Asia week ahead: Holiday lull takes over

The markets may slacken slightly ahead of the Lunar New Year holiday, but central banks and statistical agencies will still be busy at work

A short week ahead

It’s a short week for markets as most Asian countries celebrate the arrival of the Lunar Year of the Ox.

China begins its new year-Golden Week holiday on 11 February as does Korea while Taiwan starts a day earlier on Wednesday. Most other countries will be out on Friday.

The holiday lull is expected to drain the liquidity from the markets, making it a relatively quiet week for market watchers.

The data

Even as regional markets slacken next week in the run-up to the holiday, statistical authorities in some countries will remain busy.

China’s Statistical Bureau will begin its monthly data dump for January and the front-loading of activity ahead of the New Year holiday should underscore firmer growth trend coming into 2021. Lined up next week are foreign exchange reserves and inflation figures, though we might get monetary and trade releases for January before the holiday starts.

Following on strong January export reading in Korea, Taiwan's exports data for January should further confirm the positive global semiconductor cycle. The cyclical upswing also received a further boost from a favourable base effect, which is what underlies the consensus of over 20% year-on-year surge in Taiwan's exports in the last month.

Malaysia will be in the limelight for its 4Q20 GDP report. No prizes for guessing that accelerated Covid-19 spread dented output further. We anticipate a steeper GDP contraction in the last quarter, by -5.2% YoY than the -2.7% seen in 3Q20. This should strengthen our call of a 25bp policy rate cut from the central bank this quarter.

Philippines central bank meeting

The Philippines’ central bank, which meets next Thursday paused its rate cut cycle at the last meeting in December after slashing the policy rate by total 175 basis points in the last year. The economy continues to take a beating from the pandemic as reflected by continued GDP contraction. However, CPI inflation also has started moving higher in recent months, which blunts the argument of more policy support for growth.

With the central bank's overnight borrowing rate of 2.0% and about 3.5% inflation rate, the real rate is already negative. We don't think the BSP wants to push it even lower and risk a weaker currency and potentially high inflation. In our view, the BSP easing cycle has run its course. The next move in the policy rates will be higher, though that’s not something for this year or even the next.

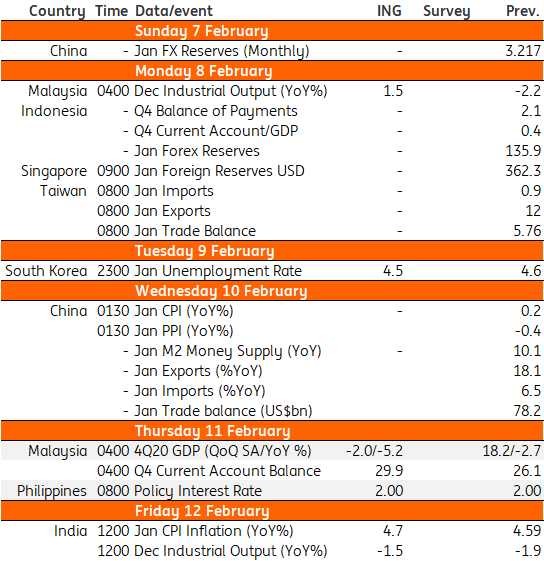

Asia Economic Calendar

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

Asia week aheadDownload

Download article

4 February 2021

Our view on next week’s key events This bundle contains 3 Articles