Asia week ahead: Deal, no deal, or extended truce

Two key events that will push everything else into the background next week – the deadline to reach a deal on US-China trade conflict and the second Trump-Kim summit

US-China trade truce ends, or it doesn’t?

One more week before we wake up to the 1 March deadline that marks the end of the trade truce between the US and China. It’s not a hard deadline as President Trump recently suggested before the last round of talks currently taking place in Washington. We think this round of talks is unlikely to be the last round, given the scepticism, and with both sides miles apart - an extension of the truce appears to be the most likely outcome.

I can't tell you exactly about timing. The date is not a magical date because a lot of things are happening. We'll see what happens. - President Trump

For now, markets should take comfort in the fact that both sides are aiming for a deal, have started to outline it, and are working out agreements on the stickier issues. Nothing concrete yet, and we may not see anything until the next Trump-Xi meeting later in March.

Aside from the looming deadlines, the focus will be on China’s Purchasing Managers Index data. The Lunar New Year holiday slack imparts downside risk to the consensus of little-changed manufacturing PMI from the January reading of 49.5.

The second Trump-Kim Summit may not be the last either

The second Trump-Kim Summit takes place in Hanoi, Vietnam, on 27-28 February, and this too is unlikely to be the last meeting between the two leaders aiming to end North Korea’s nuclear programme. There was little progress after the Singapore summit, with no significant indications by North Korea for complete de-nuclearisation, while President Trump seems to be in no rush to achieve it either as the US sanctions on North Korea continue.

Like the Singapore meeting, we may end up with too much fanfare and not any meaningful advance. However, the news that the North Korean leader is prepared to shut a main nuclear facility is a hopeful sign.

We’re in no rush whatsoever, we’re going to have our meeting… we’ll see what happens and I think ultimately we’re going to be very successful. – President Trump

The Trump-Kim summit is likely to overshadow economic news from South Korea where lots of activity data including business confidence and exports, as well as the central bank meeting is scheduled. Latest export data with deepening contraction isn’t good news for the Bank of Korea after having hiked the policy rate by 25 basis points in late 2018. Our base case is a stable central bank policy well into 2020.

Things aren't looking too great for Asia's growth numbers

Aside from February manufacturing PMI from the region, January industrial production data will be a guide to GDP growth in the first quarter, as weakening exports weigh down manufacturing and GDP growth.

Meanwhile, Hong Kong and India are the last Asian countries to report fourth-quarter GDP data for 2018, and we expect them to join the majority of regional countries who have posted slower growth. In our view, if India gets 6.6% GDP growth in 4Q18, this won't be great news for Prime Minister Modi just before the election, though it would validate the central bank’s policy rate cut earlier this month.

| 6.6% |

India's GDP growth in 4Q18ING Forecast |

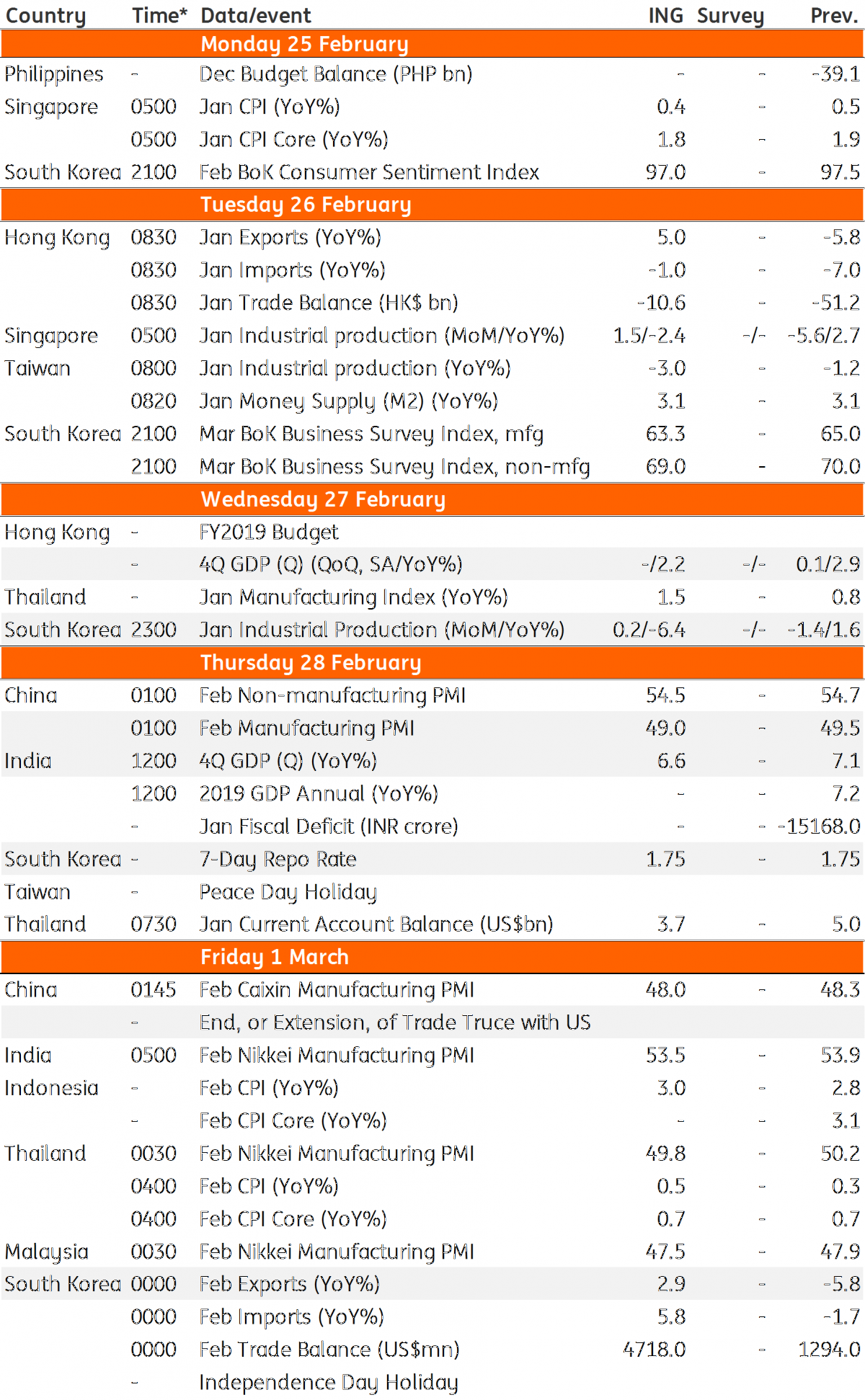

Asia Economic Calendar

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

22 February 2019

Our view on next week’s key events This bundle contains 3 Articles