Asia week ahead: Central banks to take cues from GDP

Central bank policy meetings and 4Q18 GDP reports dominate next week’s Asian economic calendar. Asian central banks will tread a cautious path but will mostly leave policies on hold this year

Downside risk to China’s growth

The week begins with China’s 4Q18 GDP and December data on retail sales, fixed asset investment, and industrial production. The consensus estimate of 6.4% year-on-year GDP growth is barely a slowdown from 6.5% in the previous quarter despite all the hue and cry that weighed down global markets in the last quarter. However, a sharp deceleration in manufacturing and retail sales as well as in trade growth, and falling industrial profits signal a downside risk to the consensus GDP estimate. Our house forecast is 6.3%.

Net trade seemed to have offset some of the slack in domestic spending. Although export growth slowed in the last quarter, import growth slowed by more than exports and the trade surplus widened from a year ago. Net trade subtracted from GDP growth in the first three quarters of 2018 but contributed to it in the final quarter.

China: What's driving GDP growth?

Asia’s GDP growth ends 2018 on weaker note

Korea and the Philippines also report GDP for 4Q18. As with China, we think consensus growth estimates -- 2.8% for Korea and 6.4% for the Philippines -- are subject to asymmetric downside risk (ING forecasts 2.1% and 5.9% respectively).

Singapore’s industrial production figures for December will indicate the direction of revision to the advance release of 4Q GDP estimate of 2.2%. It will certainly be downward given disappointing non-oil domestic exports in December. Likewise, Taiwan’s December IP data will help to fine-tune estimates of GDP growth in the last quarter.

More reasons for central banks to stay on hold in 2019

A weak end to one year makes it arithmetically harder for the following year to score well, underpinning our view that most Asian central banks will leave policies on hold this year, if not ease.

Central banks in Japan, Korea, and Malaysia meet next week. All are expected to remain on hold. Our interest lies in the Bank of Korea’s policy as the central bank also releases its quarterly Economic Outlook on the same day (24 January). In its October report, the BoK forecast 2.7% GDP growth for 2019, the same as its estimate for 2018. The 2018 growth forecast is unlikely to be met and the pace for 2019 looks to be far off in view of the global slowdown in the tech sector. As such, a downgrade to the BoK’s growth outlook for the current year shouldn’t come as surprise to anyone. However, we don't think this will move the central bank to reverse the December rate hike just yet.

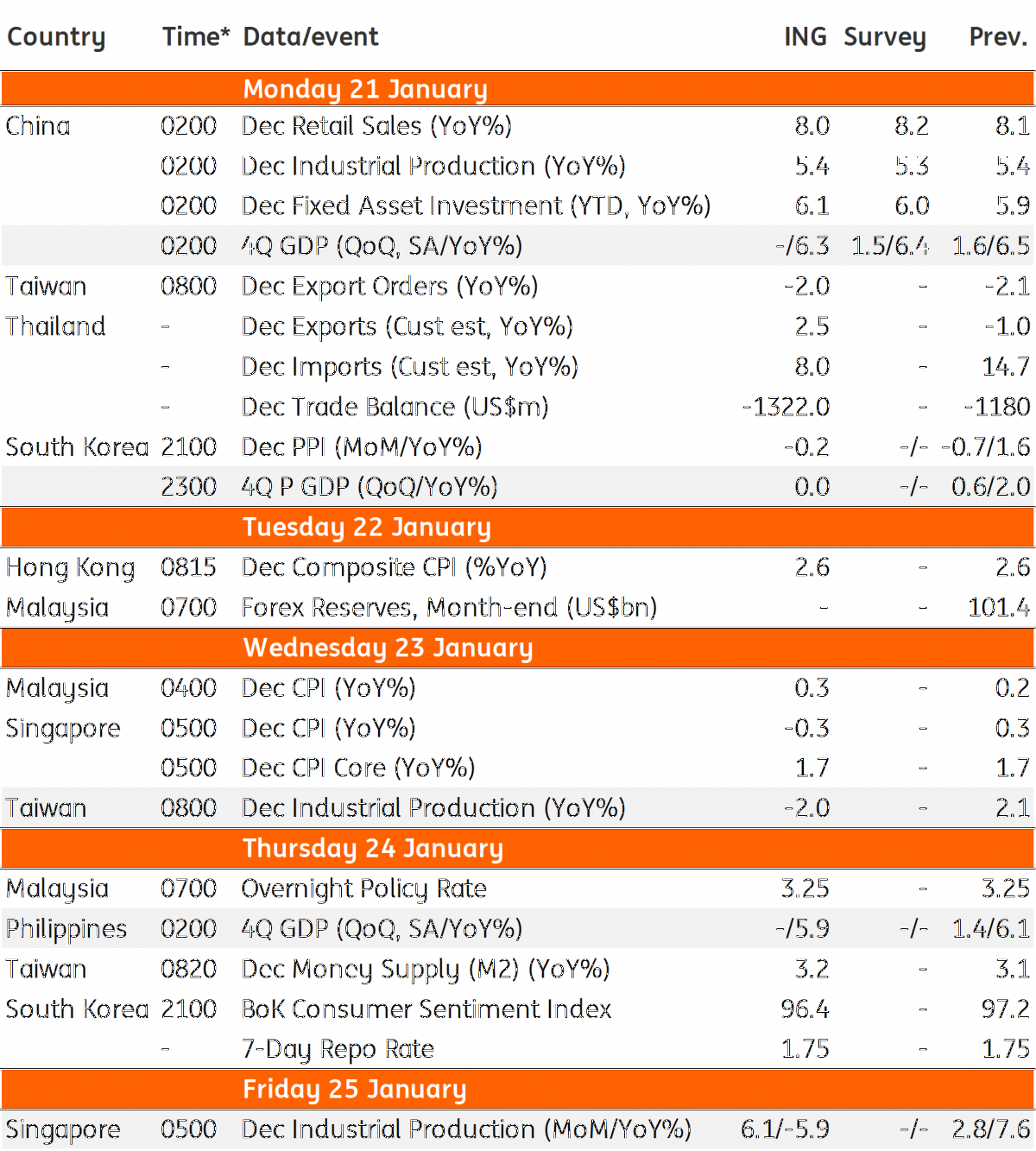

Asia Economic Calendar

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

17 January 2019

Our view on next week’s key events This bundle contains 3 Articles