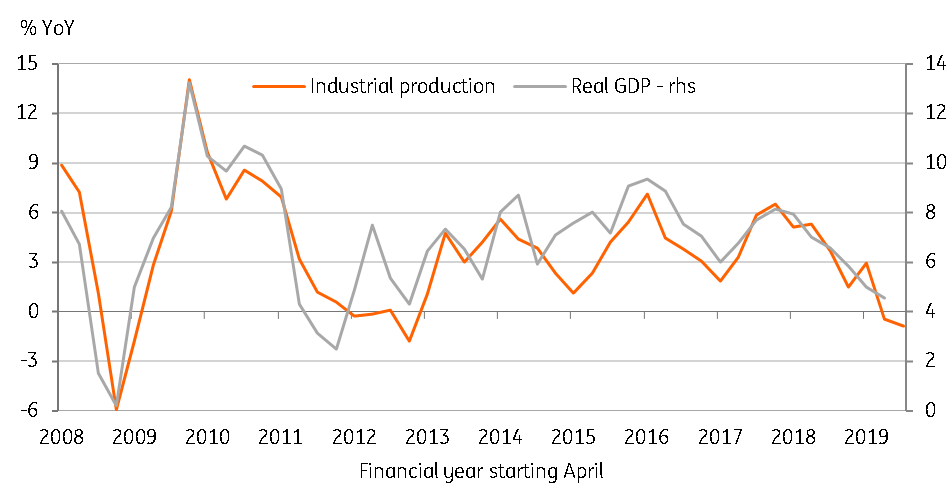

India: Persistent slowdown

Lots of manufacturing data

The economic data has been overshadowed by the Covid-19 outbreak and the barrage of manufacturing data coming out next week will be no exception either.

Moreover, January data is also distorted by the timing of the Lunar New Year (which in 2019 fell in February but this year was in January), which makes the usual year-on-year growth rates more of a noise rather than a clear trend. The tendency is to read combined January-February growth, though now these will also be impacted adversely by an extended slump in the economic activity due to the virus outbreak after the new year.

We believe economic data will remain just a watching brief for at least a couple more months before it provides a good gauge of the economic impact of evolving developments on the Covid-19 front.

Asia Economic Calendar

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

20 February 2020

Our view on next week’s key events This bundle contains 3 Articles