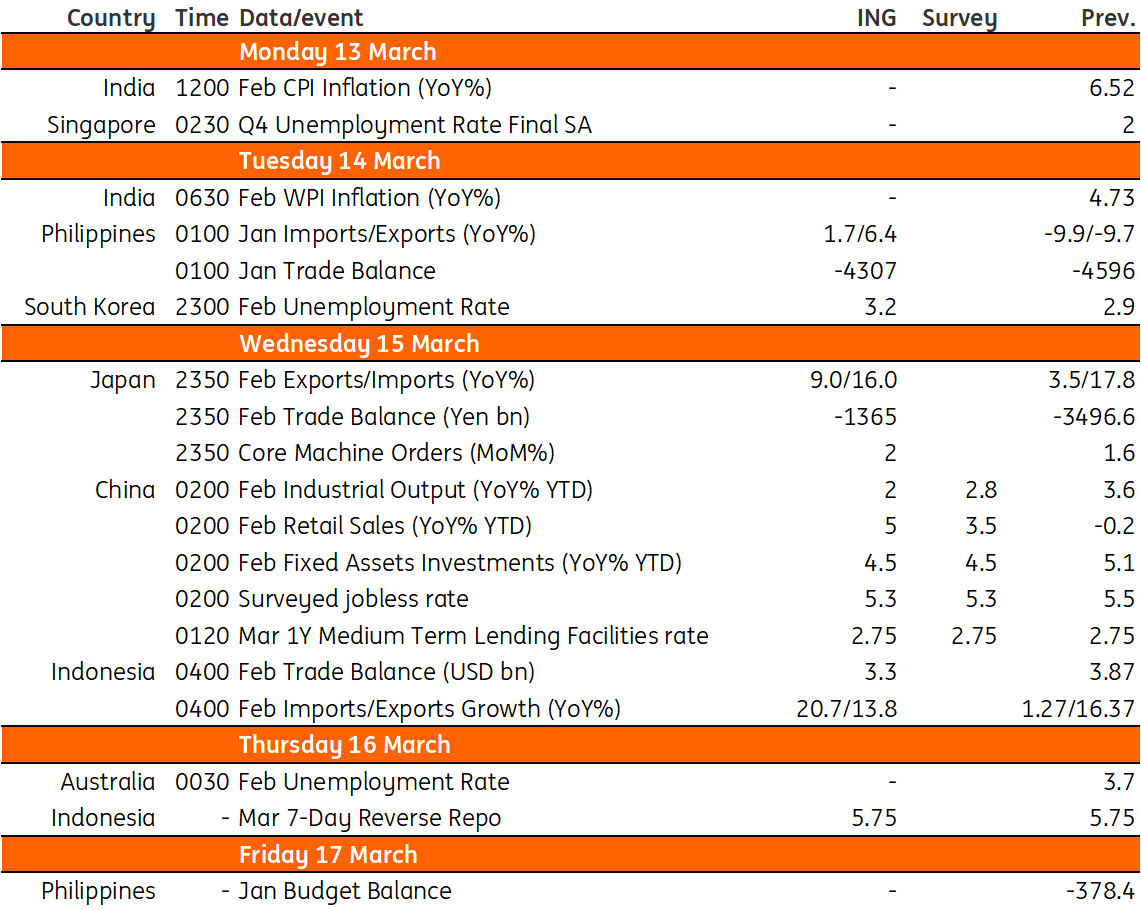

Asia week ahead: Flurry of data from China plus key central bank meeting

Next week’s data calendar is packed, with a data dump from China, India’s inflation reading, Australia’s labour figures, Japan’s trade data and the Bank Indonesia policy meeting

Upcoming activity data from China

China will release two months’ worth (January and February) of activity data on Wednesday, and we should see an approximate picture of economic growth in the first quarter. We expect retail sales to rise about 5% year-on-year, year-to-date in February, which looks optimistic, but industrial production may increase a more modest 2%YoY YTD as export-related manufacturing declines due to weak external demand. The surveyed jobless rate could improve to 5.3% (5.5% previously), which will provide support for consumption in the coming months. Meanwhile, home prices should be stable in the first two months but should pick up more in the coming quarters as there are still down payments on deposit accounts waiting for confidence in the housing market to return.

Overall, we believe this set of data should point to a stable recovery of the economy. Given the data, it is likely that the People's Bank of China will keep the 1Y medium-term lending facility (MLF) interest rate unchanged at 2.75%, and there should be no net injection of liquidity from MLF.

Has inflation peaked in India?

On Monday, India releases CPI data for February. Widespread declines in the price of foodstuffs in February together with flat prices for gasoline should see the headline inflation rate dip back below the Reserve Bank’s 6% upper target bound – well below the consensus forecast of a more modest decline from 6.5% to 6.3%. More importantly, we may also see core measures dipping lower too, which could also encourage thoughts that the RBI may be near to or have even peaked already in this rate cycle.

RBA to look to upcoming labour data for confirmation of peak rates

Australian labour data for February will be interesting after two months of decline. The upcoming labour data will give an indication as to whether the previous releases were arbitrary or if there is confirmation that the economy really is slowing down. With the Reserve Bank of Australia indicating that it is getting close to peak cash rates, a much weaker employment number could even give rise to thoughts that rates may have already peaked at 3.6%.

Jobless rate expected to rise in Korea

Korea’s jobless rate is expected to rise as the slowdown in construction and manufacturing activity continues while IT and financial services also begin to trim down headcount. Rising unemployment shouldn’t be a major concern for the Bank of Korea just yet as the unemployment rate should stay close to the relatively healthy level of 3% for some time.

Upcoming trade data from Japan

Japan’s February trade figures should begin to normalise with the unwinding of Lunar New Year effects. Exports are expected to rise 9.0%YoY (vs 3.5% in January). Core machinery orders data is also expected to rise as the domestic economy continues to expand with the services sector leading the recovery.

Can Bank Indonesia pause again?

Bank Indonesia (BI) meets next week to decide on policy. BI recently declared victory over inflation with Governor Perry Warjiyo indicating that he need not hike rates anymore this year. Decelerating core inflation could give BI a reason to keep rates untouched although recent pressure on the Indonesian rupiah (IDR) could force the central bank to take a hard look at a potential rate hike.

Possible bounce back for trade in Indonesia and the Philippines

Trade activity should pick up for both Indonesia and the Philippines, however, the trend of worsening trade balances should persist for both economies. Indonesia’s hefty trade surplus had previously been a key support for the IDR in 2022. This trend has since reversed and we are likely to see a further narrowing of the trade surplus to roughly $3.3bn by February. Meanwhile, the Philippine trade deficit is expected to remain substantial and settle at around $4.3bn. The narrowing trade surplus in Indonesia and the persistent trade deficit in the Philippines point to depreciation pressure for both the IDR and the Philippine peso in the near term.

Key events in Asia next week

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

9 March 2023

Our view on next week’s key events This bundle contains 2 Articles