Asia week ahead: Lots of Chinese and Indian data

Data out from China next week should show the third-quarter is off on a firmer start, but unlike China, the economic slump in India seems to be far from over and the data will only confirm that

China: More momentum

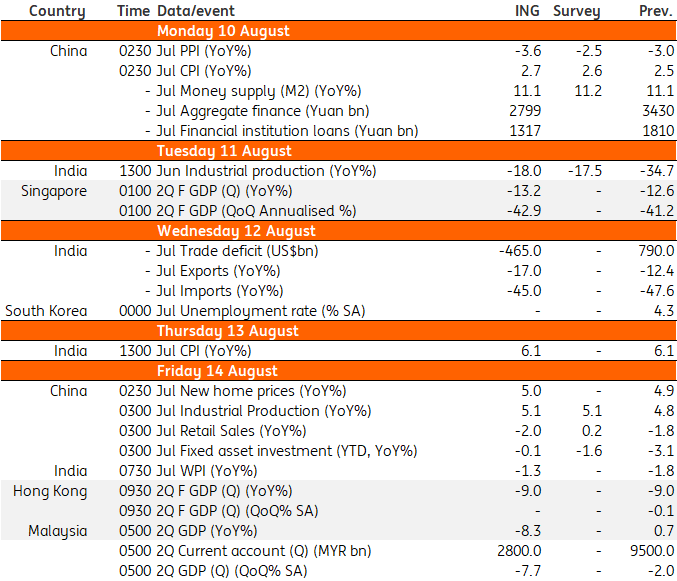

China’s July data pipeline started this week and will continue throughout next week with figures on industrial production, fixed investment, retail sales, consumer and home price inflation, and monetary and lending indicators.

We think most indicators will post better readings than they did in June, suggesting that the third quarter is off on a firmer start.

India: Not looking any better

Unlike China, the economic slump in India seems to be far from over, while resurgent inflation has closed the door on central bank monetary easing this week. We don’t think forthcoming data will alter this either.

We see July CPI inflation to be steady above the Reserve Bank of India’s 6% policy limit. Food remained a dominant inflation driver but high utility and transport costs also contributed. Real economic activity may have seen some pick up in recent months following the relaxation of the Covid-19 lockdowns, though it still remains way below the level that was seen just a year ago, as will be reflected by persistently big declines in exports and manufacturing.

Malaysia: The worst may be over

Malaysia’s 2Q20 GDP is out next week too. We forecast an 8.3% year-on-year contraction - the steepest since the 1998 Asian crisis. We think markets have almost become indifferent to downside GDP growth surprises from around the region and they are unlikely to be perturbed if Malaysia’s growth numbers follow a similar path.

With key drivers of exports and tourism missing, the negative GDP trend will remain over the second half of the year. And, with inflation continuing to be negative, the doors remain open for some more monetary easing from the central bank.

Rest of Asia: Looks pretty slow

Other things on the calendar include July labour report in Australia, a central bank meeting in New Zealand, a couple of activity releases in Japan, and revised 2Q GDP in Singapore.

We share the consensus view of a sharp slowdown in Australia's jobs growth (ING forecast 62.5k vs. 210.8k in June). There is unlikely to be much happening at New Zealand's central bank meeting with rates remaining on hold.

Singapore’s 2Q GDP might as well go unnoticed despite a likely downward revision from the -12.6% YoY first print on the back of weak June manufacturing.

Asia Economic Calendar

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

6 August 2020

Our view on next week’s events This bundle contains 3 Articles