Asia week ahead: China and Malaysia in focus

Investors will scrutinise a raft of December data in Asia next week to gauge the impact of the resurging virus. China’s 4Q20 GDP and Malaysian central bank policy are likely to take centre stage

China: GDP growth accelerates

The week kicks off with China's GDP report for the last quarter of 2020 and remaining December activity data – industrial production, retail sales and fixed asset investment, all due on Monday, 18 January.

We believe the export-led recovery gained further traction in the last quarter, keeping GDP growth on a steady upward path. Export growth nearly doubled to 17% year-on-year in 4Q20 from 8.9% in 3Q. This should outweigh any possible softening of domestic demand due to the renewed virus threat. We consider our 5.5% YoY house view of 4Q GDP growth, up from 4.9% in 3Q, subject to an upside surprise.

The People’s Bank of China is also set to review its prime lending rates next week – the monthly rite that is. We see no changes to the benchmark 1-year and 5-year Loan Prime Rate, currently 3.85% and 4.65%, respectively.

Malaysia: Central bank resumes easing

Bank Negara Malaysia’s Monetary Policy Committee meets on Wednesday, 20 January. The significant surge in Covid-19 will push BNM to cut the overnight policy rate by 25 basis points to 1.50%, in our view.

A nearly five-fold jump in infections during the last two months, to over 144k currently, has forced the government to tighten movement restrictions across the country, while it also declared a state of emergency until 1 August. This is poised to derail Malaysia’s economic recovery from a record slump in the last year -- the five most affected states by the pandemic (Melaka, Johor, Penang, Selangor and Sabah) together make up half of Malaysia’s total GDP.

And, unlike most other Asian central banks, which have almost exhausted their rate policies, BNM still has room to cut the policy rate further. Moreover, persistently negative inflation - in November it fell 1.7% YoY (December data is due next week) - has left real interest rates some of the highest in the region. This is detrimental for the recovery.

The earlier the BNM cuts, the better it will be to soften the blow to the economy from the worsening pandemic.

Rest of Asia: Export recovery prevails

Central banks in Indonesia and Japan are also set to review their policy settings next week. Both central banks will retain an accommodative stance in view of the recent rise in Covid-19 cases, though none are likely to change the current policy settings. That said, Bank Indonesia's meeting may well be of interest as low inflation keeps this central bank firmly on an easing path. At 3.75% currently, the BI policy rate is one of the highest in Asia.

December trade data from Japan, Taiwan, Philippines, and Thailand will help to determine the state of global demand, as the spread of Covid-19 has intensified. Released export figures from China, Korea and Taiwan painted a positive picture. We expect the same in the rest of Asia.

Down under, Australia’s labour report for December and New Zealand’s 4Q CPI inflation will provide insights into the impact of the disease on consumer spending.

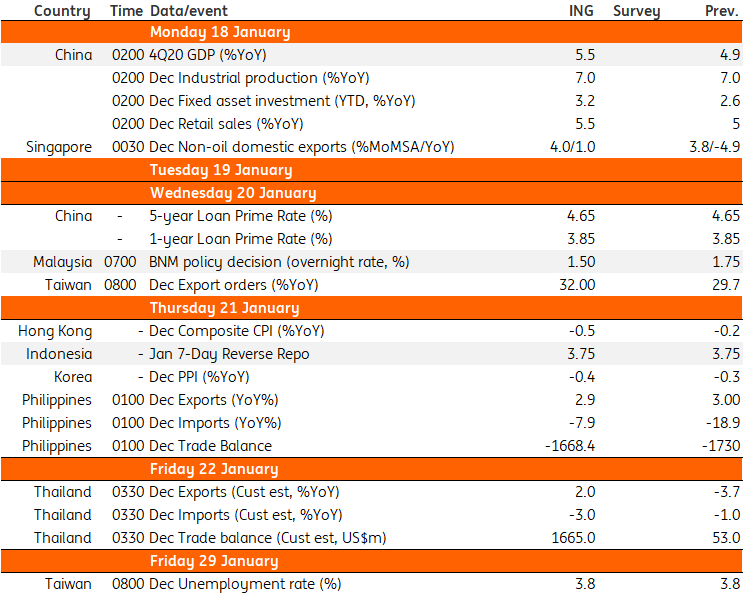

Asia Economic Calendar

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

14 January 2021

Good MornING Asia - 18 January, 2021 This bundle contains 5 Articles