Asia week ahead: Going for accommodation

Trade, inflation and policy rates dominate the calendar in Asia this week. Expect trade figures to tick up, though the overall story should remain rather sombre. Central bank-wise, Philippines' inflation could provide some support for further cuts next year, while the Bank of Thailand is likely to act now

Trade data to remain gloomy

Trade data from Malaysia, the Philippines, China and Taiwan are due, and each could tell a different story with respect to the trade war, the global tech slump, and domestic demand for imports. The absence of further incremental tariffs and some evidence of a floor in electronics demand should provide some support to the figures, but the overall message is likely to remain a very sombre one.

Philippines' inflation to set the BSP for a cut but not until next year...

Philippines' inflation is expected to come in at 0.9% year-on-year in October, well below the central bank's 2-4% target thanks to low food prices. This should set up the central bank for a further rate cut, but possibly not until 1Q20.

... while some other central banks could take action rather sooner

Meanwhile, we are hoping for a bit more action from one of Asia’s other central banks. One of the most reluctant to ease has been the Bank of Thailand (BoT), but given the currency's resilience in the face of measures aimed at weakening the currency, and the domestic economy’s continued stagnation, we are looking for a 25 basis point easing of policy rates to 1.25% at the coming meeting.

After easing a fourth consecutive time in October, Bank Indonesia will likely scrutinise forthcoming 3Q19 GDP data and current account balances to assess whether there is either the need for and room for further easing. A sub-5.0% GDP print could provide the catalyst for a further 25 basis points of easing this year, give recent pro-growth comments from Governor Warjiyo. Their next meeting is on 21 November.

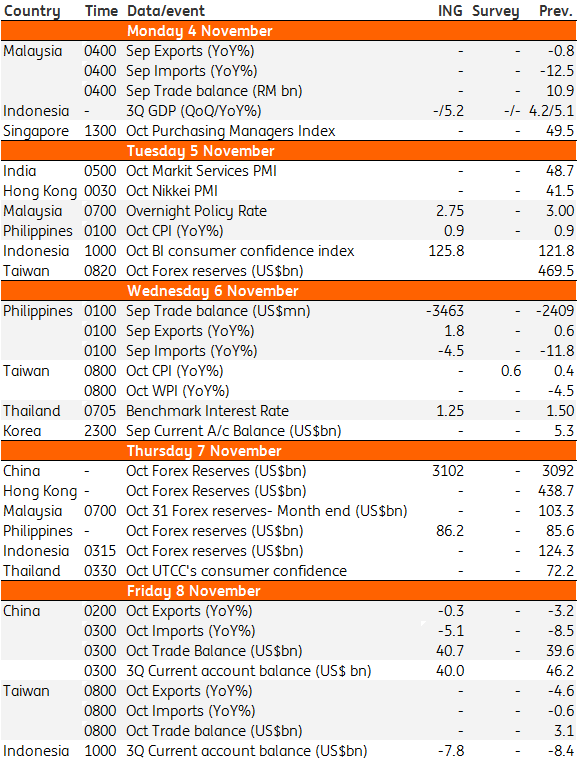

Asia Economic Calendar

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

31 October 2019

Good MornING Asia - 4 November 2019 This bundle contains 3 Articles